Global| Feb 16 2010

Global| Feb 16 2010German Investors Continue To Lower Expectations

Summary

The financial community in Germany has become less enthusiastic about economic prospects in Germany and in the Euro Area as a whole. The results of the latest ZEW survey of analysts and institutional investors showed that the balance [...]

The financial community in Germany has become less enthusiastic about

economic prospects in Germany and in the Euro Area as a whole. The

results of the latest ZEW survey of analysts and institutional

investors showed that the balance of those looking for improved

conditions six months ahead in Germany over those looking for

deteriorating conditions was 45.4% in February, down 1.8 points from

47.2% in January and down 12.6 points from the peak, 57.7%, in

September of last year. Although the majority of the participants still

view current conditions negatively, the excess of pessimists over

optimists declined slightly from 56.6% to 54.8%.

The financial community in Germany has become less enthusiastic about

economic prospects in Germany and in the Euro Area as a whole. The

results of the latest ZEW survey of analysts and institutional

investors showed that the balance of those looking for improved

conditions six months ahead in Germany over those looking for

deteriorating conditions was 45.4% in February, down 1.8 points from

47.2% in January and down 12.6 points from the peak, 57.7%, in

September of last year. Although the majority of the participants still

view current conditions negatively, the excess of pessimists over

optimists declined slightly from 56.6% to 54.8%.

The

participants in the latest survey are generally less optimistic about

profit prospects. Among the thirteen industries covered, only

construction and services showed an increased balance of optimists over

pessimists. The negative balances of opinion on the outlook for profits

in the automobile and the retail/consumer goods industries increased in

February. The balance on the profit outlook for the automobile industry

was -29.7% in February compared with -23.2% in January. The comparable

figures for the consumption/trade industries were-18.9% and -12.1%. The

balances of opinion on the out look for profits in the remaining

industries are still positive after declines in February. The balances

of opinion for the thirteen industries in February and their changes

from January are shown in the table below.

The

participants in the latest survey are generally less optimistic about

profit prospects. Among the thirteen industries covered, only

construction and services showed an increased balance of optimists over

pessimists. The negative balances of opinion on the outlook for profits

in the automobile and the retail/consumer goods industries increased in

February. The balance on the profit outlook for the automobile industry

was -29.7% in February compared with -23.2% in January. The comparable

figures for the consumption/trade industries were-18.9% and -12.1%. The

balances of opinion on the out look for profits in the remaining

industries are still positive after declines in February. The balances

of opinion for the thirteen industries in February and their changes

from January are shown in the table below.

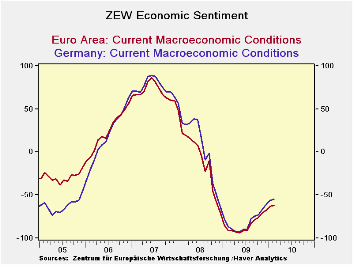

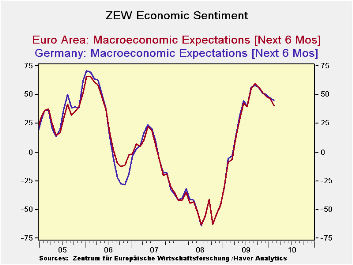

In addition to an appraisal of current economic conditions and expectations of conditions six months ahead for Germany, the participants in the ZEW survey also provide a similar appraisal for the Euro Area. The balance of those expecting an improvement in the economy of the entire Euro Area was 40.2% in February, 4.9 points lower than that for Germany and the balance on current conditions was -62.7%, 6.1 points more unfavorable than the -56.6% for Germany. The two attached charts compare the balances of opinion on (1) current conditions and (2) expectations for Germany and for the Euro Area. No doubt the severity of the financial crisis in Greece together with continued concern over the economies of Ireland, Portugal and Spain account for the more cautious appraisal of prospects for the entire Euro Area than that for Germany.

| ZEW INDICATORS (% Balance) | Feb 10 | Jan 10 | Peak | M/M Chg | Chg from Peak | Industry | Feb 10 | M/M Chg |

|---|---|---|---|---|---|---|---|---|

| Germany | Banks | 15.8 | -6.8 | |||||

| Current Conditions | -54.8 | -56.6 | -92.8** | 1.8 | 38.0 | Insurance | 11.0 | -5.6 |

| Expectations | 45.1 | 47.2 | 57.7* | -1.9 | -12.6 | Automobile | -29.7 | -6.5 |

| Chem/Pharma | 35.8 | -4.9 | ||||||

| Euro Area | Steel | 23.8 | -5.5 | |||||

| Current Conditions | -62.1 | -62.7 | -93.2** | 1.6 | 31.1 | Electronics | 22.0 | -5.0 |

| Expectations | 40.2 | 46.2 | 59.6* | -6.0 | -19.4 | Mech. Eng | 29.6 | -4.2 |

| Retail/ Cons | -18.9 | -6.8 | ||||||

| Construction | 4.2 | +3.8 | ||||||

| Utilities | 21.4 | -0.6 | ||||||

| Services | 22.1 | +1.0 | ||||||

| Telecom | 6.4 | -3.1 | ||||||

| * September 2009 ** May 2009 | Info Tech | 33.5 | -2.9 | |||||