Global| Apr 07 2005

Global| Apr 07 2005Initial Claims For Jobless Insurance Fell

by:Tom Moeller

|in:Economy in Brief

Summary

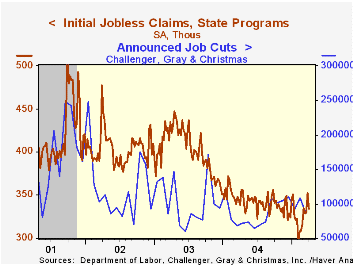

After increasing steadily from the early February low, initial claims for unemployment insurance fell last week by 19,000 to 334,000 versus an upwardly revised level the prior week. Consensus expectations had been for 330,000 claims. [...]

After increasing steadily from the early February low, initial claims for unemployment insurance fell last week by 19,000 to 334,000 versus an upwardly revised level the prior week. Consensus expectations had been for 330,000 claims. The latest level remained 12.8% above the low.

During the last ten years there has been a (negative) 74% correlation between the level of initial claims for unemployment insurance and the monthly change in payroll employment. There has been a (negative) 66% correlation with the level of continuing claims.

The four week moving average of initial claims was about unchanged at 336,500 (-1.9% y/y) and it is up 9.5% from the low in February.

Continuing claims for unemployment insurance jumped 90,000 from the upwardly revised level of the prior week but the insured unemployment rate remained at 2.1%.

| Unemployment Insurance (000s) | 04/02/05 | 03/26/05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Initial Claims | 334 | 353 | -1.5% | 343 | 402 | 404 |

| Continuing Claims | -- | 2,688 | -10.5% | 2,926 | 3,531 | 3,570 |

by By Carol Stone April 7, 2005

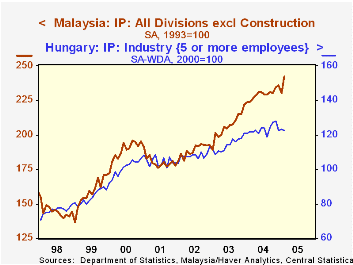

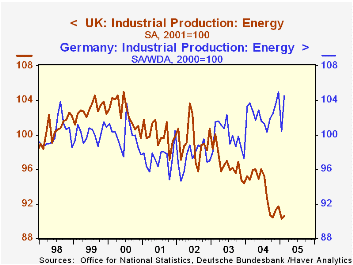

Four diverse countries reported February industrial production data today, UK, Germany, Hungary and Malaysia. While three saw a decrease in February, output is generally rising, albeit fitfully.

Malaysia has the strongest gains of these nations, with February up 5.2% from the previous month and 8.5% from a year ago after an overall advance of 11.3% in 2004. Rubber, food and chemicals show the most distinct uptrends. Malaysia is included in Haver's EMERGEPR database. Hungarian data are in the EMERGECW database. Output in Hungary was strong in 2004 also, with growth of 8.4%, but has slowed noticeably in recent months. A decline of 0.3% in February put it just 1.3% ahead of the year-earlier month. The recent weakness is evident in the mining sector, although wood, paper and machinery industries continue to show gains.

The larger industrial countries are no more than mixed. Output in the UK and Germany fell in February by 0.4% and 1.4%, respectively, with German production up 1.9% from a year ago, but the UK off 1.4%. The UK's energy sector has been weakening steadily since 2000 and this is restraining overall growth. Machinery and appliances, however, continue to increase. In Germany, the energy refining and production sector, by contrast, is providing some growth, along with chemicals, paper and electrical equipment.

Each Germany and the UK has its own Haver database, and a summary of the production data is also included in G10. This latter database, compiled by Haver directly from its country sources, is arranged by country and also by concept, so production among individual countries can be easily compared. A database from Eurostat, the EU's data coordinator, also contains summary production data, as do a number of other international organization and privately generated databases among Haver's collections.

| Percent Changes Monthly, seasonally adjusted |

Feb 2005 | Jan 2005 | Year Ago | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| UK | -0.4 | -0.3 | -1.4 | 0.5 | -0.1 | -2.5 |

| Germany | -1.4 | 2.8 | 1.9 | 4.2 | 0.4 | -1.1 |

| Hungary | -0.3 | 0.3 | 1.3 | 8.4 | 6.6 | 3.3 |

| Malaysia | 5.2 | -2.3 | 8.5 | 11.3 | 9.3 | 4.6 |

| Memo: US | 0.3 | 0.1 | 3.3 | 4.1 | -0.0 | -0.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates