Global| Mar 13 2007

Global| Mar 13 2007German Financial Types Become a Little More Positive on the German Outlook, and a Little Less So for the Euro Area [...]

Summary

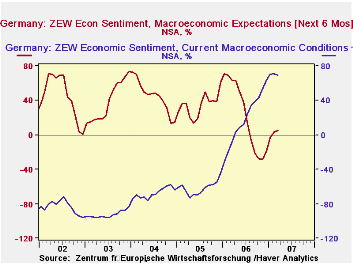

The ZEW Indicator of Economic Sentiment for Germany, which assesses the outlook in the next six months, based on the opinions of investors and analysts, rose 2.9 points in March to 5.8%. While the current level is a substantial [...]

The ZEW Indicator of Economic Sentiment for Germany, which assesses the outlook in the next six months, based on the opinions of investors and analysts, rose 2.9 points in March to 5.8%. While the current level is a substantial improvement over the pessimism reached last November when pessimists exceeded optimists by 28.5%, it is well below the long term average of 33.2%. On the other hand, the fact that the participants became more positive during a survey period which included a sharp down turn in world stock markets and only a partial recovery, was in itself a pleasant surprise. Many observers had expected the indicator to decline.

The assessment of current conditions declined slightly to 69.2% from 70.9%, the first decline since June 2005. The indicators for the outlook and current conditions are shown in the first chart.

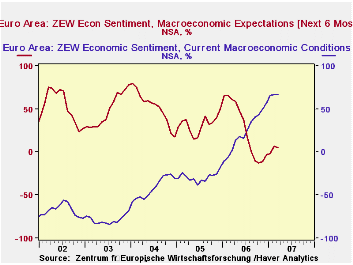

The ZEW Financial Markets Survey also asks its participants to report on the outlook and current conditions in the entire Euro Area. The assessment of the outlook for the entire Euro Area declined in March 5.1% from 6.8% in February and the appraisal of current conditions rose marginally from 66.7% in February to 66.9% in March. The indicators of current conditions and the outlook for the Euro Area are shown in the second chart.

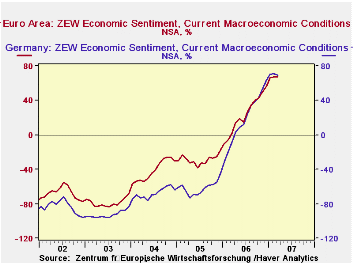

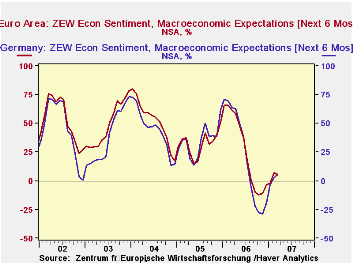

The indicators for the Euro Area, of course, include those for Germany, but the differences between the indicators of the Euro Area and those of Germany can shed some light on the performance of Germany relative to the rest of the Euro Area. From the appraisal of current conditions in the total area and in Germany, we can infer that the participants had rated conditions in the Euro Area outside of Germany higher than those in Germany until November, 2006. Since then, the appraisal of current conditions in Germany has been higher than that for the whole region, as can be seen in the third chart. Similar inferences can be derived from the appraisals of the outlook in the two series. The outlook for Germany was less positive than that for the whole area indicator until about mid 2005 when it became more positive than the whole area indicator. It remained more positive from then until June 2006. After that until this March of this year, the German outlook for the German economy appeared to be much less positive than that for the Euro Area as a whole. The divergence may have been due, in part perhaps, to the prospect of the January 1, 2007 increase in Germany's VAT. Since the effects of the higher VAT appear to have been less onerous than expected, optimism in the German outlook has has become modestly more positive relative to the whole area, as can be seen in the fourth chart.

Similar inferences can be derived from the appraisals of the outlook in the two series. The outlook for Germany was less positive than that for the whole area indicator until about mid 2005 when it became more positive than the whole area indicator. It remained more positive from then until June 2006. After that until this March of this year, the German outlook for the German economy appeared to be much less positive than that for the Euro Area as a whole. The divergence may have been due, in part perhaps, to the prospect of the January 1, 2007 increase in Germany's VAT. Since the effects of the higher VAT appear to have been less onerous than expected, optimism in the German outlook has has become modestly more positive relative to the whole area, as can be seen in the fourth chart.

| ZEW INDICATORS (% Balance) | Mar 06 | Feb 06 | Mar 05 | M/M DIF | Y/Y DIF | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Germany | ||||||||

| Current Conditions | 69.2 | 70.9 | -8.4 | -1.7 | 77.6 | 18.3 | -61.8 | -67.7 |

| Expectations 6 Months Ahead | 5.8 | 2.9 | 63.4 | 2.9 | -47.6 | 22.3 | 34.8 | 44.6 |

| Eurostat | ||||||||

| Current Conditions | 66.9 | 66.7 | 2.0 | 0.2 | 64.9 | 23.8 | -28.7 | -41.4 |

| Expectations 6 Months Ahead | 5.1 | 6.8 | 61.1 | -1.7 | -56.0 | 26.6 | 32.3 | 52.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates