Global| Oct 15 2014

Global| Oct 15 2014German Inflation Finalizes with Some Fizz

Summary

Despite the weaknesses in Germany's economic data and its just-released leading economic index, German inflation does not seem to be under as much downward pressure in September. The sequential growth rates for Germany's harmonized [...]

Despite the weaknesses in Germany's economic data and its just-released leading economic index, German inflation does not seem to be under as much downward pressure in September.

Despite the weaknesses in Germany's economic data and its just-released leading economic index, German inflation does not seem to be under as much downward pressure in September.

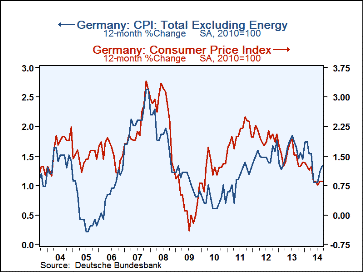

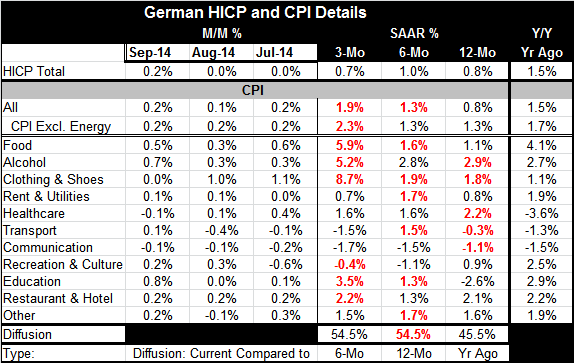

The sequential growth rates for Germany's harmonized index of consumer prices (HICP) show the inflation rate going from 0.8% over 12 months to 1% over six months to 0.7% over three months, a sort of erratic and minor deceleration of inflation pressures. But Germany's domestic CPI shows a very different story. Inflation is 0.8% over 12 months. Its pace is up to 1.3% over six months and to 1.9% over three months. In the German domestic treatment, inflation is clearly accelerating and nearly back to normal. In the same domestic report, the CPI excluding energy is also firming: there is a 1.3% pace of inflation over 12 months and six months which rises to 2.3% over three months.

If this background has credibility, German policymakers are going to see tradeoffs in the European Union that are different from everybody else in the EMU. Inflation across the rest of the union is low and for the most part stuck low, and moving lower. Germany, despite being hit with economic weakness, is still showing some firmness to inflation.

The German HICP inflation rate moved up to 0.2% month-to-month in September after being flat in July and August. The domestic CPI pace moved up a 0.2% in September after posting 0.1% in August and 0.2% in July. Interestingly, although the domestic and HICP inflation rates show very different sequential growth rates, they both show a rise of 0.8% year-over-year and one year ago they were both up by 1.5%. Over the long haul, these two inflation rates have given us the same results; it's over the short periods that they giving us very different signals and the differences are very important.

The domestic CPI shows inflation rising in 54% of the categories over three months and six months but rising in only 45% of the categories over 12 months. The diffusion approach is showing some mild inflation pressure.

Looking at the details, there are six of 11 categories that are showing inflation acceleration over three months. One of those rising rates is for recreation and culture, and is an inflation rate that is still negative. It's just not as weak as it was over six months. There are still three categories in the German CPI that have prices falling over three months. There are only five of 11 categories with inflation over 2%.

Over six months, the results are much the same, with six categories showing acceleration compared to year-over-year inflation. However, over six months, there are only two categories with prices still falling. That occurs in communication and in recreation and culture. Over six months there is only one category with inflation running over 2%.

Over 12 months, there are only five categories with inflation accelerating compared one year ago. There are three categories with prices declining year-over-year. There are four categories with inflation running at a pace above 2%.

The German trends show slightly more pressure over these shorter time horizons and German officials will be aware of this. However, the near-term calculations are also the most fickle because we are compounding results over three months. And that can create distortions.

In addition to the inflation trend, we have to take a look at the environment. The recent German ZEW index gave us such a weak reading. It could be telling us that the German economy is on the brink of recession. If that's true, then we would expect price weakness to reappear. Switzerland today produced another weak reading on its economic expectations. The rest of the euro area continues to show very weak results; its recent PMI gauges as well as the recently finalized industrial production data that were quite soft. So the region surrounding Germany is still weak and sanctions on Russia are still in place. Russia and Ukraine are still hostile. In addition, we have the Saudis pumping oil in massive amounts perhaps to try to make oil shale look less economic, but in the short run, the act is certainly geared to try to regain its control and share of oil output among other oil producers who have been unwilling to cut back their output to stabilize the oil price.

Given the environmental factors, inflation risks would still seem to be on the downside. The emergence of some firming in price trends in Germany over the last several months is still not reliable enough to let policy depend on it. The performance of the German economy and the environment around it suggest that the view the price stability may be obtained is overmatched by all these other factors which are continuing downward pressure on inflation. This month's German CPI may be a breath of fresh air for those fearing deflation. But it's not a report that signals that price stability is won, nor is it decisive in any way.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.