Global| Oct 17 2017

Global| Oct 17 2017Germany Has Become the High Inflation Country in EMU

Summary

German inflation year-to-date is at 1.8%. Among the original EMU members, that pace is exceeded only by Austria at 2.3%, Belgium and Luxembourg each at 2%, and Spain at 1.9%. Seven other of the original EMU member countries plus [...]

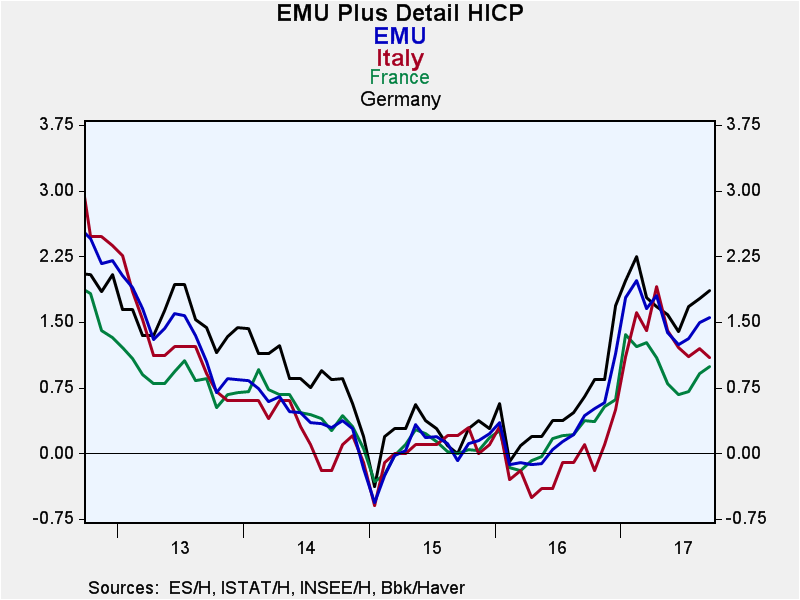

German inflation year-to-date is at 1.8%. Among the original EMU members, that pace is exceeded only by Austria at 2.3%, Belgium and Luxembourg each at 2%, and Spain at 1.9%. Seven other of the original EMU member countries plus Greece have inflation rates that reside below Germany's. German inflation has generally been above the pace in Spain and Italy and the EMU as a whole since mid-2013. Prior to that, Germany had been consistently the low inflation country in the EMU. And with that, there is now a very low inflation divergence in the EMU area. Inflation divergence, defined as the standard deviation of year-on-year inflation rates across all original members, has been lower than it is now less than 5% of the time back to August 2001. Some EMU members have paid a great price with their domestic austerity programs to harness inflation in such a short time. The year before the financial crisis hit, core Greek inflation was running in a range from 2.6% to 4.1%. Currently, Greek headline inflation is 1.0% with the core at 0.6%.

German inflation year-to-date is at 1.8%. Among the original EMU members, that pace is exceeded only by Austria at 2.3%, Belgium and Luxembourg each at 2%, and Spain at 1.9%. Seven other of the original EMU member countries plus Greece have inflation rates that reside below Germany's. German inflation has generally been above the pace in Spain and Italy and the EMU as a whole since mid-2013. Prior to that, Germany had been consistently the low inflation country in the EMU. And with that, there is now a very low inflation divergence in the EMU area. Inflation divergence, defined as the standard deviation of year-on-year inflation rates across all original members, has been lower than it is now less than 5% of the time back to August 2001. Some EMU members have paid a great price with their domestic austerity programs to harness inflation in such a short time. The year before the financial crisis hit, core Greek inflation was running in a range from 2.6% to 4.1%. Currently, Greek headline inflation is 1.0% with the core at 0.6%.

The inflation progress and the inflation convergence will make euro area monetary policy more effective. But there are still issues within the euro area. The area is still wrestling with its relationship with the U.K. post-Brexit. Political shifting is underway within Germany and Italy. A part of Spain is trying to declare independence. The treatment of migrants remains and unresolved problem. Europe has a host of noneconomic issues in the works but also economic issues.

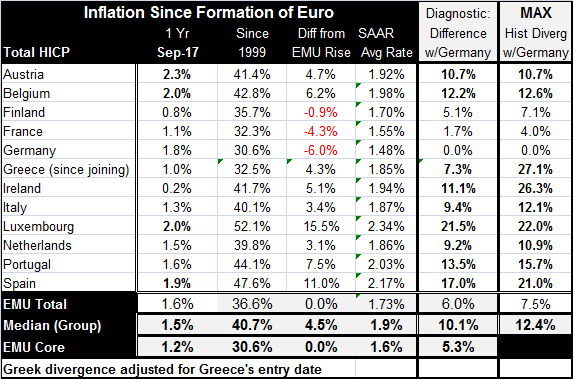

The far right hand columns of the table compare how price levels in the EMU have shifted relative to Germany's since the single currency union was formed and shows where they stand today compared to where they were at their worst distortion. Here we see that there are still substantial divergences within the euro area. While all countries have made some progress on reducing their price level gap with Germany from its worst position, Belgium and Luxembourg have only managed to reduce their divergence from its maximum by less than 10%. The Netherlands and Portugal have reduced their divergence by about 15% from its maximum. Greece has come a long way, reducing its divergence by about three-quarters. France has reduced its divergence with Germany by about 60%. But eight members have current divergence of 10 percentage points or more vis-a-vis Germany. Only France and Finland have keep price levels at 5% or less than their respective ratios to Germany's when the EMU was formed. Greece's price level is now within 7% of what it was relative to Germany when it joined the EMU. The Netherlands, Italy and Austria are near a 10% divergence.

Ongoing price level divergences imply ongoing disparate levels of competitiveness within the EMU which is a fixed exchange rate area. The only way to reset those levels is for member countries to run lower inflation rates than Germany that has accumulated a competitiveness lead. By running lower inflation than all other EMU members, Germany has a competitiveness lead that ranges from 1.7% on France to 21.5% vs. Luxembourg and 17% vs. Spain. For now that process of remedy is still underway for most of the original members. But for some, there is still a long way to go.

France, still having work rules and competitiveness problems, has nonetheless stuck close to Germany with its price level comparisons. France's President Emmanuel Macron is pressing for labor market reforms to further improve France's competitiveness position. Other European nations have ongoing competitiveness problems that cannot always be laid at the feet of price level issues. But looking ahead, at least the inflation rates have come together. That means that the price-level problems are not getting worse. But the bad news is that they are only getting better at a slow pace. And for progress to continue, Germany must continue to be the 'high inflation' country in the EMU. It is unlikely that such a thing will continue.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates