Global| Oct 13 2009

Global| Oct 13 2009German Financial Experts A Little Less Optimistic

Summary

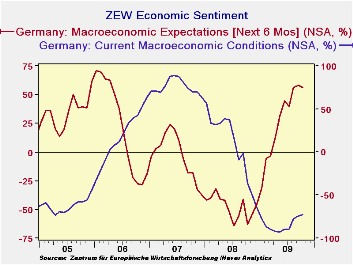

The German financial community lowered slightly its expectations for the economic outlook. The ZEW indicator of economic expectations declined slightly in October to 56.0% from 57.7% in September. This is still well above the long [...]

The German financial

community lowered slightly its expectations for

the economic outlook. The ZEW indicator of economic

expectations declined slightly in October to 56.0% from 57.7% in

September. This is still well above the long term average of

26.7%. Their assessment of current conditions was, however,

slightly less pessimistic in October, -72.2%, than it was in September

-74.0%. The decline in optimism was the second decline this

year. In July, the excess of optimists in regard to the

outlook declined to 39.5% from 44.5% in June, a more substantial

decline than the present one. The indicators of current

conditions and expectations are shown in the first chart. There survey

was conducted between September 28 and October 12. 288

institutional investors and analysts

participated.

The German financial

community lowered slightly its expectations for

the economic outlook. The ZEW indicator of economic

expectations declined slightly in October to 56.0% from 57.7% in

September. This is still well above the long term average of

26.7%. Their assessment of current conditions was, however,

slightly less pessimistic in October, -72.2%, than it was in September

-74.0%. The decline in optimism was the second decline this

year. In July, the excess of optimists in regard to the

outlook declined to 39.5% from 44.5% in June, a more substantial

decline than the present one. The indicators of current

conditions and expectations are shown in the first chart. There survey

was conducted between September 28 and October 12. 288

institutional investors and analysts

participated.

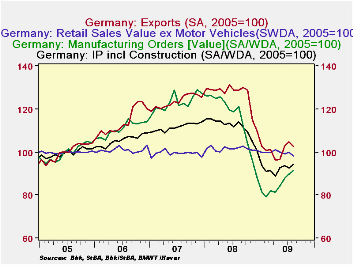

A number

of factors could

account for the caution about the outlook expressed by the participants

in the survey. The economic news from Germany in recent weeks

has been mixed. Industrial Production and New Orders

continued to be positive, but exports declined in August and retail

trade has shown little strength as seen in the second chart. (Exports

have been expressed as an index for comparability.)

A number

of factors could

account for the caution about the outlook expressed by the participants

in the survey. The economic news from Germany in recent weeks

has been mixed. Industrial Production and New Orders

continued to be positive, but exports declined in August and retail

trade has shown little strength as seen in the second chart. (Exports

have been expressed as an index for comparability.)

The Press has highlighted the decline in expectations, but ZEW's President, Wolfgang Franz, down played the decline. According to him, "The assessment of the financial market experts reflects the prevalent view. The economy will improve only gradually."

| ZEW INDICATORS (Percent Balance) | Oct 09 | Sep 09 | Aug 09 | Jul 09 | Jun 09 | May 09 | APR 09 | Mar 09 |

|---|---|---|---|---|---|---|---|---|

| Current Conditions | -72.2 | -74.0 | -77.2 | -89.3 | -89.7 | -92.8 | 91.6 | -89.4 |

| Expectations | 56.0 | 57.7 | 56.1 | 39.5 | 44.8 | 31.1 | 13.0 | -3.5 |

| Exports (2005=100) | -- | -- | 102.9 | 104.5 | 102.8 | 96.6 | 96.2 | 101.1 |

| Retail Trade (2005=100) | -- | -- | 98.2 | 100.0 | 99.3 | 100.1 | 101.2 | 99.7 |

| Manufacturing New Orders (2005=100) | -- | -- | 91.3 | 89.7 | 87.9 | 84.4 | 81.3 | 91.9 |

| Industrial Production (2005=100) | -- | -- | 64.3 | 92.7 | 93.7 | 92.8 | 88.7 | 91.3 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates