Global| Feb 17 2009

Global| Feb 17 2009German Investors Begin To See A Ray Of Hope For The Economy

Summary

While German investors continue to see current economic conditions getting worse, they have begun to be less negative on the outlook. The German government has approved an 80 billion euro ($102 billion) stimulus program to be spent [...]

While German investors continue to see current economic conditions getting worse, they have begun to be less negative on the outlook. The German government has approved an 80 billion euro ($102 billion) stimulus program to be spent over two years. The European Central Bank, after reducing its key interest by 225 basis points since October 2008, kept the rate at 2% in February but, in his press conference on February 5, Jean-Claude Trichet, President of the Bank stated that 2% was not considered by the Governing Council to be a lower limit and that the situation would be examined at the next meeting.

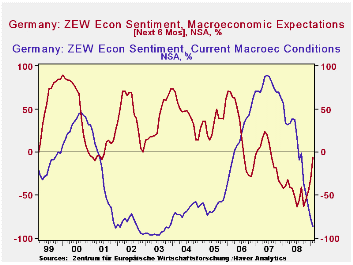

These developments may have influenced the institutional

investors and analysts who participated in the latest ZEW survey which

took place between February 2 and 16.The excess of pessimists over

optimists regarding economic conditions six months ahead fell from

31.0% to 5.8%. Although the decline in pessimists regarding the outlook

is encouraging, put in perspective, it is less reassuring. It is still

negative and well below the long term average of an excess of optimists

over pessimists of 26.4%. ZEW President, Wolfgang Franz, summarized the

results of the survey as "A ray of hope--no more, no less."

Although the investors were less negative about the prospects six months ahead, they became even more negative about current conditions. The excess of pessimist over optimists regarding current economic conditions increased from 72.1% to 86.2%.

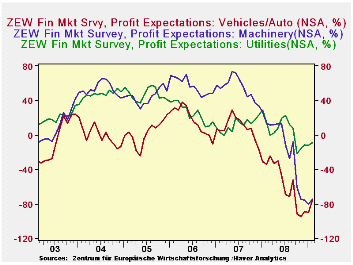

In line with their less negative view of the outlook, the investors have become less negative about their profit expectations, but they are still far from expecting anything but lower profits. The highest expectations of profits in a -9.2% for Utilities. That is, those expecting a decrease in profits outweigh those expecting an increase by 9.2%. The worst is for Vehicles/Automobile where the excess of those expecting a decrease in profits over those expecting an increase is 75.3%. The outlook for profits in the Machinery industry is only marginally better than that for Automobiles.The excess of those expecting a decrease in profits over those expecting an increase is 74.6%. Profit expectations for the these industries are shown in the second chart.

| GERMANY | Feb 09 | Jan 09 | Dec 08 | Nov 08 | Oct 08 |

|---|---|---|---|---|---|

| ZEW Survey | |||||

| Current Conditions (% Balance) | -86.2 | -72.1 | -64.5 | -50.4 | -35.9 |

| Condition 6 Months Ahead (% Balance) | -5.8 | -31.0 | -45.2 | -53.5 | -63.0 |

| Profit Expectation (% Increase-Decrease) | |||||

| Utilities | -9.2 | -12.4 | -11.2 | -15.9 | -22.3 |

| Vehicles/Automobiles | -75.3 | -90.3 | -89.3 | -94.6 | -91.7 |

| Machinery | -74.6 | -80.1 | -75.2 | -74.8 | -61.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates