Global| Sep 23 2003

Global| Sep 23 2003Hurricane Isabel Lowered Weekly Chain Store Sales Sharply

by:Tom Moeller

|in:Economy in Brief

Summary

Chain store sales fell 1.8% last week as Hurricane Isabel struck the U.S. mid-Atlantic region Thursday, according to the BTM-UBSW survey. The hurricane left over 10 million people without power and killed at least 28. The decline in [...]

Chain store sales fell 1.8% last week as Hurricane Isabel struck the U.S. mid-Atlantic region Thursday, according to the BTM-UBSW survey.

The hurricane left over 10 million people without power and killed at least 28.

The decline in sales followed a 0.3% dip the prior week and lowered the level of sales so far in September 0.3% below the August average.

During the last five years there has been a 62% correlation between the year-to-year percent change in chain store sales and the change in non-auto retail sales less gasoline.

The BTM-UBSW retail chain-store sales index is constructed from the sales results reported by seven retailers: Dayton Hudson, Federated, Kmart, May, J.C. Penney, Sears and Wal-Mart.

| BTM-UBSW (SA, 1977=100) | 9/20/03 | 9/13/03 | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total Weekly Retail Chain Store Sales | 420.2 | 428.0 | 4.0% | 3.6% | 2.1% | 3.4% |

by Tom Moeller September 23, 2003

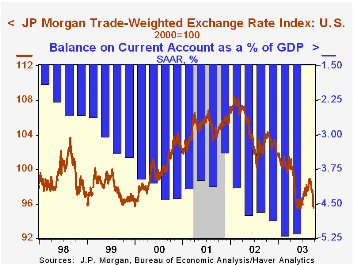

The recent decline in the foreign exchange value of the US dollar gained momentum yesterday. It responded to a weekend communiqué from the US, Britain, Canada, France, Germany, Italy and Japan which indicated that a flexible currency rate "is desirable for Major countries or economic areas" in order to iron out global economic imbalances.

JP Morgan's Trade Weighted Value of the US currency fell 0.8% yesterday and the value is down about 3% from the summer high.

The dollar's value fell yesterday 1.1% against the Euro and 1.8% against the Japanese yen. Since the summer peaks the dollar is down roughly 5% versus the Euro and 7% against the yen.

Versus the UK pound the dollar fell 1.0% yesterday and is down roughly 5% from the summer high.

Against the Canadian dollar the US currency was about stable yesterday but it has been sliding since early last year.

Economists at the Federal Reserve Bank of San Francisco ask "Is Official Foreign Exchange Intervention Effective?".

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates