Global| Jun 05 2014

Global| Jun 05 2014German Orders Bounce Back

Summary

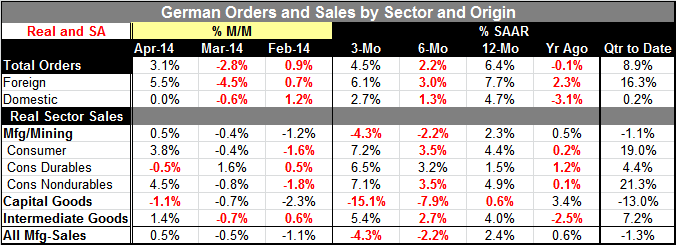

German orders rebounded strongly in April, rising by 3.1% after dropping by 2.8% in March. Domestic orders were flat in April, after falling by 0.6% in March. Foreign orders have recovered, rising by 5.5% after falling by 4.5% in [...]

German orders rebounded strongly in April, rising by 3.1% after dropping by 2.8% in March. Domestic orders were flat in April, after falling by 0.6% in March. Foreign orders have recovered, rising by 5.5% after falling by 4.5% in March.

German orders rebounded strongly in April, rising by 3.1% after dropping by 2.8% in March. Domestic orders were flat in April, after falling by 0.6% in March. Foreign orders have recovered, rising by 5.5% after falling by 4.5% in March.

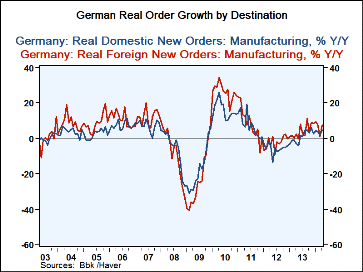

The trend for orders shows a gain of 6.4% over 12 months; that drops to 2.2% at an annual rate over six months, and recovers to a 4.5% pace over three months. Orders are growing over all these periods, but it's not clear exactly what the growth rate is for German orders and that notion is even more complicated looking at the recent extreme monthly volatility.

Foreign orders are rising at a 6.1% annual rate over three months, up from a 3% pace over six months but down from a 7.7% pace over 12 months. Still, foreign orders are growing faster than domestic orders for each of these horizons. Domestic orders are advancing at a 2.7% annual rate over three months; that is a pickup from their 1.3% pace over six months but it's below their 4.7% rise over 12 months.

Real sector sales in Germany showed increases in most of the categories with a 0.5% decline for consumer durables and a 1.1% decline for capital goods. Capital goods real sector sales are down for three consecutive months, and that's usually the leading sector for the German economy.

Consumer goods real sector sales are showing firm growth that is accelerating over three months; the growth rate runs from a 4.4% annual rate over 12 months to a 3.5% rate over six months then up to a 7.2% rate over three months. The usually-leading capital goods sector shows real sector sales up by only 0.6% over 12 months, falling by 7.9% at an annual rate over six months and falling even faster at a -15% annual rate over three months. Intermediate goods show more or less steady growth with real sector sales of 4% over 12 months, rising at a 2.7% annual rate over six months and at a 5.4% annual rate over three months.

Manufacturing as a whole is dominated by capital goods as the twelve-month growth rate of 2.3%, decays to -2.2% over six months and -4.3% at an annual rate over three months.

German orders data taken by themselves are reassuring. There are strong growth rates for both foreign and domestic orders over all the main horizons. In the quarter to date, foreign orders are rising at a 16.3% annual rate but domestic orders are stuck and rising only at a 0.2% annual rate. On these data Germany seems to be once again dependent on growth from abroad. Germany's real sector sales suggest that there is some significant weakness in its usually dependable capital goods sector.

On balance the German orders data show a sharp group rebound from what had been an unexpectedly weak result in March. Netting the April and March performance against one another and looking at the three-month growth rates, we see reasonably strong growth rates, remembering that these are already expressed in real terms. In the quarter to date, growth seems to be quite strong. But the foreign sector is carrying the entire burden and domestic orders are quite flat. There is no sense in these figures that Germany is suffering from any of the sanctions placed on Russia since it's German domestic orders that are weak while its foreign orders are strong.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates