Global| Jan 20 2009

Global| Jan 20 2009Germany's Zew Indicators: Expectations Less Pessimistic Current Conditions Continue To Worsen

Summary

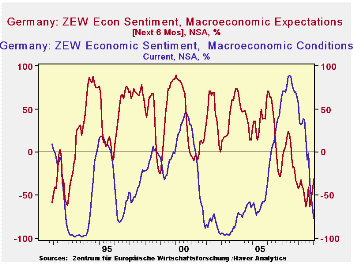

Germany's ZEW indicator of expectations of economic conditions* six months ahead improved for the third month in a row in January. It is, however, still negative at -31%, and well below its long term average of a positive 26.5%. The [...]

Germany's ZEW indicator of expectations of economic

conditions* six months ahead improved for the third month in a row in

January. It is, however, still negative at -31%, and well below its

long term average of a positive 26.5%. The indicator of current

economic conditions** continued to decline and was -77.1%, 12.6

percentage points below December's 64.5%. The first chart shows both

indicators since December 1991, when the series began, to date. The

current conditions indicator has, at times, been even lower than

January reading, but the expectations indicator has rarely been as low

as the recent readings.

The survey which was conducted between January 5 and January 19 polled 312 analysts and institutional investors. During this period, in response to increasingly discouraging statistics, the European central Bank reduced its benchmark rate for the fourth time since September when it was 4.25% to 2% on January 15. In addition, the German government agreed to a second stimulus package, amounting to 80 billion euros over the next two years. These fiscal and monetary measures, have helped, no doubt, to lower the difference between the pessimists and the optimists regarding the outlook.

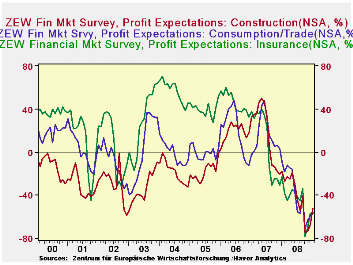

They may also account for the improvement in the profit expectations of three of the industries that are covered in the survey. (See the second chart). The percent balance in the Construction industry rose to -52.0% in January from -67.8% in December and in the Consumption/Trade Industry to -56.7% in January from -59.3% in December. The improvement in the profit outlook of the Insurance industry, to -56.5% in January from -56.6% in December is so small that it might properly be indicative of stability rather than improvement.

| GERMANY ZEW INDICATORS (% Balance) | Jan 09 | Dec 08 | Nov 08 | Oct 08 | Sep 08 | Aug 08 | July 08 |

|---|---|---|---|---|---|---|---|

| Current Conditions | -77.1 | -64.5 | -50.4 | -35.9 | -1.0 | -9.2 | 17.0 |

| Expectation, 6 mo ahead | -31.0 | -45.2 | -53.5 | 63.0 | -41.1 | -55.5 | -63.9 |

| Profit Expectations, 6 mo ahead | |||||||

| Construction | -52.0 | -67.8 | -73.8 | -74.4 | -42.0 | -53.9 | -45.0 |

| Consumption/Trade | -56.7 | -59.3 | -64.0 | -71.0 | -40.8 | -57.0 | -55.4 |

| Insurance | -56.5 | -56.6 | -70.1 | -77.9 | -34.3 | -45.1 | -42.1 |

| ECB Interest Rate %) | 2.0 | 2.50 | 3.25 | 3.25 | 4.25 | 4.25 | 4.25 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates