Global| Oct 19 2010

Global| Oct 19 2010Germany's Financial Experts See The Good Times Waning

Summary

The German financial community is more positive about the current situation but more cautious about the outlook. The latest survey of 282 institutional investors and analysts, conducted by ZEW Center for European Economic Research [...]

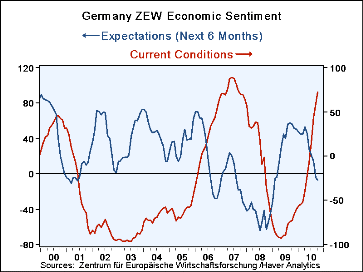

The German financial community is more positive about the current situation but more cautious about the outlook. The latest survey of 282 institutional investors and analysts, conducted by ZEW Center for European Economic Research over the period, October 4th to the 18th, found that the balance of opinion on current conditions rose 12.7 points from 59.9% in September to 72.6% in October, the highest percentage since September, 2007. Recent data on industrial production and new orders show continued growth in the German economy. Rising concern, however, over how long the good times will last, has led to an increase in the negative balance of opinion on the outlook. The pessimists on the outlook now outnumber the optimists by 7.2%, up from 4.3% in September. The percent balances of opinion on the current conditions and expectations for the next six months are shown in the first chart.

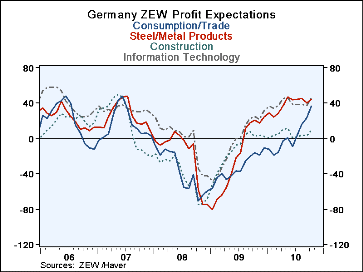

In addition to expressing their views on current and expected economic conditions, the participants in the ZEW survey express their views on the profitability of thirteen selected sectors of the economy. Their views in September and October and the changes between the two months are shown in the table below. The data are shown in descending order in October, from a 58.4% balance for Chemicals/Pharmaceuticals sector to a 5.8% balance for the Insurance sector. As can be seen in the table, expectations of profit increases are strongest in those sectors in which Germany has traditionally excelled. The biggest surprise in the October data is the increase of 13.5 percentage points in the expected profitability of the Consumption/Trade sector. The financial community apparently expects rising employment and incomes to fuel domestic consumption. The sharp rise in the percent balance for profitability in the Consumption/Trade sector is compared with the more subdued increases in the profitability of the next highest increases, 8.8% for the Information Technology sector, 5.5% for the Construction sector and 3.8% for the Steel/Metal sector.

| ZEW | Oct 10 | Sep 10 | Aug 10 | Jul 10 | Jun 10 | May 10 | Apr 10 | Mar 10 |

|---|---|---|---|---|---|---|---|---|

| Current Conditions (% Balance) | 72.6 | 59.9 | 44.3 | 14.6 | -7.9 | -21.6 | -39.2 | -51.8 |

| Expectations for Next 6 Months (% Balance) | -7.2 | -4.3 | 14.0 | 26.2 | 28.7 | 45.8 | 53.0 | 44.5 |

| SECTOR | Oct 10 | Sep 10 | Change | |||||

| Chemicals/Pharmaceuticals | 58.4 | 56.4 | 2.0 | |||||

| Machinery | 57.4 | 56.6 | 0.8 | |||||

| Electronics | 46.1 | 43.0 | 3.1 | |||||

| Information Technology | 45.9 | 37.1 | 8.8 | |||||

| Steel/Metal | 44.1 | 40.3 | 3.8 | |||||

| Vehicles/Automotive | 41.9 | 41.8 | 0.1 | |||||

| Consumption/Trade | 36.5 | 23.0 | 13.5 | |||||

| Services | 33.7 | 30.3 | 3.4 | |||||

| Telecommunications | 18.7 | 13.8 | 4.9 | |||||

| Banks | 10.0 | 11.0 | -1.0 | |||||

| Utilities | 9.8 | 16.0 | -6.3 | |||||

| Construction | 8.5 | 3.0 | 5.5 | |||||

| Insurance | 5.8 | 2.8 | 3.0 | |||||

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates