Global| Aug 17 2010

Global| Aug 17 2010German Investors Lower Their Appraisal Of The Outlook But Raise Their Appraisal Of The Current Economic Situation

Summary

The 284 German institutional investors and analysts who participated in the ZEW survey between July 26 and August 16 have become less optimistic about future economic conditions. At the same time, they raised their appraisal of the [...]

The 284 German institutional investors and analysts who participated in the ZEW survey between July 26 and August 16 have

become less optimistic about future economic conditions. At the same time, they raised their appraisal of the current

economic situation significantly. The balance of opinion on expectations for the next six months fell from 21.2% in July

to 14.0% in August. The balance of opinion on current conditions rose from 14.1% in July to 44.3% in August.

The 284 German institutional investors and analysts who participated in the ZEW survey between July 26 and August 16 have

become less optimistic about future economic conditions. At the same time, they raised their appraisal of the current

economic situation significantly. The balance of opinion on expectations for the next six months fell from 21.2% in July

to 14.0% in August. The balance of opinion on current conditions rose from 14.1% in July to 44.3% in August.

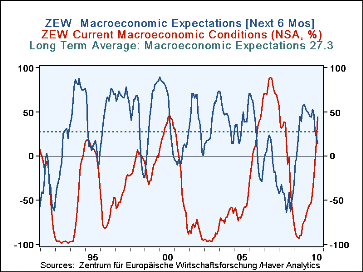

The big rise in the positive balance of opinion on current conditions was, no doubt, a reflection of the exceptionally good economic performance of the German economy in recent months. On August 13th it was announced that real GDP in the second quarter rose at an annual rate of increase of 9.01%, the largest increase recorded since reunification. While the details of the second quarter GDP will not be available until August 24, it is clear that part of Germany's stellar performance in the second quarter was due to increased exports. With signs of slowdowns in some of Germany's trading partners, namely the U. S. and China, fewer German investors now expect prospects for the next six months to improve. The excess of investors expecting improvement in the economy over those expecting worsening conditions in the next six months is now only 14.0%. This figure is significantly below the long term average of 27.3%, as can be seen in the attached chart, that shows the balances of opinion for current conditions and expectations together with the long term average of the balance of opinion on expectations.

In spite of the less positive balance of opinion on economic conditions six months ahead, balances of opinion on the profitability, over the next six months, of many industries remains high: Automobiles (47.8%), Chemical/Pharmaceutical (58.7%), Steel (48.6%), Mechanical Engineering (64.7%), and Information Technology (38.9%). Moreover, there were two industries where the balances of opinion on profitability rose sharply: Retail/Consumer Goods, where the balance of opinion rose 12.1 points from 4.2% to 16.3% and Services where the balance for opinion rose ten points from 21.6% to 31.6%.

| Aug 10 | July 10 | Jun 10 | May 10 | April 10 | Mar 10 | Feb 10 | Jan 10 | |

|---|---|---|---|---|---|---|---|---|

| Current Conditions (% Balance) | 44.3 | 14.6 | -7.9 | -21.6 | -39.2 | -56.9 | -54.8 | -56.6 |

| Expectations (% Balance) | 14.0 | 21.2 | 28.7 | 45.8 | 53.0 | 44.5 | 45.1 | 47.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates