Global| Jan 10 2006

Global| Jan 10 2006German Investors and Analysts More Confident of Improving Economy and Profits

Summary

After a sharp rise in confidence among institutional investors and analysts in Germany last month, confidence increased meaningfully again in January. The excess of optimists over pessimists expecting improved conditions over the next [...]

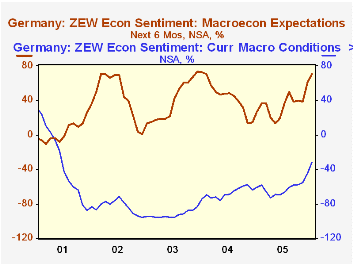

After a sharp rise in confidence among institutional investors and analysts in Germany last month, confidence increased meaningfully again in January. The excess of optimists over pessimists expecting improved conditions over the next six months is now 71%. 9.4 percentage points above December, 2005, 44.1 points above January 2005 and the highest excess since January, 2004. The investors and analysts also became less pessimistic regarding current conditions. Although pessimists still exceed optimists in appraising current conditions by 31.6% in January, the excess of pessimists was 12.8% less than that of December, 2005 and 29.6% less than that of January, 2005 and well below the extreme pessimism of the first half of 2003 when the excess of pessimists averaged around 95%. The percent balances for expectations and current conditions in the German economy are shown in the first chart.

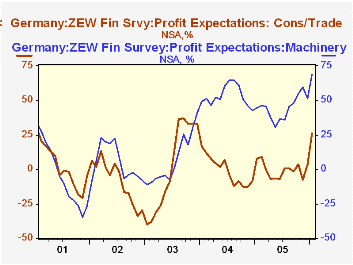

In its survey of investors and analysts, ZEW research also asks for opinions on profit expectations in a wide variety of industries. The results are expressed as the percent balance of those expecting increases over those expecting decreases. In the latest survey, the excess of those expecting increases over those expecting decreases varied from 68.7% for machinery to 3.4% for construction. The second chart shows profit expectations for the machinery and the consumption/trade industries. Expectations for rising profits have been strong for the machinery industry since Mid 2003 while those for the consumption/trade industry have been poor. The sharp rise in the excess of those expecting an increase over those expecting a decrease in the profits of the consumption/trade industry in January to 25.9% from 3.5 % last December is particularly encouraging.

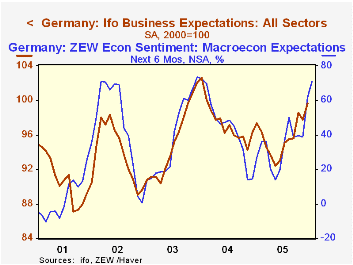

As shown in the third chart the ZEW measure of confidence, which is based on a small sample of some 300 investors and analysts, frequently anticipates the results of the broader IFO measure which is based on replies from some 7000 firms engaged in manufacturing, construction, wholesaling and retailing. The IFO index is scheduled to be release on January 25.

| Jan 06 | Dec 05 | Jan 05 | M/M Dif | Y/Y Dif | 2005 | 2004 | 2003 | |

|---|---|---|---|---|---|---|---|---|

| ZEW Investor Confidence Measure (% Balance) Exports | ||||||||

| Current Conditions | -31.6 | -44.4 | -61.2 | 12.8 | 29.6 | -61.8 | -67.7 | -92.6 |

| Expectation 6 Months Ahead | 71.0 | 61.6 | 26.9 | 9.4 | 44.1 | 34.8 | 44.6 | 38.4 |

| Profit Expectations | ||||||||

| Machinery | 68.7 | 51.0 | 44.4 | 17.7 | 23.3 | 44.7 | 53.4 | 7.0 |

| Consumption/Trade | 25.9 | 3.5 | 7.8 | 22.4 | 18.1 | -0.4 | -0.8 | 2.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates