Global| Jun 19 2007

Global| Jun 19 2007German Financial Community Turns Less Optimistic

Summary

The ZEW indicator that measures the balance of opinion among German institutional investors and analysts on the outlook six months ahead fell to 20.3% in June from 24% in May. The consensus expectation was for a rise to 29%. At the [...]

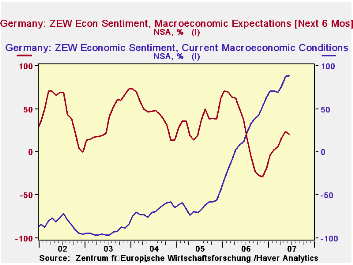

The ZEW indicator that measures the balance of opinion among German institutional investors and analysts on the outlook six months ahead fell to 20.3% in June from 24% in May. The consensus expectation was for a rise to 29%. At the same time the balance of opinion on current conditions rose to a record of 88.7%, as shown in the first chart.

Some of the events that took place and some of the data that were released during the period, June 4th to June 18th, when the participants of the survey were asked for their opinions, may help explain the decline in the optimists over the pessimists.

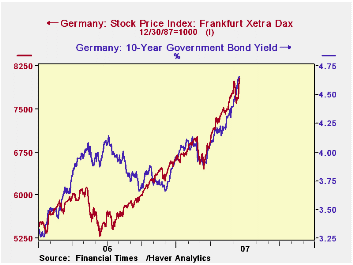

The European Central Bank raised its official rate to 4% on June 6 and suggested further increases might be in the offing. The yield on the ten year government bond, which had been rising moderately since March, jumped by 8 basis points on June 8th. Although it has since recovered, the Frankfurt Xetra Dax Index declined 2.4% in the one day of June 6. The second chart shows the ten year government bond yield and the stock market index on a daily basis for the last year and a half.

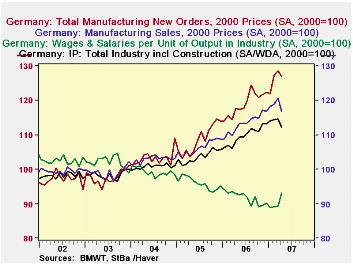

During the survey period it was revealed that the volume of manufacturing sales had declined 3.07% in April from March and that the volume of new orders for April was 1.17% below March. Moreover, April industrial production was down 2.27% from March. On the cost side, unit labor costs were up sharply, 4.25%, in April from March.

| ZEW INDICATOR (% BALANCE) | Jun 07 | May 07 | Jun 06 | M/M Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Current Conditions | 88.7 | 88.0 | 11.9 | 0.7 | 76.8 | 18.3 | -61.8 | -67.7 |

| Expectations 6 months ahead | 20.3 | 24.0 | 37.8 | -3.7 | -17.5 | 22.3 | 34.8 | 44.6 |

| ECONOMIC INDICATORS (2000=100) | Apr 07 | Mar 07 | Apr 06 | M/M % | Y/Y % | 2006 | 2005 | 2004 |

| Manufacturing Sales | 116.9 | 120.6 | 111.6 | -3.07 | 4.75 | 113.3 | 106.3 | 103.0 |

| Manufacturing New Orders | 127.0 | 128.5 | 117.7 | -1.17 | 7.90 | 119.0 | 108.7 | 103.2 |

| Industrial Production | 112.1 | 114.7 | 108.1 | -2.27 | 3.70 | 109.8 | 103.7 | 100.8 |

| Unit Labor Cost | 93.2 | 89.4 | 93.0 | 4.25 | 0.22 | 91.8 | 95.9 | 99.3 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates