Global| Jun 19 2012

Global| Jun 19 2012German Financial Experts Turn Negative on German Economic Prospects

Summary

The 274 German financial analysts and institutional investors who participated in the ZEW survey that took place during the period from May 29 to June 18 greatly reduced their expectations of German macroeconomic conditions in the six [...]

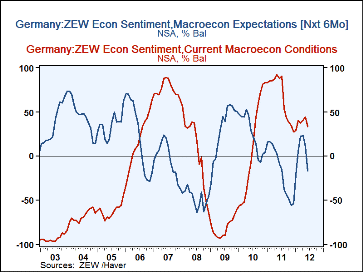

The 274 German financial analysts and institutional investors who participated in the ZEW survey that took place during the period from May 29 to June 18 greatly reduced their expectations of German macroeconomic conditions in the six months ahead. Before the survey was taken, there was an excess of 10.8% of those expecting improved conditions in the six months ahead. By the end of the survey period, there was an excess of 16.9% of those expecting worsened conditions. The shift in expectations, a decline of 27.7 percentage points, was the largest that has occurred since October 1998 when expectation declined by 29 percentage points. The analysts and investors also reappraised their opinions of current economic conditions in Germany. Currently those viewing current conditions favorably exceed those viewing current conditions unfavorably by 33.2% compared with 44.1% a month ago. The first chart shows the ZEW indicators of current conditions and expectations for Germany.

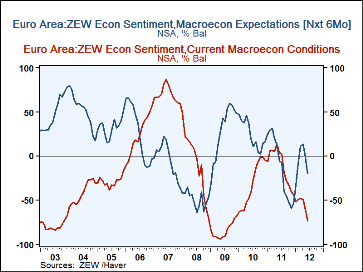

ZEW also publishes the German financial experts' appraisals of current conditions and expectations for the whole Euro Area. There is a very big difference between Germany and the Euro Area regarding Current Conditions. Currently, for example, in Germany the optimists exceed the pessimists by 33.2% while in the Euro Area, the pessimists exceed the optimists by 73.2%. Without Germany the appraisal of current conditions in the Euro Area would be even worse. The difference is largely due to the worsening economic conditions in Portugal, Spain, Ireland and Greece. The difference between expectations of macroeconomic conditions six months ahead for Germany and the Euro Area are much less stark, however, there was a significant narrowing of the difference in June to 3.2 percentage points from the 10 to 13 percentage points that prevailed earlier in the first half of this year. This could be the result of a recognition on the part of the financial experts of Germany's increasing vulnerability to the crisis in the Euro Area. The second chart shows current conditions and expectations for the Euro Area.

The period during which the survey was taken was filled with rising concerns over the Spanish banks and uncertainty over the Greek election that may have been responsible for much of the increased caution on the part of the financial community. These problems are still pressing and are unlikely to be resolved speedily.