Global| Jun 22 2009

Global| Jun 22 2009German Business Confidence Improving But Still Subdued

Summary

Germany's IFO institute reported today that its business climate index rose to 85.9 (2000=100) in June up from 84.3 in May. This was the third month of improvement. The business climate index is made up of the business community's [...]

Germany's IFO institute reported today that its business

climate index rose to 85.9 (2000=100) in June up from 84.3 in May. This

was the third month of improvement. The business climate index is made

up of the business community's appraisal of current conditions and the

economic outlook six months ahead. There was a small decline in the

appraisal of current conditions, from 82.5 to 82.4 which was more than

offset by a significant improvement in the outlook six months ahead

from 86.0 to 89.5.

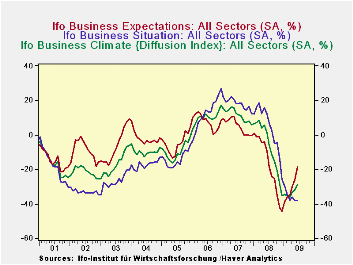

Although these signs are encouraging, business confidence remains subdued. The business climate index is lower than the 100 mark, which represents conditions back in 2000 and even much lower than the recent peak of 109.1, reached in December 2006. There are still many more pessimists than optimists--38.3%-- regarding current conditions. While the outlook for the next six months has improved, there are still 18.8% more of the respondents who are pessimistic about the outcome than those who are optimistic. The percent balances for the Business Climate, Current Conditions and Outlook for the next six months are shown in the first chart.

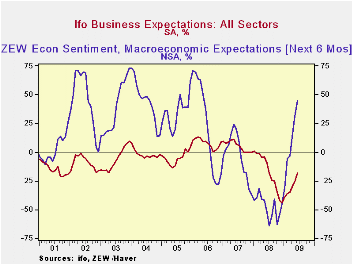

Just last week the ZEW survey revealed that the financial community was decidedly more optimistic about the future of the economy. Since April optimists in the financial community have outweighed pessimists regarding the six months outlook. In June the excess was 44.8%, up from 31.1% in May and 13.0% in April. The second chart compares the percent balances of opinions on expectations for the business and financial communities. Expectations of both communities tend to move in the same direction but the expectations of the financial community tend to be much more volatile than those of the business community. Part of the greater volatility of the ZEW survey may be due, in part, to its small sample size. The ZEW sample in June consisted of 271 institutional investors and financial analysts, while the IFO sample consisted of some 7000 representatives of manufacturing, construction and wholesaling and retailing.

| German Business Confidence | Jun 09 | May 09 | Apr 09 | Mar 09 | Feb 09 | Jan 09 |

|---|---|---|---|---|---|---|

| IFO (2000=100) | -- | -- | -- | -- | -- | -- |

| Business Climate | 85.9 | 84.3 | 83.7 | 82.2 | 82.6 | 83.1 |

| Current Conditions | 82.4 | 82.5 | 83.5 | 82.7 | 84.3 | 86.7 |

| Expectations | 89.5 | 86.0 | 84.0 | 81.7 | 81.0 | 79.6 |

| IFO ( % Percent Balance) | -- | -- | -- | -- | -- | -- |

| Business Climate | -28.9 | -32.1 | -33.1 | -36.2 | -35.4 | -34.4 |

| Current Conditions | -38.3 | -38.0 | -36.1 | -37.8 | -34.7 | -29.8 |

| Expectations | -18.8 | -25.9 | -30.1 | -34.7 | -36.1 | -38.9 |

| ZEW (% Percent Balance) | -- | -- | -- | -- | -- | -- |

| Expectations | 44.8 | 31.1 | 13.0 | -3.5 | -5.8 | -31.0 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates