Global| Mar 18 2008

Global| Mar 18 2008Inflation Targeting in UK and CANADA

Summary

With turmoil in world financial markets and slowing economies, monetary authorities in some of the countries that have been targeting inflation may find the "target" too restrictive. The release of inflation data in the United Kingdom [...]

With turmoil in world financial markets and slowing economies, monetary authorities in some of the countries that have been targeting inflation may find the "target" too restrictive.

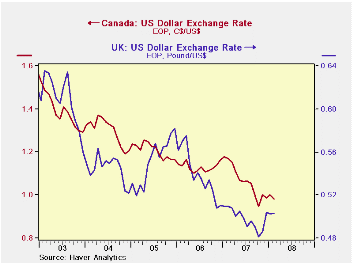

The release of inflation data in the United Kingdom and Canada today illustrates two different cases. In the United Kingdom where inflation is increasing and economic conditions deteriorating, inflation targeting may be relaxed. In Canada where inflation is falling, weakening demand can be addressed by easier monetary policies without fear of setting off an inflationary spiral.

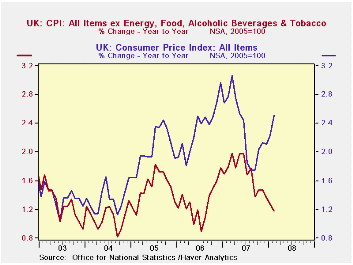

In the UK, where the base interest rate is 5.25%, a reduction

in the rate would ordinarily be likely in view of the slowing economy.

However, inflation has been creeping up since a low of 1.75% was

reached last August. It was 2.51% in February, the highest since June

of last year and well above the Bank of England's target rate of 2%. On

the other hand, Core inflation, defined as total excluding energy,

food, alcoholic beverages and tobacco, has been declining over the same

period and is now 1.17%.  Overall

inflation and core inflation in the UK are shown in the first chart.

The better performance of the core relative to total inflation may

influence the Monetary Policy Committee against raising interest rates

and may even pave the way for a cut. The next meeting of the Monetary

Policy Commission of the Bank of England will be on April 10th.

Overall

inflation and core inflation in the UK are shown in the first chart.

The better performance of the core relative to total inflation may

influence the Monetary Policy Committee against raising interest rates

and may even pave the way for a cut. The next meeting of the Monetary

Policy Commission of the Bank of England will be on April 10th.

The Bank of Canada reduced its base rate by 50 basis points to 3.5% on March 4, 2008. At that time the Bank suggested that further monetary stimulus might be required. It is unlikely that monetary policy in Canada in the coming months will be restrained by inflation considerations. Inflation has been declining since November and was 1.8% in February. below the Bank of Canada's target rate of 2%. Although core inflation, defined as total inflation less 8 volatile items and indirect taxes, increased from 1.38% in January to 1.47% in February it was the first increase in core inflation since June, 2006 and the level is still relatively subdued. Overall inflation and core inflation in Canada are shown in the second chart. The next interest rate announcement by the Bank of Canada will be on April 22, 2008.

| CONSUMER PRICE INDEXES AND INFLATION | Feb 08 | Jan 08 | Feb 07 | M/M %Chg | Y/Y %Chg | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| UNITED KINGDOM | ||||||||

| Total CPI (2005 =100) | 106.3 | 105.5 | 103.7 | 0.76 | 2.51 | 104.7 | 102.33 | 100.0 |

| Core CPI (2005 =100) | 103.4 | 103.1 | 102.2 | 0.29 | 1.17 | 103.0 | 101.3 | 100.0 |

| CANADA | ||||||||

| Total CPI (2005=100)* | 104.9 | 104.5 | 103.0 | 0.36 | 1.81 | 104.2 | 102.0 | 100.0 |

| Core CPI (2005=100)* | 105.0 | 104.4 | 103.4 | 0.54 | 1.47 | 104.1 | 101.9 | 100.0 |

| * Rebased from (2002=100) | ||||||||