Global| Feb 14 2012

Global| Feb 14 2012German Investors And Analyst Turn Positive: Greek Debt Agreement The Reason?

Summary

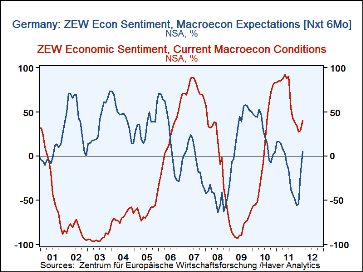

German investors and analysts interviewed over the period from January 30 to February 13, 2012 by the ZEW Institute in Mannheim, Germany, became more optimistic. From an excess of pessimists of 21.5% in January there was an excess of [...]

German investors and analysts interviewed over the

period from January 30 to February 13, 2012 by the ZEW Institute in

Mannheim, Germany, became more optimistic. From an excess of

pessimists of 21.5% in January there was an excess of optimists of 5.4% in

February, a positive change of 27 percentage points resulting in the

first excess of optimists since May 2011. The financial community also

felt better about current conditions There was a rise of 11.9

percentage points in the optimists, from 28.4% in January to 40.3% in

February.& The course of the financial community's opinions on

current conditions and expectations over the past decade can be seen in

the attached chart. Currently expectations, at 5.4%, are some 10

percentage points below the mean (15.6%) over the past ten years while the

appraisal of current conditions is about 60 percentage points above its

ten year average (-20.6%) suggesting that the financial community has turned

from highly pessimistic appraisal of the outlook to a cautiously

optimistic one.

German investors and analysts interviewed over the

period from January 30 to February 13, 2012 by the ZEW Institute in

Mannheim, Germany, became more optimistic. From an excess of

pessimists of 21.5% in January there was an excess of optimists of 5.4% in

February, a positive change of 27 percentage points resulting in the

first excess of optimists since May 2011. The financial community also

felt better about current conditions There was a rise of 11.9

percentage points in the optimists, from 28.4% in January to 40.3% in

February.& The course of the financial community's opinions on

current conditions and expectations over the past decade can be seen in

the attached chart. Currently expectations, at 5.4%, are some 10

percentage points below the mean (15.6%) over the past ten years while the

appraisal of current conditions is about 60 percentage points above its

ten year average (-20.6%) suggesting that the financial community has turned

from highly pessimistic appraisal of the outlook to a cautiously

optimistic one.

While the positive economic data may have led to a more favorable outlook for Germany, it is probable that progress in the negotiations between the Greek Government and its creditors towards the end of the interview period played a major role in the financial community's much more optimistic outlook. To the extent that this is the case, however, it should be noted that any immanent resolution to the debt crisis may prove elusive. (It wasn't until the end of the interview period that the public reaction to the terms of the agreement--riots in the streets of Athens--was known.) Not only is the outlook, cautiously optimistic, but also fragile.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates