Global| Sep 26 2011

Global| Sep 26 2011German Business Confidence Weakens Again

Summary

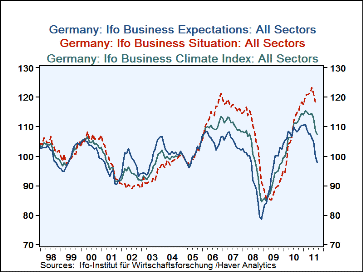

Given the seriousness of the financial situation and talk of recession in the Euro Area, it is not surprising that German business confidence weakened again in September. The IFO Institute measures confidence in industry and trade [...]

Given the seriousness of the financial situation and talk of recession

in the Euro Area, it is not surprising that German business confidence

weakened again in September. The IFO Institute measures

confidence in industry and trade based on the proprietors' appraisal of

current conditions and expectations. Seasonally adjusted data on an

index basis and a percent balance basis are available since January;

1991. Seasonally unadjusted data for the service industries are

available only on a percent balance basis and are available only since May

2001. The IFO Institute reported today that the index of the

Business Climate in Trade and Industry was 107.5 (2005=100) in September,

down 1.2% from August and down 6.8% from its recent peak of 115.4 in

February of this year. Expectations were down 2.0% from August and

11.5% from the peak of 110.7 in February. Appraisals of the current

situation declined only 0.2% in September and were 4.4% below their

peak of 123.2 in June. The indexes for the Climate, Current

Conditions and Expectations for Industry and Trade are shown in the first

chart.

Given the seriousness of the financial situation and talk of recession

in the Euro Area, it is not surprising that German business confidence

weakened again in September. The IFO Institute measures

confidence in industry and trade based on the proprietors' appraisal of

current conditions and expectations. Seasonally adjusted data on an

index basis and a percent balance basis are available since January;

1991. Seasonally unadjusted data for the service industries are

available only on a percent balance basis and are available only since May

2001. The IFO Institute reported today that the index of the

Business Climate in Trade and Industry was 107.5 (2005=100) in September,

down 1.2% from August and down 6.8% from its recent peak of 115.4 in

February of this year. Expectations were down 2.0% from August and

11.5% from the peak of 110.7 in February. Appraisals of the current

situation declined only 0.2% in September and were 4.4% below their

peak of 123.2 in June. The indexes for the Climate, Current

Conditions and Expectations for Industry and Trade are shown in the first

chart.

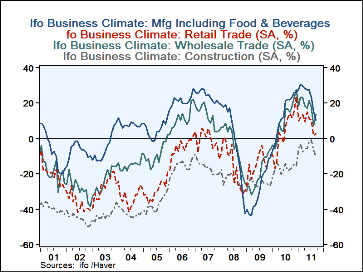

The balance of opinion on the climate for Industry and Trade was 7.5% in September, down from 9.8% in August and 15.2 percentage points from its peak in February 11. The excess of optimists over pessimists regarding the manufacturing industry declined to 10.6% in September from 15.5% in August and from 30.5 % in February of this year. And in construction the excess of pessimists increased to 9.9% in September from 6.5% in August but the excess was below the year ago figure of 17.5%. The climate in Trade, however improved in September from August. The increase in the excess of optimists in wholesaling was up 6.0 percentage points and the excess of optimists in retailing was up 1.4 points to an excess of 2.9 . The excess of optimists in wholesaling, however, is down 14.2 points from its peak in December.2010 and that for retailing is down 28.0 points from its December, 2010 peak.

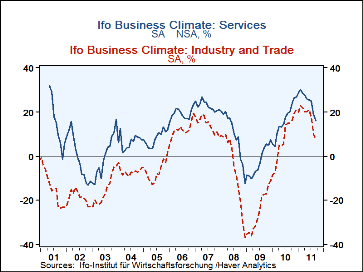

The climate in the Services has generally been rosier than that in Industry and Trade but it has followed the same ups and downs as can be seen in the third chart.

| Germany: IFO |

Sep 11 |

Aug 11 |

Sep 10 |

M/M% or Pnt Chg |

Y/Y% or Pnt Chg |

Rcnt Peak |

Date | % or Pnt Decline frm Peak |

|---|---|---|---|---|---|---|---|---|

| Industry & Trade 2005=100 | ||||||||

| Climate | 107.5 | 108.7 | 111.3 | -1.2 | -3.8 | 115.4 | Feb 11 | -6.85 |

| Current Situation |

117.9 | 118.1 | 114.3 | -0.2 | 3.6 | 123.2 | Jun 11 | -4.38 |

| Expectations | 98.0 | 100.0 | 108.2 | -2.0 | -10.2 | 110.7 | Feb 11 | -11.47 |

| Climate (% Balance) | ||||||||

| Industry & Trade |

7.5 | 9.8 | 15.0 | -2.3 | -7.5 | 22.7 | Feb 11 | -15.2 |

| Mfg | 10.6 | 15.5 | 21.8 | -4.9 | -11.2 | 30.5 | Feb 11 | -19.9 |

| Construction | -9.9 | -6.5 | -17.5 | -3.4 | 7.6 | -17.5 | Sep 10 | 7.6 |

| Wholesaling | 13.1 | 7.1 | 14.7 | 6.0 | -1.6 | 27.3 | Dec 10 | -14.2 |

| Retailing | 2.9 | 1.5 | 13.9 | 1.4 | -11.0 | 23.9 | Dec 10 | -21.0 |

| Services (NSA % Balance) | ||||||||

| Climate | 16.5 | 19.7 | 20.5 | -3.2 | -4.0 | 31.0 | Feb 11 | -14.5 |

| Current Situation |

31.0 | 31.0 | 24.0 | 0.0 | 7.0 | 36.0 | Apr 11 | -5.0 |

| Expectations | 3.0 | 9.0 | 17.0 | -6.0 | -4.1 | 31.0 | Feb 11 | -28.0 |

| Climate (SA, Haver function) |

16.1 | 18.7 | 20.2 | -2.6 | -4.1 | 30.3 | Feb 11 | -14.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates