Global| Mar 15 2005

Global| Mar 15 2005German Analysts and Institutional Investors More Positive Regarding Overall Economy but Profit Expectations Are Mixed

Summary

The ZEW Center for European Economic Research in Mannheim, Germany, reported that German analysts and institutional investors became slightly more optimistic regarding Germany's economic prospects over the next six months. The [...]

The ZEW Center for European Economic Research in Mannheim, Germany, reported that German analysts and institutional investors became slightly more optimistic regarding Germany's economic prospects over the next six months. The proportion of optimists over pessimists rose to 36.3% in March from 35.9% in February. Although this figure is well below the 73.4% reached in December 2003, it is 22.4 percentage points above the recent low of 13.9% recorded in November of last year.

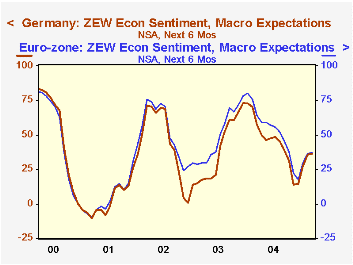

Haver has recently added ZEW data regarding appraisals of current condition and expectations of conditions six months ahead for the Euro zone. For the six month outlook for the Euro Zone as a whole, the proportion of optimists over pessimists rose to 37.3% in March from 36.0% in February. This figures is 42.8 percentage points below the recent peak of 80.1 in January, 2004 and 19.6 points above the low of 17.7 in December 2004. The attached chart compares the expectations for Germany with those for the Euro Zone as a whole. As Germany is such a large component of the Euro Zone, the two series tend to move together.

In addition to appraisals of current conditions and expectations of conditions six months ahead for the entire Euro Zone, Haver has added appraisals of the profit outlook six months ahead for thirteen industries: banking, insurance, vehicles/automotive, chemical/pharmaceutical, steel/metal, electronics, machinery, consumption/ trade, construction, utilities, services, telecommunications and information technology. The March data show that, except for the consumption/trade and construction industries, optimists exceeded pessimists in appraising the profit outlook of all the other industries. The excess of optimists over pessimists varied from 28.8% for the electronics industry to 59.% for information technology.

| Germany: ZEW index | Mar 05 | Feb 05 | Mar 04 | M/M dif | Y/Y dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Macroeconomic conditions 6 months ahead |

||||||||

| Germany | 36.3 | 35.9 | 57.6 | 0.4 | -21.3 | 44.6 | 38.4 | 45.3 |

| Euro Zone | 37.3 | 36.0 | 64.3 | 1.3 | -27.0 | 52.1 | 48.9 | 53.1 |

| Profit expectations | ||||||||

| Banking | 55.5 | 54.9 | 71.2 | 0.6 | -15.7 | 59.6 | 30.5 | -8.4 |

| Insurance | 43.1 | 41.2 | 62.2 | 1.9 | -19.1 | 56.5 | 27.8 | 6.6 |

| Vehicle/automotive | -2.9 | 3.2 | -6.7 | -6.1 | 3.8 | -0.1 | -8.2 | -6.0 |

| Chem./pharmaceutical | 50.5 | 47.5 | 37.8 | 3.0 | 12.7 | 37.5 | 25.8 | 25.4 |

| Steel/metal | 45.0 | 47.1 | 41.6 | -2.1 | 3.4 | 48.7 | 13.1 | 4.7 |

| Electronics | 28.8 | 27.2 | 49.9 | 1.6 | -21.1 | 46.6 | 19.9 | 11.9 |

| Machinery | 45.6 | 46.0 | 46.6 | -0.4 | -1.0 | 53.4 | 7.0 | 5.4 |

| Consumption/trade | -0.4 | 9.0 | 7.9 | -9.4 | -8.3 | -0.8 | 2.2 | -8.6 |

| Construction | -22.6 | -24.6 | -4.7 | 2.0 | -17.9 | -18.2 | -33.7 | -28.9 |

| Utilities | 42.6 | 49.7 | 45.9 | -7.1 | -3.3 | 46.9 | 19.1 | 18.2 |

| Services | 52.2 | 55.2 | 62.4 | -3.0 | -10.2 | 58.0 | 35.2 | 25.4 |

| Telecommunications | 56.5 | 58.0 | 71.7 | -1.5 | -15.2 | 62.5 | 49.7 | 9.8 |

| Information technology | 59.4 | 52.4 | 68.4 | 7.0 | -9.0 | 63.0 | 45.2 | 17.6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates