Global| Sep 19 2003

Global| Sep 19 2003Hong Kong Trade & Finance Grow in Second Quarter -- Despite SARS

Summary

Hong Kong business sales data and industrial production showed widely divergent trends in the second quarter largely due to the differential impact of the SARS epidemic. Domestic activity and tourism were hit hard by the highly [...]

Hong Kong business sales data and industrial production showed widely divergent trends in the second quarter largely due to the differential impact of the SARS epidemic.

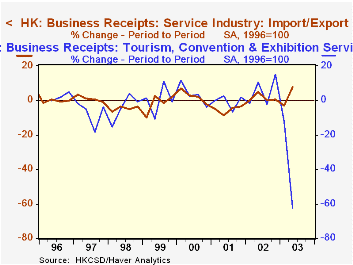

Domestic activity and tourism were hit hard by the highly contagious disease, as seen in the dramatically precipitous drops in sales at hotels, restaurants, tourism, air travel and local retail trade. Manufacturing activity, indicated in Hong Kong's "index of industrial production" has never really recovered after the 1997-98 currency crises, and it experienced one of its more severe decline in the second quarter. To be sure, economic sluggishness in many countries early this year would have also be a restraint for business activity in Hong Kong.

Notably, though, several important sectors expanded anyway during the period. Hong Kong is primarily a trade and transport center, and those activities continued apace. Export/import sales gained, and maritime transport held its first quarter level. Banking, insurance and other finance all increased. Also, encouragingly, monthly retail sales data indicate that virtually as soon as the incidence of new SARS cases moderated in early May, local consumers resumed shopping immediately. Employment finally turned upward just in August. Both of these developments bode well for an early rebound in the Hong Kong economy and suggest the disease had little or no lasting impact.

| Hong Kong Sales and Production Data (% Changes) |

2Q 03 (Q/Q) | 1Q 03 (Q/Q) | 2Q 03 (Y/Y) | Q4/Q4|||

|---|---|---|---|---|---|---|

| 2002 | 2001 | 2000 | ||||

| Manufacturing Production | -4.3 | -2.7 | -12.5 | -9.2 | -9.4 | -0.2 |

| Hotels | -60.9 | -10.6 | -64.3 | 12.6 | -21.3 | 17.6 |

| Air Transport | -20.9 | -8.2 | -21.5 | 22.7 | -15.0 | 22.3 |

| Tourism | -60.2 | -20.4 | -63.2 | 22.4 | -2.8 | 13.9 |

| Maritime Transport | 0.8 | 4.7 | 13.7 | 5.9 | 2.4 | 13.3 |

| Export/Import Trade | 7.7 | -3.1 | 4.8 | 5.4 | -20.0 | 9.4 |

| Banking | 11.9 | -18.7 | 2.3 | 7.3 | 4.5 | -8.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates