Global| Jul 14 2009

Global| Jul 14 2009German Investors And Analysts Become Less Positive On The Outlook

Summary

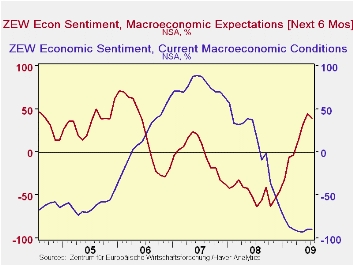

German investors and analysts have become somewhat less positive about the economic outlook, six months ahead. In the July survey of the financial community by the ZEW institute, the excess of optimists over pessimists regarding the [...]

German investors and analysts have become somewhat less

positive about the economic outlook, six months ahead. In the July

survey of the financial community by the ZEW institute, the excess of

optimists over pessimists regarding the economic outlook dropped to

39.5% from 44.8% in June. It is not surprising that some of the

participants in the survey may be becoming more cautious about the

recovery after the rapid decline of pessimists and the rapid rise of

optimists that has taken place since the low of last July. The swing

from the majority of pessimists in July 2008 to the majority of

optimists in June was 108.7 percentage points. With the decline in

optimists in July, the swing is still large at 103.4 percentage points.

Moreover, the July excess of optimists of 39.5 % is still well above

the long term average of 26.3%.

Pessimists in the financial community continue to dominate the optimists regarding the current economic situation. In July, although slightly improved from the June figure of 89.7%, the excess of pessimists was 89.3%. Expectations and appraisals of current conditions are shown in the first chart.

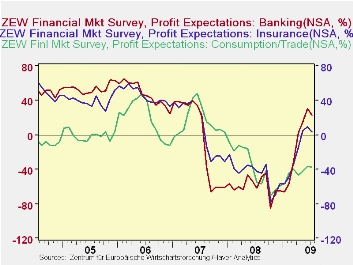

Among the factors that may have influenced the participants in

the July ZEW survey are their profit expectations. In the July survey,

they expect a detererioration in profits for the banking and insurance

industries, the first deterioration since January, 2009.  While the

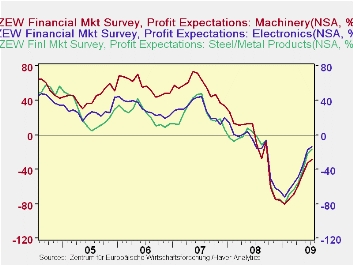

expectations of profits in the producing industries, such as machinery,

metals/steel and electronics are expected to show some improvement,

profits in consumption and trade are expected to decline slightly.

Profit expectations that are expected to increase and those that are

expected to decrease are shown in the second and third charts.

While the

expectations of profits in the producing industries, such as machinery,

metals/steel and electronics are expected to show some improvement,

profits in consumption and trade are expected to decline slightly.

Profit expectations that are expected to increase and those that are

expected to decrease are shown in the second and third charts.

| ZEW SURVEY (Percent Balances ex where noted) | July 09 | June 09 | July 08 | M/M Chg | Y/Y Chg | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|

| Expectations | 39.5 | 44.8 | -63.9 | -5.3 | 103.4 | -47.5 | -30 | 22.3 |

| Current Conditions | -89.3 | -89.7 | -17.0 | 0.4 | -106.3 | 7.3 | 75.9 | 18.3 |

| Profit Expectations | July 09 | June 09 | May 09 | Apr 09 | Mar 09 | Feb 09 | Jan 09 | |

| Banking | 22.0 | 30.8 | 15.1 | 2.0 | -31.6 | -55.7 | -65.7 | -- |

| Insurance | 3.2 | 9.7 | 5.1 | -15.1 | -34.2 | -49.0 | -56.5 | -- |

| Consumption | -37.4 | -36.6 | -42.1 | -46.0 | -40.2 | -44.3 | -56.2 | -- |

| Metal/Steel | -16.0 | -22.3 | -41.5 | -55.1 | -64.1 | -69.3 | -80.1 | -- |

| Machinery | -28.4 | -32.5 | -45.6 | -58.5 | -69.4 | -74.6 | -80.1 | -- |

| Electronics | -13.7 | -17.3 | -36.0 | -48.9 | -57.2 | -64.0 | -72.2 | -- |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates