Global| Jun 21 2011

Global| Jun 21 2011German Investors Reconsider The Outlook

Summary

German institutional investors and analysts have become more cautious regarding economic prospects over the next six months. The ZEW (Center for Economic Research in Mannheim) reported today that its indicator of economic sentiment [...]

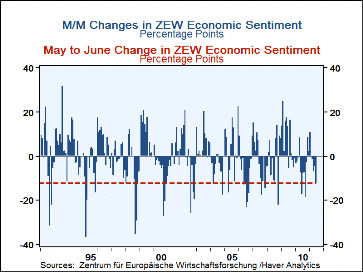

German institutional investors and analysts have become more cautious regarding economic prospects over the next six months. The ZEW (Center for Economic Research in Mannheim) reported today that its indicator of economic sentiment dropped 12.1 points in June from 3.1% in May to -9.0% in June. While this is not the biggest month to month decline that has taken place in the history of indicator, it is among the larger declines, as can be seen in the first chart that shows the month to month changes compared to the May to June 2011 decline.

No doubt the deterioration in the financial situation in Greece over the period during which the survey was taken (May 30 to June 20) accounts for much of the sharp change in investors' appraisal of the outlook. A crucial vote of confidence in the Greek government is scheduled for tonight and, depending on the outcome, could lead investors to panic or breathe a sigh of relief.

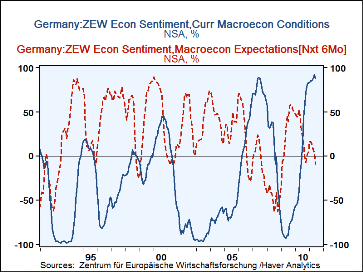

As can be seen in the second chart, at the same time that investors lowered their macroeconomic expectations for the next six months, they also lowered their appraisal of current conditions by 4 percentage points from 91.5% in May to 87.5% in June. This is still an unusually high percentage of optimists over pessimists, but the decline suggests that doubts that the good times will go on forever are beginning to rise. The recent slow down in growth in the United States is not a good sign for German exports.

The ZEW survey also includes investors' profit expectations for various industries. In the latest survey, profit expectations in each of the industries were lower in June than they were in May, as shown in the table below. The biggest decline, 24.6 percentage point, took place in the banking industry where the excess of those expecting an increase in profits over those expecting a decrease went from a plus 14.1% in May to a negative 10.5% in June.

| GERMANY ZEW (% Bal) | June'11 | May'11 | Apr'11 | Mar'2011 | Feb'11 | Jan'11 |

|---|---|---|---|---|---|---|

| Current Macro Economic Conditions | 87.5 | 91.5 | 87.1 | 85.4 | 85.2 | 82.8 |

| Macro Expectations (Headline Series) | -9.1 | 3.1 | 7.6 | 14.1 | 15.7 | 15.4 |

| Profit Expectations | June'11 | May'11 | M/M chg* | |||

| Banking | -10.5 | 14.1 | -24.6 | |||

| Insurance | -11.6 | -4.3 | -7.2 | |||

| Automobiles | 27.0 | 40.2 | -12.2 | |||

| Chemicals/Pharmaceuticals | 39.8 | 49.3 | -9.5 | |||

| Steel | 24.8 | 35.9 | -11.1 | |||

| Electronics | 29.0 | 37.0 | -8.0 | |||

| Mechanical Engineering | 38.1 | 52.0 | -13.9 | |||

| Retail/Consumer Goods | 27.0 | 35.0 | -8.0 | |||

| Construction | 25.2 | 29.2 | -4.0 | |||

| Utilities | -44.2 | -36.0 | -8.2 | |||

| Services | 21.9 | 28.9 | -7.0 | |||

| Telecommunications | 0.8 | 5.9 | -5.1 | |||

| Information Technology | 30.6 | 37.6 | -7.0 | |||

| * Percentage points | ||||||