Global| Mar 01 2021

Global| Mar 01 2021Inflation Fears Are Probably Over-stated

by:Andrew Cates

|in:Economy in Brief

Summary

Inflation fears have surfaced in financial markets in recent weeks. That at least is the message from rising bond yields and the climb in breakeven inflation rates that has accompanied that increase. Greater confidence in a global [...]

Inflation fears have surfaced in financial markets in recent weeks. That at least is the message from rising bond yields and the climb in breakeven inflation rates that has accompanied that increase. Greater confidence in a global economic revival and a likely further impressive dose of fiscal stimulus from the US are some generic reasons for these fears. Indeed when combined with some dovish testimony last week from Fed Chair Powell, financial markets are arguably now signalling that policy settings may now be too loose for too long relative to the likely pace of US (and broader global) growth.

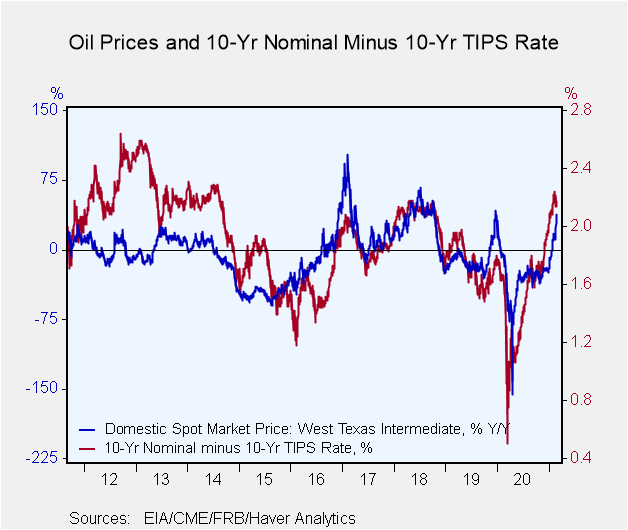

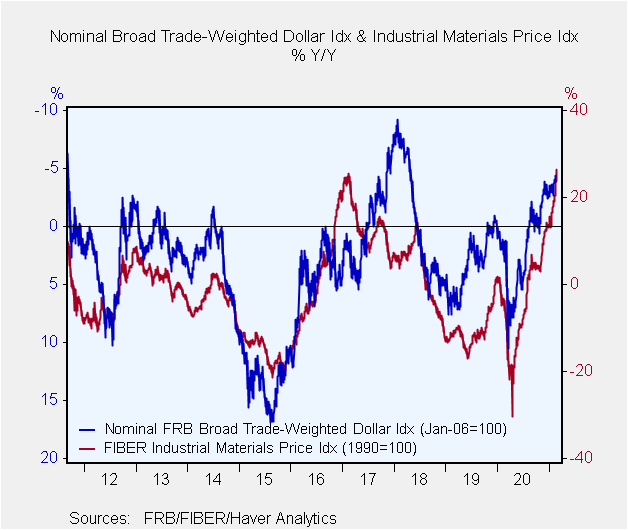

Other factors that have contributed to a growing sense of unease concern higher commodity prices and higher oil prices in particular. The increase in the latter in recent weeks certainly appears to explain a good chunk of the recent climb in US medium-term breakeven inflation rates (see figure 1 below). However, some weakness in the value of the US dollar in recent months could also have been a factor not least given the high correlation between that currency's gyrations and commodity price swings (see figure 2 below).

Figure 1: US 10 year breakeven inflation versus oil prices

Figure 2: Industrial commodity prices versus the trade weighted value of the dollar

Second round effects matter

Whether or not there is now follow-through from this into higher recorded rates of consumer price inflation maybe a moot point. After all, what matters for financial markets is not necessarily rooted in statisticians' estimates of the rate of increase in items within consumer price baskets. Indeed - and for the record - there is a near-inevitability of a sharp climb in headline inflation rates in coming months. That's because of base effects from the sharp decline in oil (and other commodity) prices as well as the collapse in demand (and other prices) that unfolded as the COVID crisis first hit toward the end of Q1 last year.

The bigger issue for financial markets is whether or not these arithmetic influences morph into more of a sustained increase in factors such as wage inflation and the public's inflation expectations. It is, after all, these factors that would really worry Central Bankers and potentially trigger an earlier and sharper tightening of monetary policy than markets have hitherto been discounting.

There are lots of moving parts to this debate and some of this will hinge on difficult-to-predict factors not least of which is how the COVID virus behaves in the coming weeks and how governments subsequently respond. However, if we focus instead on what we know now and what is more straightforward to predict, there does not seem to be any major reason for the world's major Central Banks to be that alarmed about the inflation outlook. That view is based on what we know about the impact of oil prices on inflation in the past; about what financial markets really think about the likely evolution of inflation; about underlying capacity tensions in the world economy; and about structural factors that have been – and should continue – to restrain inflationary pressures in the period ahead.

Oil and inflation

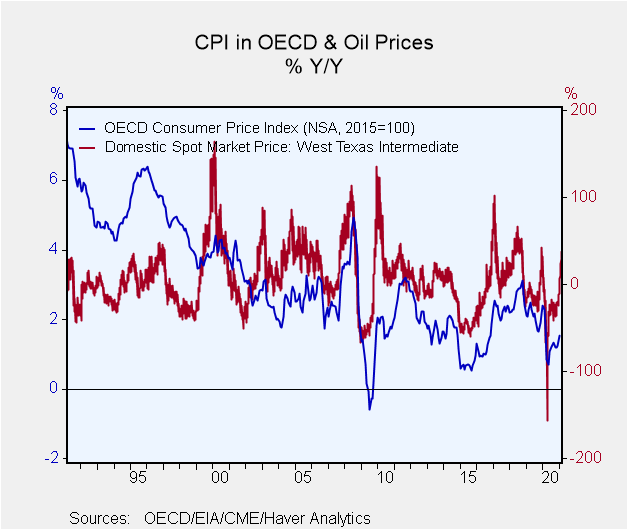

Let's start with the links between oil prices and headline inflation. As figure 3 attests there has been a reasonably high correlation over the last 20 years between these two variable as one would expect given the relative weight of energy in consumer price baskets. However, two features of this figure are worth noting. First that the recent climb in oil prices - which in WTI terms is presently around 35% on an annual basis - does not yet look that marked relative to some of the oil price upswings that we have seen in recent decades. Those upswings incidentally did not yield any sustained increase in inflation. Secondly – and the obvious reason for this – is that unless oil prices keep climbing and at the same pace as they did before the arithmetic influence on headline inflation of their impact will fade. As we suggested above, what really matters is the follow-through from this to factors that are more liable to feed the inflation equation.

Figure 3: Oil prices versus headline inflation CPI in the OECD

Inflation expectations are well-anchored

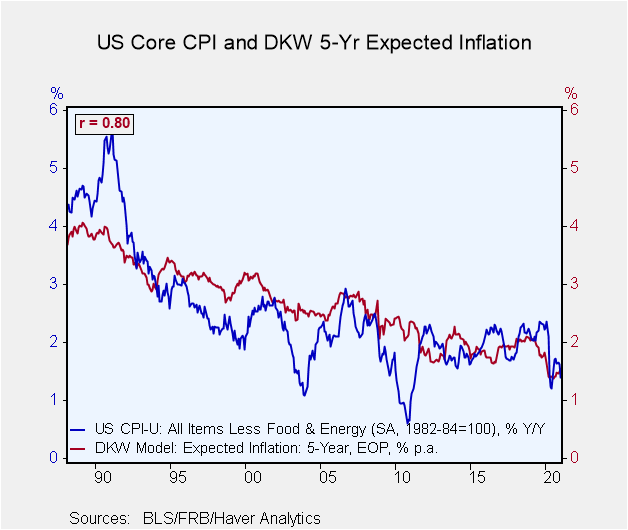

And on that score there is little evidence at present to suggest any follow-through. Consumers' medium-term inflation expectations have risen a little to be sure but they still lie toward the bottom end of the past two decades' averages. And if we strip out from nominal bond yields other factors such as real yields, term premiums and inflation risk premiums, market-based inflation expectations are still very firmly under wraps. We can see this in figure 4 below which shows the US Fed's estimates of 5 year ahead inflation expectations plotted against US core CPI inflation. The reading from the former at the end of January was 1.55% and arguably therefore much lower than where the Fed would actually prefer these expectations to be (give its inflation goals).

Figure 4: US core CPI inflation versus the Fed's (DKW) model-based estimates of 5-year inflation expectations

Excess capacity

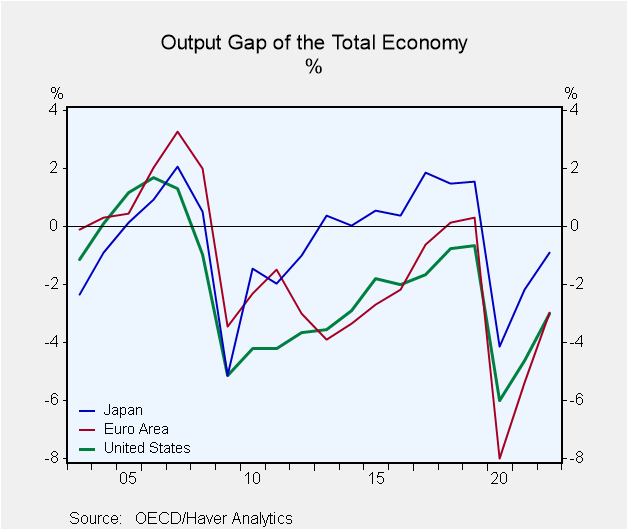

Follow-through from oil prices or inflation expectations into broader gauges of inflation (such as wages) will additionally hinge, however, on other factors and in very broad terms on underlying capacity tensions. Most inflation models these days are typically rooted in textbook Phillips curve analysis and therefore have a significant weight attached to capacity terms. The question we should be asking therefore is whether or not the burst of speed in economic activity in coming months will meaningfully erode any excess capacity and thereby drive down unemployment rates and fuel wage and broader price inflation. A further question that's pertinent to this incidentally is the degree to which the capacity – and labour market capacity in particular - will come back on stream if the COVID-crisis now begins to ebb.

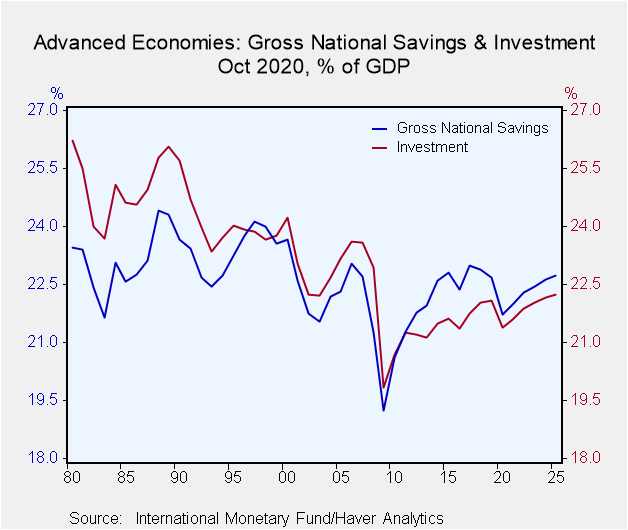

Focusing though solely on the demand side suggests little reason for concern about underlying capacity-driven inflation tensions in the immediate months ahead. The world economy has, after all, been saddled with excess savings, lacklustre investment demand as well as large pockets of excess capacity throughout most of the last decade or two (see figures 5 and 6 below). That's been rooted in a number of global trends including a globalisation of trade, labour markets and finance as well as on the related and growing use of new technologies.

Figure 5: Saving and investment rates in advanced economies

Figure 6: Output gap estimates in the US, Japan and the Euro Area

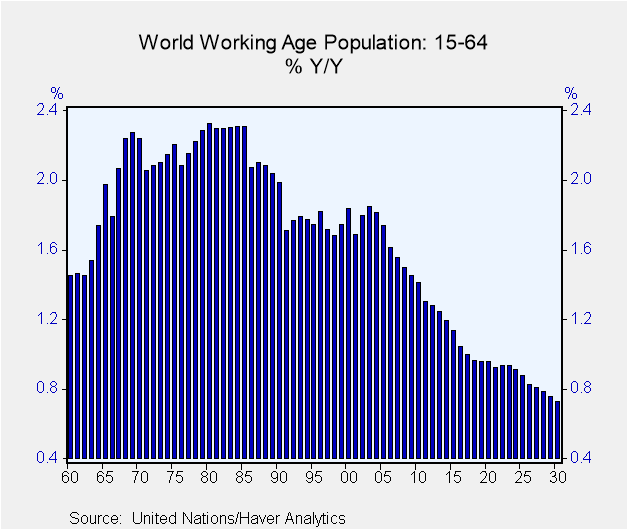

It's possible that a structural de-globalization of trade (and finance) will reverse these trends and catalyse higher inflation in the coming months and quarters. But there is another factor that is often overlooked in these debates but which should continue to drive a dis-inflationary thrust into most economies' inflation equations. It concerns ageing demographics.

Ageing and inflation

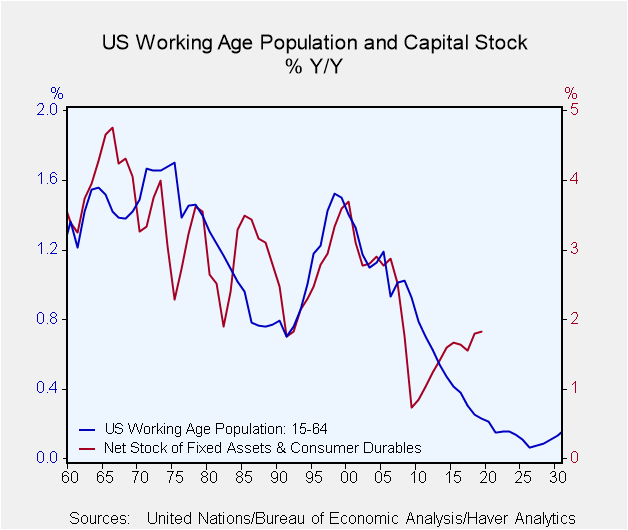

To be fair there has been an active debate in academic and Central Banking circles about the influence of ageing demographics on inflation in recent years. Some authors tend to focus on supply side factors and argue that few workers imply higher wages. Ageing demographics might therefore be inflationary. However the empirical evidence – at least to this scribe – tends to support the opposite conclusion with the Japanese experience in recent decades being the classic example. Ageing demographics have tended to go hand in hand with slower investment activity (see figure 7 below), reduced dynamism, weaker household and business credit formation and ultimately – via those previous channels – lower inflation as well. With the world economy in general confronting an ageing demographic profile (see figure 8) and its major economies in particular (including China) this ought to continue to structurally restrain inflation expectations and contain any prospective climb in wage (and core) inflation. Indeed the challenge for Central Bankers through most of the post-GFC (Global Financial Crisis) era has been how to lift inflation from a moribund state. Ageing demographics may have been one of the key reasons for this. The implication is that once the initial burst of relief in a post-COVID era has passed that these structural dis-inflationary challenges may well resume.

Figure 7: US Working Age population growth versus the growth in the US capital stock

Figure 8: Global working age population growth

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates