Global| Jun 23 2008

Global| Jun 23 2008German Business Confidence Weakens

Summary

Business confidence, as measured by the IFO Business Climate Indicator, continued to weaken in June. The percent balance indicator fell to 1.7% from 6.1% in May. This was the lowest value since January 2006. The 7000 business [...]

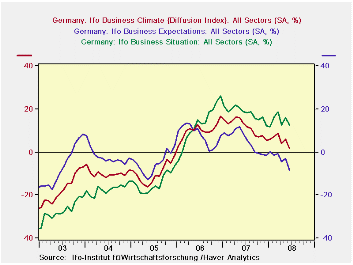

Business confidence, as measured by the IFO Business Climate Indicator, continued to weaken in June. The percent balance indicator fell to 1.7% from 6.1% in May. This was the lowest value since January 2006. The 7000 business executives in manufacturing, construction, wholesale and retail trade who participate in the survey, lowered their appraisals of both their current conditions and their outlook for the next six months. The percent balance between the optimists and the pessimists regarding their current condition fell to 12.4% in June from 15.9% in May while the percent balance of the pessimists over the optimists regarding the outlook six months ahead rose to 8.4% in June from 3.2% in May. The trends in the overall measure and its components--current conditions and the six month's outlook--are shown in the first chart.

Earlier the rise in the euro with its negative impact on exports and the slowdown in the U. S. economy accounted for some of the earlier loss in confidence, but now the recent sharp rises in oil and food prices increase the possibility or an interest rate rise by the European Central Bank.

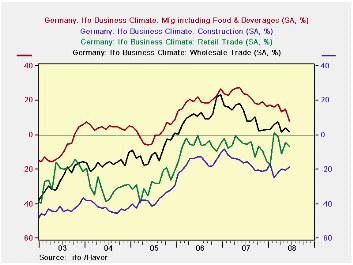

Confidence, as measured by the business climate, declined in manufacturing, wholesale and retail trade, but became slightly less pessimistic in construction as shown in the second chart.

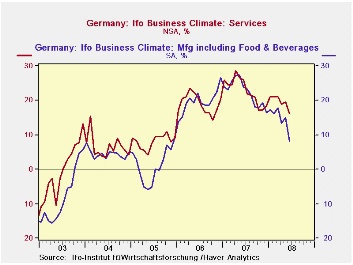

The IFO has published confidence measures for the service sector since May, 2001. (The industry sector measures go back to 1991.) These data are based on the opinions of 2000 executives and are not, as yet, seasonally adjusted. Despite the difference between seasonally adjusted and non seasonally adjusted data, the comparison between confidence in the manufacturing industry and the services, suggests that confidence in the services tends to be higher and less volatile than that in manufacturing as shown in the third chart.

| GERMAN

BUSINESS CONFIDENCE IFO (SA ex where noted) (% balance) |

Jun 08 | May 08 | Jun 07 | M/M Chg | Y/Y Chg | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|

| Business Climate | 1.7 | 6.1 | 13.2 | -4.4 | -11.5 | 11.3 | 10.1 | -9.7 |

| Current Conditions | 12.4 | 15.9 | 18.5 | -3.5 | -6.1 | 18.1 | 12.6 | -14.2 |

| Outlook, Six Months Ahead | -8.4 | -3.2 | 8.1 | -5.2 | -16.5 | 5.1 | 7.8 | -5.1 |

| Manufacturing Climate | 8.2 | 15.0 | 24.0 | -6.8 | -15.8 | 22.3 | 19.7 | 1.2 |

| Construction Climate | -18.9 | -20.2 | -16.2 | 1.3 | -2.7 | -16.2 | -15.8 | -37.1 |

| Retail Trade Climate | -6.5 | -4.4 | -5.1 | -2.1 | -1.4 | -6.5 | -6.1 | -28.0 |

| Wholesale Trade Climate | 2.1 | 4.0 | 14.1 | -1.9 | -12.0 | 11.0 | 11.6 | -9.8 |

| Services (NAS) | 16.3 | 19.4 | 26.0 | -3.1 | -9.7 | 22.8 | 19.1 | 8.1 |