Global| Jan 19 2010

Global| Jan 19 2010German Investors More Cautious On The General Outlook But Still See Improvement In The Profit Outlook

Summary

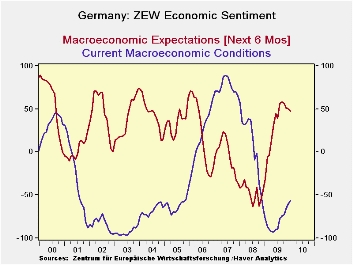

According to the January ZEW indicator, the percentage of German investors and analysts optimistic about the outlook six months ahead declined for the fourth month. The percent balance is now 47.2% compared with the recent peak of [...]

According

to

the January ZEW indicator, the percentage of German investors and

analysts optimistic about the outlook six months ahead declined for the

fourth month. The percent balance is now 47.2% compared with

the recent peak of 57.7% in September, however, it is still well above

the long term average of 27.1%. At the same time, more of

these investors see improvement in current conditions although the

pessimists still outweigh the optimists. The percent balance

between those who see improvement in current conditions and those who

see deterioration was -56.6% in January, 2010, compared with -60.6% in

December and the peak of -92.8% in May of 2009. The disparity

between the participants' views of current conditions and expectations

is not unusual as can be seen in the first chart.

According

to

the January ZEW indicator, the percentage of German investors and

analysts optimistic about the outlook six months ahead declined for the

fourth month. The percent balance is now 47.2% compared with

the recent peak of 57.7% in September, however, it is still well above

the long term average of 27.1%. At the same time, more of

these investors see improvement in current conditions although the

pessimists still outweigh the optimists. The percent balance

between those who see improvement in current conditions and those who

see deterioration was -56.6% in January, 2010, compared with -60.6% in

December and the peak of -92.8% in May of 2009. The disparity

between the participants' views of current conditions and expectations

is not unusual as can be seen in the first chart.

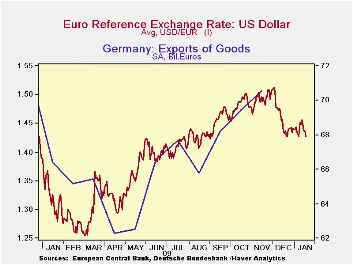

The impact on the Euro Area of the financial difficulties in Greece that have come to the surface during the survey period may have had some dampening effect on expectations and outweighed some of the more favorable economic developments. Over the past month or so, the Euro has declined 5.5% from $1.5120 to $1.4279 today and exports continue to rise. The second chart shows the movement in the Euro on a daily basis and the trend in monthly exports over the past year.

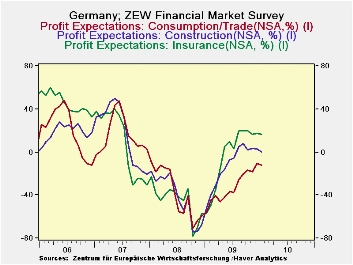

Along with the improvement in the appraisal of current conditions there has been a general improvement in the outlook for profits in the 13 industries that ZEW monitors. The positive appraisal for profits in Banking, Chemical, Steel/Metal, Electronic, Machinery, Utilities, Service, Telecommunications, and Information Technology industries increased in January and the negative percent balance for profits in the Vehicles/Automotive industry was reduced. The percent balances on only three industries declined--Insurance, Consumption/Trade and Construction in January, but the profit outlook in these industries has shown improvement since the low point reached in October 2008 as can be seen in the third chart. There are now only two industries where the percent balances on the profit outlook are negative--Consumption/Trade (-12.1%) and Vehicles/Automotive (-23.2%).

| ZEW INDICATORS (% Balance) | Jan 10 | Dec 09 | Nov 09 | Oct 09 | Sep 09 | Aug 09 | July 09 | June 09 | May 09 |

|---|---|---|---|---|---|---|---|---|---|

| Current Conditions | -56.6 | -60.6 | -65.6 | -72.2 | -74.0 | -77.2 | -88.3 | -89.7 | 92.8 |

| Expectations 6 Months Ahead | 47.2 | 50.4 | 51.1 | 56.0 | 57.7 | 56.1 | 39.5 | 44.8 | 31.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates