Global| Mar 30 2007

Global| Mar 30 2007Goldilocks Meets Her Untimely Fate at the Hands of a Raucous Core PCE

Summary

Consumer Spending And Income TrendsStart of Q4Percentage changes at annualized rates: various horizonsInflation-adjustedOne monthThree monthsSix monthsOne [...]

| Consumer Spending And Income Trends | Start of Q4 | |||||

| Percentage changes at annualized rates: various horizons | ||||||

| Inflation-adjusted | One month | Three months | Six months | One Year | Q1/Q4 | Oct/Q3 |

| Consumption | 2.1% | 3.6% | 4.2% | 3.2% | 3.9% | 3.2% |

| Goods | -3.7% | 3.7% | 5.2% | 3.4% | 5.1% | 1.4% |

| Durable Goods | -1.2% | 6.9% | 7.5% | 5.3% | 9.2% | 5.3% |

| Nondurable Goods | -5.0% | 2.0% | 4.0% | 2.5% | 3.1% | -0.5% |

| Services | 6.2% | 3.8% | 3.6% | 3.2% | 3.3% | 4.7% |

| Consumer Income | ||||||

| Real DPI | 1.7% | 3.4% | 4.9% | 2.6% | 4.0% | -- |

| Per Capita | 1.0% | 2.6% | 3.9% | 1.6% | -- | -- |

| Memo: | Feb.07 | Three-Mos | Six-Mos | One-Year | -- | -- |

| Savings Rate (Pct) | -1.2 | -1.3 | -1.2 | -1.2 | -- | -- |

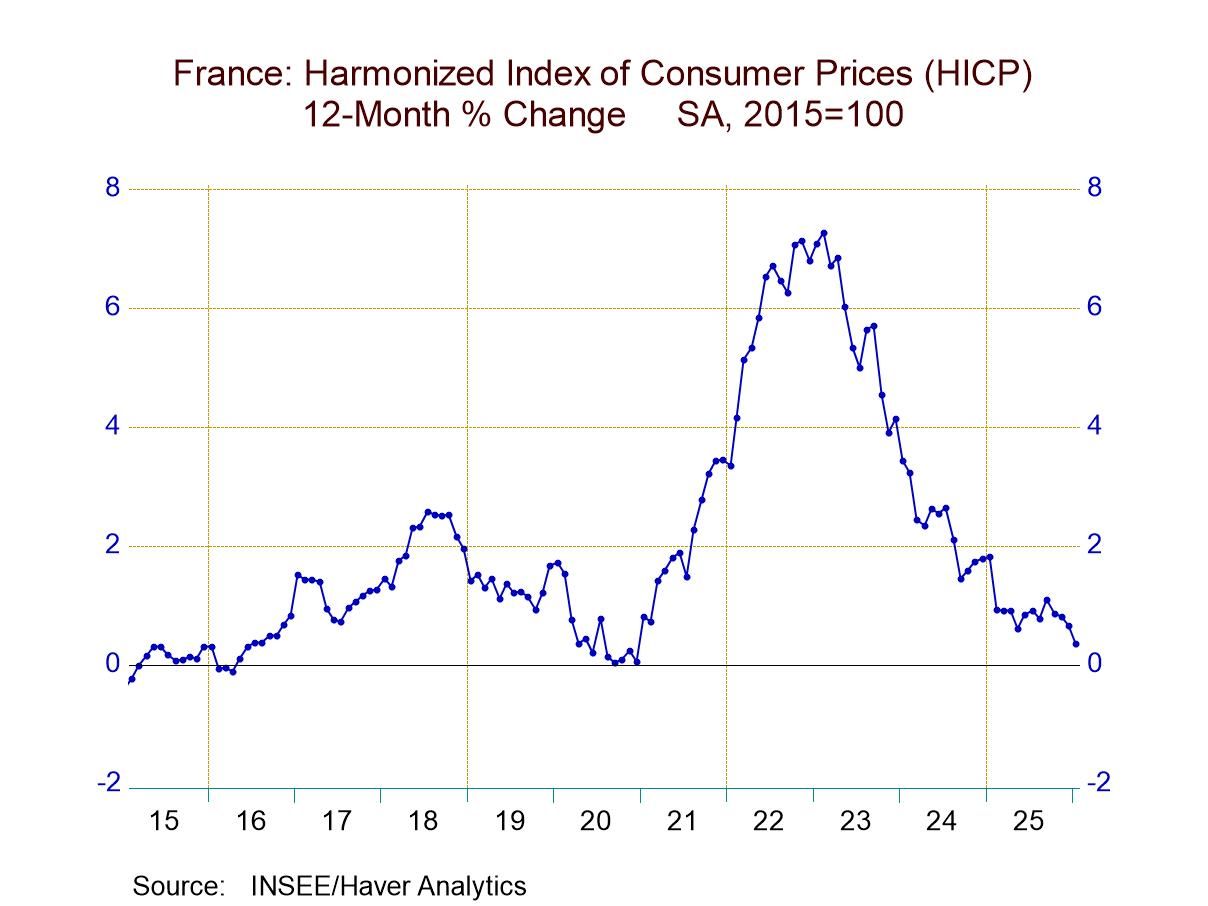

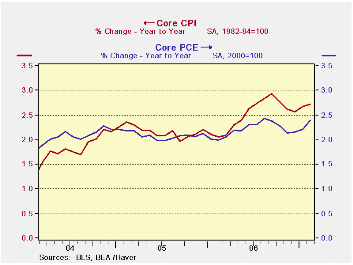

Is it too late for the PCE-flu vaccine? A simple perusal of the data (see the chart on the left) shows the PCE deflator skimming along the ceiling (did I say ceiling?) at a pace of 2%, plus or plus more. Now - don’t hold me to this - but if you look at the chart 2% looks suspiciously like a FLOOR not a ceiling for the PCE. You might carpet the floor but never the ceiling, what is the Fed up to? The Fed no sooner waters down its anti-inflation policy directive than inflation really does appear! What timing! Makes me wonder how Barney Frank feels after rubbing the Fed’s nose in its own statement of forecast and risk. Looks like the Fed got it both right and wrong (right risk; wrong policy sentence). For those who have forgotten, the policy portion of the Fed’s March statement is reproduced below. It has two parts, one that warns of the inflation risk (underlined) and another sentence that says the Fed is braced to do nothing about it (depends the evolution of...yadda, yadda, yadda)In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

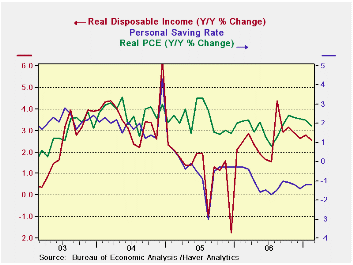

Is it too late for the PCE-flu vaccine? A simple perusal of the data (see the chart on the left) shows the PCE deflator skimming along the ceiling (did I say ceiling?) at a pace of 2%, plus or plus more. Now - don’t hold me to this - but if you look at the chart 2% looks suspiciously like a FLOOR not a ceiling for the PCE. You might carpet the floor but never the ceiling, what is the Fed up to? The Fed no sooner waters down its anti-inflation policy directive than inflation really does appear! What timing! Makes me wonder how Barney Frank feels after rubbing the Fed’s nose in its own statement of forecast and risk. Looks like the Fed got it both right and wrong (right risk; wrong policy sentence). For those who have forgotten, the policy portion of the Fed’s March statement is reproduced below. It has two parts, one that warns of the inflation risk (underlined) and another sentence that says the Fed is braced to do nothing about it (depends the evolution of...yadda, yadda, yadda)In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information. Looking at trends the economy seems on a more even keel that we might have thought. The other chart on the left shows that the simple Year/Year growth in spending is pretty stable (minor downward trend). And DPI (disposable personal income) is in a slow decay as well but not much different from stable. Income trends have rebounded from their contracting ways in early 2005. But the savings rate remains negative without any sign of change. Thus consumer spending is better underpinned by income growth than it was (still not fully, however, since sending growth is faster than income growth). And spending itself is reasonably firm with growth around 2%.

Looking at trends the economy seems on a more even keel that we might have thought. The other chart on the left shows that the simple Year/Year growth in spending is pretty stable (minor downward trend). And DPI (disposable personal income) is in a slow decay as well but not much different from stable. Income trends have rebounded from their contracting ways in early 2005. But the savings rate remains negative without any sign of change. Thus consumer spending is better underpinned by income growth than it was (still not fully, however, since sending growth is faster than income growth). And spending itself is reasonably firm with growth around 2%.

It’s a better picture than we thought we would have. Commentary Archive

| Consumer Spending And Income Trends | Start of Q4 | |||||

|---|---|---|---|---|---|---|

| Percentage changes at annualized rates: various horizons | ||||||

| Inflation-adjusted | One month | Three months | Six months | One Year | Q1/Q4 | Oct/Q3 |

| Consumption | 2.1% | 3.6% | 4.2% | 3.2% | 3.9% | 3.2% |

| Goods | -3.7% | 3.7% | 5.2% | 3.4% | 5.1% | 1.4% |

| Durable Goods | -1.2% | 6.9% | 7.5% | 5.3% | 9.2% | 5.3% |

| Nondurable Goods | -5.0% | 2.0% | 4.0% | 2.5% | 3.1% | -0.5% |

| Services | 6.2% | 3.8% | 3.6% | 3.2% | 3.3% | 4.7% |

| Consumer Income | ||||||

| Real DPI | 1.7% | 3.4% | 4.9% | 2.6% | 4.0% | -- |

| Per Capita | 1.0% | 2.6% | 3.9% | 1.6% | -- | -- |

| Memo: | Feb.07 | Three-Mos | Six-Mos | One-Year | -- | -- |

| Savings Rate (Pct) | -1.2 | -1.3 | -1.2 | -1.2 | -- | -- |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.