Global| Nov 10 2005

Global| Nov 10 2005Import Prices Declined

by:Tom Moeller

|in:Economy in Brief

Summary

Import prices fell an expected 0.3% last month following the revised 2.3% spike in September. Petroleum prices were the source of weakness as they reversed more than half of the prior month's gain with a 4.4% drop. Crude oil prices [...]

Import prices fell an expected 0.3% last month following the revised 2.3% spike in September. Petroleum prices were the source of weakness as they reversed more than half of the prior month's gain with a 4.4% drop. Crude oil prices fell 4.1% and "other" petroleum prices fell 14.4% but those decline were offset by a 20.9% (114.1% y/y) increase in natural gas.

Excluding petroleum, prices were strong for the second consecutive month and rose 0.8%. The gain reflected a 4.4% (16.1% y/y) rise in non-oil industrial supplies which repeated the gain in September. Elsewhere, paper prices rose 1.0% (3.8% y/y) and chemical prices jumped 2.1% (11.7% y/y). On the weak side, nonauto consumer goods prices fell 0.1% (+1.2% y/y) and capital goods prices slipped 0.3% (-0.5% y/y). Excluding another decline in computer prices, capital goods prices fell 0.1% (2.0% y/y).

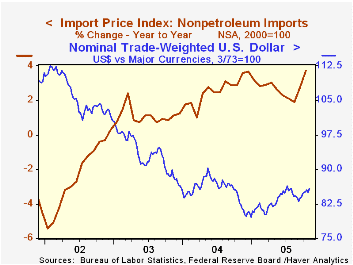

During the last ten years there has been a 66% (negative) correlation between the nominal trade-weighted exchange value of the US dollar vs. major currencies and the y/y change in non oil import prices. The correlation is a lower 47% against a broader basket of currencies and a lower 57% against the real value of the dollar.

Export prices jumped 0.6% as nonagricultural prices rose 0.6% (3.5% y/y).

Time-Varying Pass-Through from Import Prices to Consumer Prices: Evidence from an Event Study with Real-Time Data from the Federal Reserve Bank of New York is available here.

| Import/Export Prices (NSA) | Oct | Sept | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Import - All Commodities | -0.3% | 2.3% | 8.1% | 5.6% | 2.9% | -2.5% |

| Petroleum | -4.4% | 8.0% | 30.9% | 30.5% | 21.0% | 3.0% |

| Non-petroleum | 0.8% | 1.0% | 3.7% | 2.6% | 1.1% | -2.4% |

| Export - All Commodities | 0.6% | 0.8% | 3.6% | 3.9% | 1.6% | -1.0% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates