Global| Sep 19 2011

Global| Sep 19 2011India has Difficulty Containing Inflation

Summary

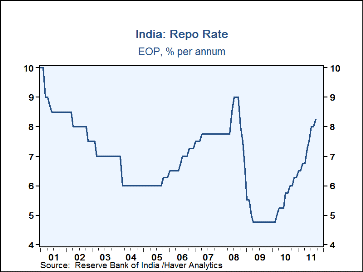

While many developed and developing countries, are beginning to loosen monetary policies in the face of the global slowdown, India continues to tighten. Over the past year, the Bank of India has raised the repo rate 350 basis points [...]

While many developed and developing countries, are beginning to loosen monetary policies in the face of the global slowdown, India continues to tighten. Over the past year, the Bank of India has raised the repo rate 350 basis points from 4.75 % at the end of February, 2010 to 8.25% at the end of September of the current year, as shown in the first chart. Further rises have not been ruled out. A rise of 25 basis points is generally expected when the Bank next meets in mid October.

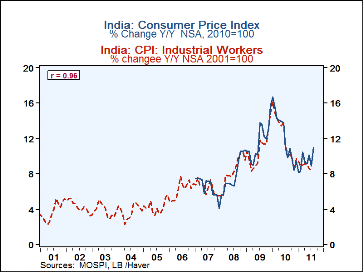

The hawkish stand of the Bank is due to high and rising inflation. The consumer price index for all India is available only from January, 2006. However, data are available for the consumer price index for industrial workers and the year to year changes in the index back to August 1968. The second chart shows the year to year changes in the CPI for all India and the year to year changes in the CPI for industrial workers. As can be seen the Inflation rate for all India is highly correlated with the Inflation rate for Industrial Workers. The additional history provided by the latter, enables one to put the current inflation in a broader perspective. In the early years of the current decade, inflation in India was relatively restrained and only began to accelerate in 2008. The peak rate of 16.67% in January, 2010 was reduced to 8.16% in January 2110, but has since climbed to 10.89% in August of this year in spite of rising interest rates.| Aug 11 |

Jul 11 |

Aug 10 |

M/M Chg |

Y/Y Chg |

2010 | 2009 | 2008 | |

|---|---|---|---|---|---|---|---|---|

| Y/Y Chg in CPI: All India (%) | 10.89 | 8.91 | 9.78 | 1.02 | 2.11 | 12.15 | 11.69 | 7.88 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates