Global| Feb 21 2011

Global| Feb 21 2011German Overall Business Confidence Indicator Rises But Confidence In Retail Trade Continues To Weaken

Summary

Confidence, as measured by the IFO, is at an all time high among Germany's businessmen engaged in industry and trade. The February release shows that the balance of opinion on the Business Climate was 21.9% an increase of 1.9 [...]

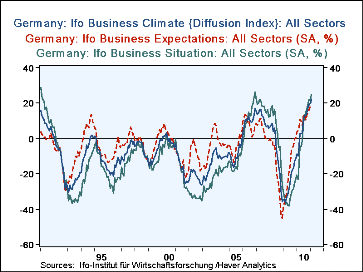

Confidence, as measured by the IFO, is at an all time high among Germany's businessmen engaged in industry and trade. The February release shows that the balance of opinion on the Business Climate was 21.9% an increase of 1.9 percentage points from January, and 36.5 percentage points from February 2010. The increase in the business appraisal of the Climate was due largely to the appraisal of the current situation, the percent balance of which rose from 21.4% in January to 25.2% in February. The percent balance on expectations rose a mere 0.1 point. The percent balances for the Business Climate, Current Conditions and Expectations are shown in the first chart.

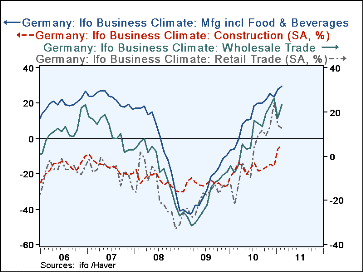

Confidence, as measured by the Business Climate, in Manufacturing increased by 1.7 percentage points to 29.4% in February, that in Construction by 2.4 points to -3.7% and in Wholesale trade, by 5.9 Points to 23.2%. The Climate in retail trade fell by 1.5 points in February, following a 10.1 point drop in January. The percent balance is now 12.5%. The trends in confidence in the broad industry classification are shown in the second chart.

The IFO, a German institute for economic research, estimates business confidence--Business Climate--on the basis of businessmen's appraisals of the Current Conditions and Expectations over the nest six months. The results are published as the percent balances between those participants in their surveys who have positive views and those who have negative views and in index form (2000=100). Data are shown for the Manufacturing, Construction Wholesale, and Retail trade industries as well as some detail in each of the industries. Not all the data are available in the first release, such as the present one for February. Among the available data are the summary data in both percent balance and index forms and the business climate for the major industries in the percent balance form only. As a result, comments on the first release are best discussed in terms of the percent balance data.

| IFO Survey (Percent Balances) | Feb 11 | Jan 11 | Feb 10 | M/M Chg | Y/Y Chg | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|

| Business Climate (Confidence) | 21.9 | 19.8 | -9.8 | 1.9 | 36.5 | 6.2 | -25.2 | -7.1 |

| Current Conditions | 25.2 | 21.4 | -23.0 | 3.8 | 48.2 | 2.3 | -323.0 | 3.9 |

| Expectations Six Months Ahead | 18.3 | 18.2 | 4.4 | 0.1 | 13.9 | 10.4 | -18.0 | -17.5 |

| Business Climate | ||||||||

| Manufacturing | 29.0 | 27.7 | -5.6 | 1.7 | 35.0 | 12.2 | -28.4 | -1.7 |

| Construction | -3.7 | -6.1 | -18.1 | 2.4 | 14.4 | -17.0 | -25.7 | -24.0 |

| Wholesale Trade | 23.3 | 17.4 | -7.5 | 5.9 | 30.8 | 9.1 | -20.2 | -5.3 |

| Retail Trade | 12.5 | 14..0 | -21.9 | -1.5 | 34.4 | 0.5 | -19.1 | -16.3 |