Global| Jan 13 2009

Global| Jan 13 2009Grim News from the UK

Summary

The British Chamber of Commerce's economic survey conducted in the fourth quarter of 2008 showed an economy losing ground at an alarming rate. The survey collects the opinions of manufacturers and service providers on the state of a [...]

The British Chamber of Commerce's economic survey conducted in

the fourth quarter of 2008 showed an economy losing ground at an

alarming rate. The survey collects the opinions of manufacturers and

service providers on the state of a wide variety of key business

indicators--domestic and export sales, domestic and export orders,

prices, employment, capacity utilization and cash flow--and on their

confidence in future sales, capital expenditure plans and

profitability. The results are expressed in percent balances--the

percent of respondents reporting an increase less the percent reporting

a decrease. The responses in the fourth quarter were almost universally

negative and many at record lows.

The table below shows the deterioration in domestic and export sales, employment expectations, plans for expansion and profitability expectations since mid 2007 when the sub prime mortgage crisis in the United States exposed the fragility of the financial system, not only in the U. S. but worldwide. In the year and a half since then, the balance of opinion of manufacturers regarding their domestic sales, for example, has gone from +37% to -38%.

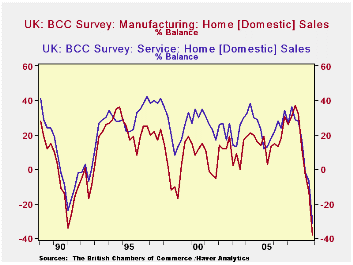

The three charts put the recent declines in domestic sales,

expectations of employment and of profitability in perspective. The

first shows that fourth quarter domestic sales of manufacturers and

service providers were about as low as they were in recession of the

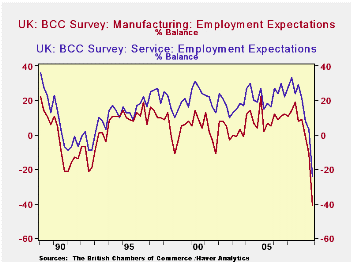

early 90's. Expectations of employment in the fourth quarter, shown in

the second chart, were below those of the earlier recession and the

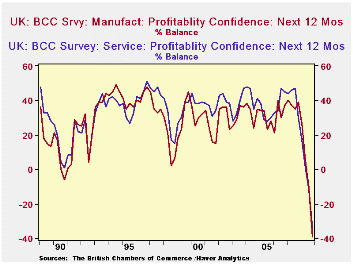

lowest so far recorded. The fourth quarter balances for expectations of

profitability, -39% and -34%, respectively for manufacturers and

service providers, shown in the third chart, compare with balances of

-6% and 1%, respectively, in the recession of the early 90's.

The three charts put the recent declines in domestic sales,

expectations of employment and of profitability in perspective. The

first shows that fourth quarter domestic sales of manufacturers and

service providers were about as low as they were in recession of the

early 90's. Expectations of employment in the fourth quarter, shown in

the second chart, were below those of the earlier recession and the

lowest so far recorded. The fourth quarter balances for expectations of

profitability, -39% and -34%, respectively for manufacturers and

service providers, shown in the third chart, compare with balances of

-6% and 1%, respectively, in the recession of the early 90's.

| BRITISH CHAMBER OF COMMERCE SURVEY (% Balance) | Q4 08 | Q3 08 | Q2 08 | Q1 08 | Q4 07 | Q3 07 |

|---|---|---|---|---|---|---|

| Domestic Sales -- Manufacturing | -38 | -13 | -3 | 12 | 32 | 37 |

| Domestic Sales -- Services | -31 | -7 | -2 | 17 | 28 | 29 |

| Export Sales -- Manufacturing | -12 | -3 | 28 | 16 | 22 | 31 |

| Export Sales -- Services | -9 | 13 | 9 | 17 | 15 | 25 |

| Employment Expectations (3 mo ahead) -- Mfg | -17 | 0 | 3 | 9 | 11 | 20 |

| Employment Expectations (3 mo ahead) -- Services | -22 | 2 | 7 | 16 | 17 | 21 |

| Plans for Expansion -- Manufacturing | -22 | -4 | 2 | 12 | 21 | 33 |

| Plans for Expansion -- Services | -27 | -2 | 5 | 8 | 14 | 17 |

| Profitability Expectations (12 mo ahead) -- Mfg | -38 | -11 | 5 | 27 | 39 | 35 |

| Profitability Expectations (12 mo ahead) -- Services | -34 | -12 | 1 | 17 | 30 | 47 |