Global| Apr 17 2007

Global| Apr 17 2007German Investors' Optimism Surprises but the Optimism Is Subdued

Summary

German investors surprised the economic community with a spurt of optimism. The balance of those looking for better conditions six months ahead over those looking for worsening conditions rose to 16.5% in April from 5.8% in March. In [...]

German investors surprised the economic community with a spurt of optimism. The balance of those looking for better conditions six months ahead over those looking for worsening conditions rose to 16.5% in April from 5.8% in March. In spite of the rise, however, the balance is well below that of 62.7% in April, 2006 and also well below the long term average of 33.1%.

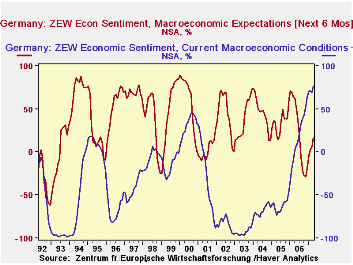

Investors continue to be impressed with current conditions. The balance of those seeing improvement in current conditions over those seeing deterioration rose to 76.9%, an all time high, from 69.2% in March and from 2.9% in April, 2006. The first chart shows the balances for current conditions and for the outlook since December 1981, when the series began.

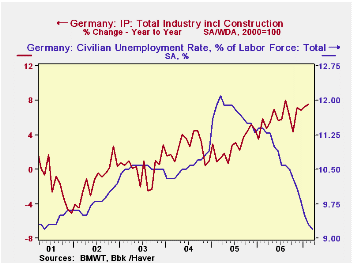

Contributing, no doubt, to the increased optimism regarding current conditions among German investors has been the continued improvement in the economy in the first months of this year. The imposition of a 3 point increase in the Value Added Tax that went into effect on January 1, 2007 has apparently had a less deleterious effect on the economy than had been feared. Retail sales declined 3.9% in January, but rose 1.26% in February. The unemployment rate of registered workers declined to 9.2% in March from 9.8% in December. Industrial production was up 7.57% in February over the corresponding month of 2006 and, on the same basis, in January, 7.24%, compared with an increase of 5.88% for all of 2006 over 2005. Unemployment rates and the year over year increases in industrial production are shown in second chart shows.

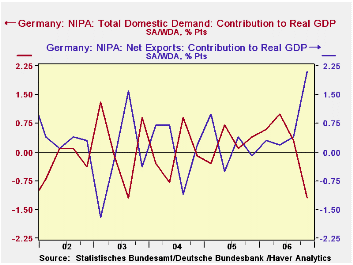

As noted above, the expectations balance is well below the long term average of 33.1%. Perhaps one of the factors that may account for the subdued expectations is the strength in the Euro and what it may mean for exports. It was export demand increasing 2.10 points that offset the 1.2 point decline in domestic demand in the final quarter of the year. The third chart shows the contributions to growth of exports and domestic demand over the last five years. Perhaps one of the questions troubling investors is whether the decline in unemployment is such that it will lead to an increase in consumer demand that could offset a decline in exports.

| GERMANY ZEW INDICATOR | Apr 07 | Mar 07 | Apr 06 | M/M Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Expectations (% Balance) | 16.5 | 5.8 | 62.7 | 10.7 | -46.2 | 22.3 | 34.8 | 44.6 |

| Current Conditions (% Balance) | 76.9 | 69.2 | 2.9 | 7.7 | 74.0 | 18.3 | -61.8 | -67.7 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates