Global| Nov 10 2009

Global| Nov 10 2009Inflationary Signals Abound;Gold& Oil Prices Strengthen While Dollar Weakens

Summary

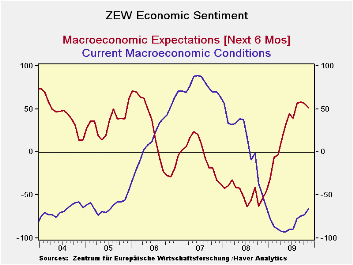

The ZEW measure of confidence among German institutional investors and analysts in the macroeconomic outlook six months ahead declined in November to 51.1 from 56.0 in October. While the extent of the decline was greater than [...]

The

ZEW measure of confidence among German institutional investors and

analysts in the macroeconomic outlook six months ahead declined in

November to 51.1 from 56.0 in October. While the extent of

the decline was greater than expected, the optimists on the outlook

still outweigh the pessimists by 51.1%. A year ago the

pessimists outweighed the optimists by 53.5%. Moreover, the

current reading is well above the long term average of

26.9%.

The

ZEW measure of confidence among German institutional investors and

analysts in the macroeconomic outlook six months ahead declined in

November to 51.1 from 56.0 in October. While the extent of

the decline was greater than expected, the optimists on the outlook

still outweigh the pessimists by 51.1%. A year ago the

pessimists outweighed the optimists by 53.5%. Moreover, the

current reading is well above the long term average of

26.9%.

Although

there has been some improvement in the

appraisal of current conditions, the majority of investors and analysts

still view current conditions negatively. The excess of

pessimists over optimists among the respondents declined to 65.6% in

November from 72.2% in October. The first chart shows the two

indicators: the macroeconomic outlook and current

conditions.

Although

there has been some improvement in the

appraisal of current conditions, the majority of investors and analysts

still view current conditions negatively. The excess of

pessimists over optimists among the respondents declined to 65.6% in

November from 72.2% in October. The first chart shows the two

indicators: the macroeconomic outlook and current

conditions.

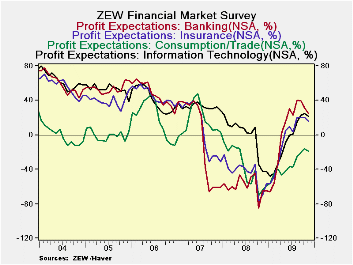

Some of

the reasons why the respondents have

become more cautious about the outlook may be found in their

appraisal of the profit prospects in the thirteen industries regularly

canvassed. In November, the respondents expected declines in

profits in seven of the industries and increases in six.

Declines in profits are expected in Banking, Insurance, Steel and

Metal, Consumption/Trade, Utilities, Telecommunication and Information

Technology. Increases in profits are expected in

Vehicles/Automotive, Chemicals/Pharmaceuticals, Electronics, Machinery,

Construction and Services. Selected industries where profits

are expected to decline are shown in the second chart and selected

industries where profits are expected to increase are shown in the

third chart. Profit expectations in the Banking and Insurance

industries have been declining since August and appear to have had the

biggest negative reappraisal.

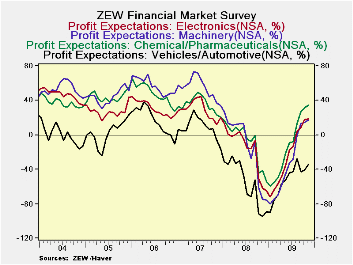

Some of

the reasons why the respondents have

become more cautious about the outlook may be found in their

appraisal of the profit prospects in the thirteen industries regularly

canvassed. In November, the respondents expected declines in

profits in seven of the industries and increases in six.

Declines in profits are expected in Banking, Insurance, Steel and

Metal, Consumption/Trade, Utilities, Telecommunication and Information

Technology. Increases in profits are expected in

Vehicles/Automotive, Chemicals/Pharmaceuticals, Electronics, Machinery,

Construction and Services. Selected industries where profits

are expected to decline are shown in the second chart and selected

industries where profits are expected to increase are shown in the

third chart. Profit expectations in the Banking and Insurance

industries have been declining since August and appear to have had the

biggest negative reappraisal.

| ZEW INDICATORS (% Bal.) | Nov 09 | Oct 09 | Nov 08 | M/M Chg | Y/Y Chg | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|

| Macroeconomic Expectations 6 Months Ahead | 51.1 | 56.0 | -53.5 | -4.9 | 104.6 | -47.5 | -3.0 | 22.3 |

| Current Conditions | -65.6 | -72.2 | -50.5 | 6.6 | -15.2 | 7.3 | 75.9 | 18.3 |

| PROFIT EXPECTATIONS | ||||||||

| Banking | 24.7 | 31.1 | -64.9 | -9.4 | 89.6 | -59.5 | -3.5 | 47.7 |

| Insurance | 16.4 | 19.8 | -70.1 | -3.4 | 86.5 | -45.4 | 9.7 | 46.0 |

| Chemicals/Pharmaceuticals | 34.8 | 31.6 | -41.6 | 3.2 | 76.4 | -8.6 | 35.3 | 48.3 |

| Vehicles/Automotive | -33.9 | -40.9 | -94.2 | 7.0 | 60.7 | -55.6 | 8.6 | 16.9 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates