Global| Oct 09 2020

Global| Oct 09 2020Housing Affordability Declines in August as Falling Income and Rising Home Prices Offset Record Low Rates

Summary

• Housing affordability decreased in August for the fourth consecutive month. • Falling incomes and rising home prices offset record low mortgage interest rates. The National Association of Realtors reported that its Fixed Rate [...]

• Housing affordability decreased in August for the fourth consecutive month.

• Falling incomes and rising home prices offset record low mortgage interest rates.

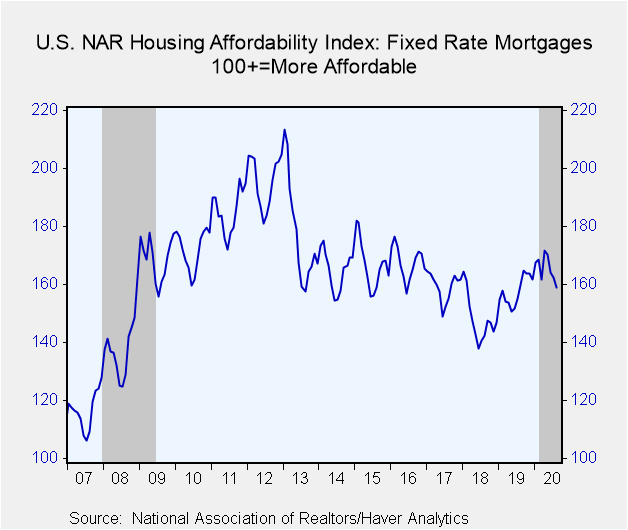

The National Association of Realtors reported that its Fixed Rate Mortgage Housing Affordability Index declined 2.1% to 158.9 in August (-0.6% year-on-year). After hitting a four-year high in April, affordability has declined for four consecutive months as incomes have fallen and home prices have risen.

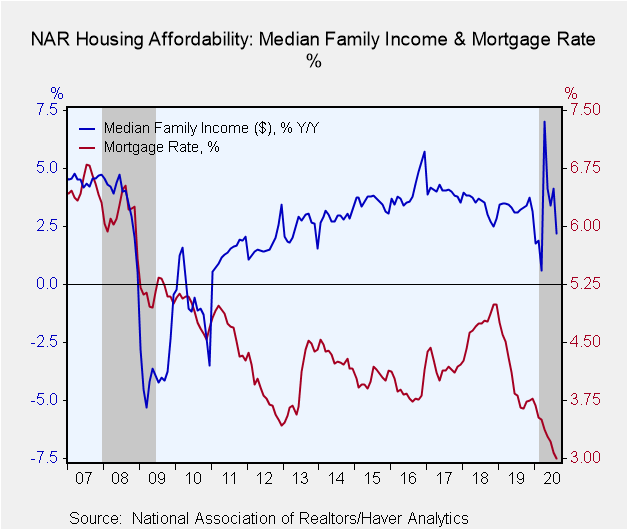

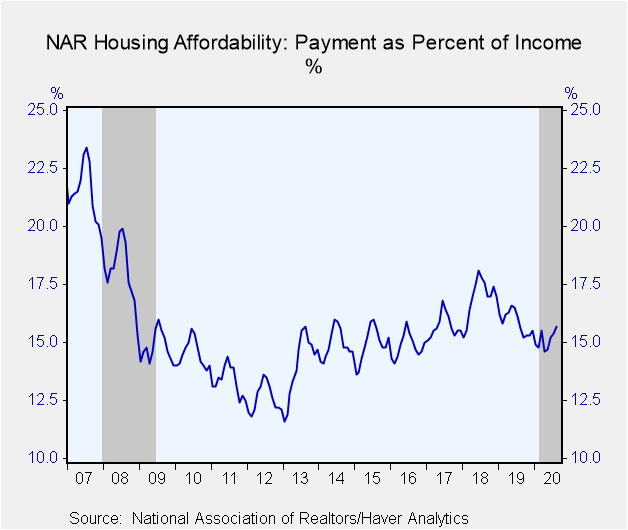

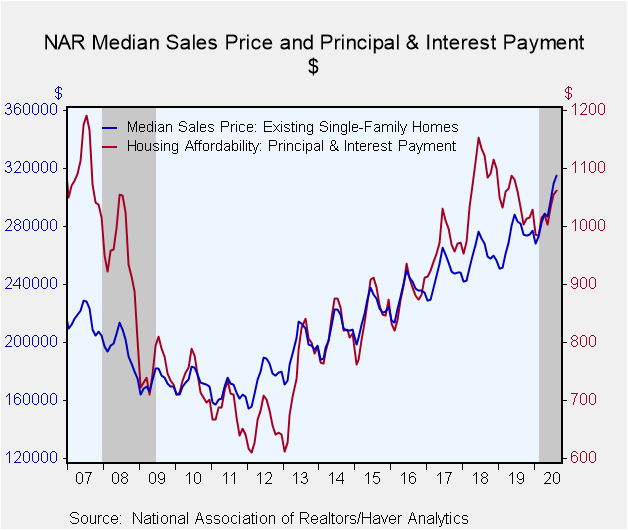

Median family income, which is projected by the National Association of Realtors, dropped 1.5% in August (+2.2% y/y). Incomes had jumped in April as government support programs offset falling compensation. Since then, the reverse has happened. Meanwhile, the effective mortgage interest rate declined eight basis points to a record low 3.00% in August (data goes back to 1981). The median sales price, which was already reported last month, increased 1.8% to a record high $315,000. Putting this together, monthly principal and interest payments increased to $1,062, raising the payment share of income to 15.7%. This ratio has been range bound for the last seven years.

The Housing Affordability Index equals 100 when median family income qualifies for an 80% mortgage on a median-priced existing single-family home. A rising index indicates an increasing number of buyers can qualify for a mortgage to purchase the median-priced home. Data on Home Affordability can be found in Haver's REALTOR database. Median sales prices are located in USECON. Higher frequency interest rate data can be found in SURVEYW, WEEKLY, and DAILY.

| Housing Affordability | Aug | Jul | Jun | Y/Y% | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Fixed Rate Housing Affordability Index (100+=More Affordable) | 158.9 | 162.3 | 164.2 | -0.6 | 157.6 | 147.9 | 159.1 |

| Payment as a Percent of Income | 15.7 | 15.4 | 15.2 | 15.6 | 15.9 | 17.0 | 15.7 |

| Principal and Interest Payment ($) | 1,062 | 1,055 | 1,033 | 2.8 | 1,044 | 1,079 | 967 |

| Monthly Fixed Mortgage Rate (%) | 3.00 | 3.08 | 3.22 | 3.66 | 4.04 | 4.72 | 4.20 |

| Median Family Income ($) | 81,009 | 82,203 | 81,424 | 2.2 | 78,964 | 76,401 | 73,891 |

| Median Sales Price (Existing Single-Family Home, $) | 315,000 | 309,500 | 297,900 | 11.7 | 272,333 | 259,458 | 247,508 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates