Global| May 17 2011

Global| May 17 2011German Investors: Almost Unanimous On Current Good Times, But Worry That The Good Times Won't Last

Summary

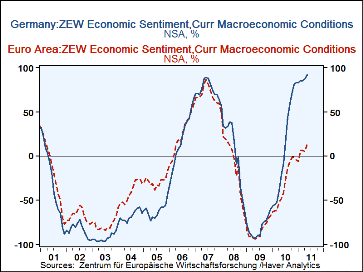

The balance of opinion on current economic conditions in Germany of the 295 Institutional investors and financial analysts responding to the ZEW financial market survey in May rose from 87.1% in April to 91.5%, the highest balance on [...]

The balance of opinion on current economic conditions in Germany of the 295 Institutional investors and financial analysts responding to the ZEW financial market survey in May rose from 87.1% in April to 91.5%, the highest balance on record. The balance of opinion on conditions improving or worsening over the next six months fell from 7.6% in April to 3.1% in May. The decline may have been due, in part, to the fact that it is hard to see conditions improving from the current high assessment of the economy and, in part, to worry over how the resolution of the financial problems of Portugal, Ireland, Greece and Spain may affect Germany's economy.

In addition to assessing current condition in the German economy and its short term prospects, the respondents to the ZEW survey also assesses current conditions and the short term outlook for the entire Euro Area. The participants in the survey have shown a growing divergence in their appraisal of current conditions in Germany and those in the Euro Area as a whole ever since the late months of 2010.

The difference between the two balances is currently the widest on record--77.9 basis points--as can be seen in the first chart. The difference is due partly to Germany's strong performance in recent months and partly to the poor performance in the problem countries noted above.

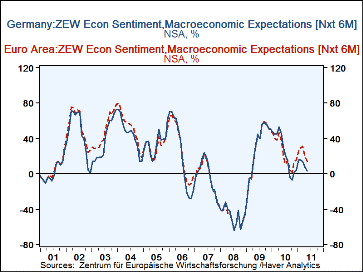

The difference between the appraisal of the short term outlook in Germany and that of the Euro Area has been much smaller that that between the appraisal of current conditions, as can be seen in the second chart. The balance of opinion on the short term outlook for Germany, declined from 7.6% to 3.1% in May while that for the Euro area as a whole declined from 19.7% to 13.6% . The declines in both cases were probably due to the appraisal of current conditions. In the case of Germany, it may be, as noted above, the belief is that things are as good as they get and, in the case of the Euro Area, worry over those problem countries.

| ZEW Financial Market Survey | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| May 11 |

Apr 11 |

Mar 11 |

Feb 11 |

Jan 11 |

Dec 10 |

Nov 10 |

Oct 10 |

Sep 10 |

Aug 10 |

Jul 10 |

Jun 10 |

|

| Balance of Opinion (%) | ||||||||||||

| Germany | ||||||||||||

| Current Condition (Good Vs Bad) | 91.5 | 87.1 | 85.4 | 85.2 | 82.8 | 82.6 | 81.5 | 72.6 | 59.9 | 44.3 | 14.6 | -7.9 |

| Condition 6M Ahead (Improving vs. Worsening) | 3.1 | 7.6 | 14.1 | 15.7 | 15.4 | 4.3 | 1.8 | -7.2 | -4.3 | 14.0 | 21.2 | 28.7 |

| Euro Area | ||||||||||||

| Current Condition (Good Vs Bad) | 13.6 | 5.6 | 6.4 | 6.1 | -6.1 | -4.6 | -1.0 | -1.1 | -6.3 | -13.0 | -26.5 | -40.8 |

| Condition 6M Ahead (Improving vs. Worsening) | 13.6 | 19.7 | 31.0 | 29.5 | 25.4 | 15.5 | 13.8 | 1.8 | 4.4 | 15.8 | 10.7 | 18.8 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates