Global| Feb 27 2007

Global| Feb 27 2007January Durable Goods Orders Fall, Giving Up Late 2006 Gains

Summary

New orders for durable goods dropped 7.8% in January, following a downwardly revised 2.8% gain in December (originally 3.1%). Consensus expectations called for about a 3% fall, which would have basically reversed the December [...]

New orders for durable goods dropped 7.8% in January, following a downwardly revised 2.8% gain in December (originally 3.1%). Consensus expectations called for about a 3% fall, which would have basically reversed the December increase.

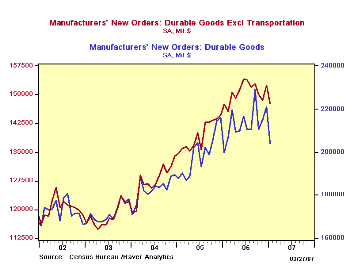

The drop was spread across several of the categories included in this "advance" report. The largest was in aircraft, both nondefense and defense. These had been up sharply in both November and December, so the decline now would not have been surprising. Motor vehicles, similarly, had been up three months running, and the January decrease, 5.1%, offset almost exactly their December rise of 5.3%. Total orders less transportation equipment were off 3.1% after December's 2.3% increase. Looking at the accompanying graph, we can't help but notice the developing downtrend in this series; at $147.7 billion in January, these orders are 4.2% below their peak last June. This comparison is less meaningful for total orders, since they swing so widely from month to month.

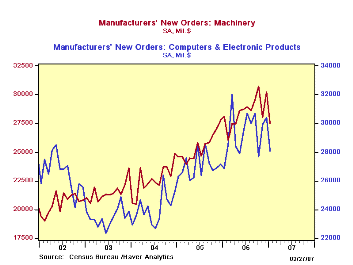

Nondefense capital goods excluding aircraft also fell, by 6.0%. This included machinery, computers and communications equipment. Correspondingly, orders for primary metals were down, although those for fabricated metal products rose. The other sector with an increase was electrical equipment, appliances and components. Also, despite the fall in orders for defense aircraft and parts, those for total defense capital goods were up 10.7%.

Durable goods shipments continued their recent pattern of modest monthly increases, rising 0.2%, after 0.5% in December and 0.3% in November. Excluding transportation, shipments were up 0.9%, after declines of 0.4% and 0.3%, respectively in the two preceding months.

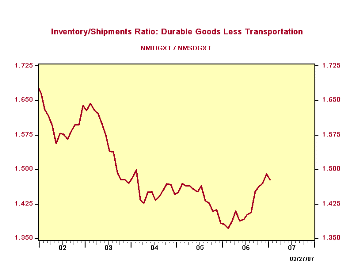

Inventories rose 0.3% but were unchanged less transportation equipment. The inventory/shipments ratio was up ever so slightly from 1.407 to 1.408, while excluding transportation, it went down from 1.490 to 1.477. These latest values compare [unfavorably] with annual averages in 2006 of 1.356 for total durables and 1.417 excluding transportation.

| Durable Goods, SA, % Chg |

Jan 2007 | Dec 2006 | Nov 2006 | Yr/Yr | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total | -7.8 | 2.8 | 2.2 | 2.1 | 7.1 | 9.0 | 6.4 |

| Ex Transportation | -3.1 | 2.3 | -0.9 | 0.2 | 8.1 | 9.4 | 7.6 |

| Nondefense Capital Goods | -19.9 | 10.5 | -0.3 | -0.5 | 9.8 | 21.4 | 5.6 |

| Ex Aircraft | -6.0 | 3.6 | -1.0 | -0.6 | 9.3 | 12.3 | 2.8 |

by Carol Stone February 27, 2007

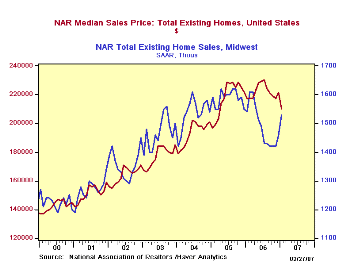

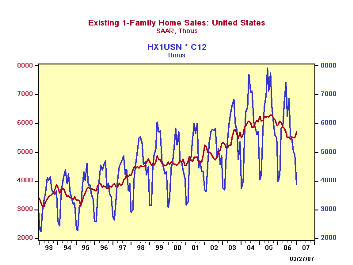

Existing home sales had a surprising gain in January, rising 3.0% to 6.46 million (SAAR), the largest volume since June. Market forecasts called for an increase of just 0.5% or so. Note that all these data have undergone annual seasonal revisions.

January is the weakest month seasonally, so we looked at the raw data to see if there was much exaggeration due to the low seasonal factors. Apparently not: the second graph here highlights that the greatest relative weakness in the existing home market was actually last summer, as the normal June seasonal peak was down 10.2% from June of the year before and the worst comparison was a whopping 16% in September. Now, the year-to-year loss is much smaller, just 2.7%.

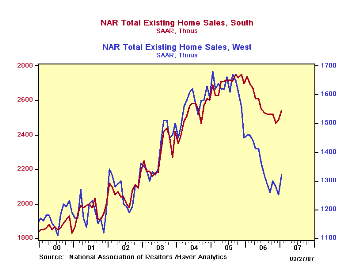

By region, sales remain "best" in the Northeast, where they are running 5.2% ahead of last year; they were flat with December after seasonal adjustment. Sales are also up on the year in the Midwest, 1.3%, and they gained 4.8% seasonally adjusted from December. In the South, volume is still down from last year, by 4.5%, but yearly comparisons show less weakness in prior months, so the whole down-cycle is more saucer-shaped there. January volume was up 2% from December. The far West is also still down, with January 9.4% below a year ago. They are less bad off now, though, than the 20%-plus plunge experienced back in the summer and January is actually up 5.6% from December.

Home prices remain soft. The national median price was $210, 600, off 3.1% from a year ago. Prices in each region were also down, with the Midwest and the West showing the greatest softness, off 3.5% and 4.6% respectively. Those in the Northeast and the South were down just 1.2% and 1.7%. So market conditions in the West are still contracting, with both prices and volume down markedly from January 2006. Lower prices elsewhere might be seen as helping sales volumes stabilize or even turn upward.

| Existing Home Sales, | Jan 2007 | Dec 2006 | Nov 2006 | Yr/Yr% Chg (NSA) | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total, 000s, SA | 6,460 | 6,270 | 6,250 | -2.7% | 6,510 | 7,075 | 6,727 |

| Median Price, NSA | $210,600 | $221,600 | $217,300 | -3.1% | $222,175 | $218,083 | $193,167 |

by Louise Curley February 27, 2007

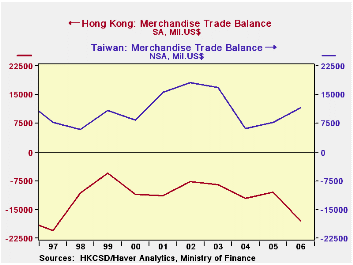

Taiwan and Hong Kong have recently released trade data that may be found in the Haver data base EMERGEPR. The data for Taiwan are shown in millions of U. S. dollars while those for Hong Kong are shown in millions of HK dollars with the exception of total exports, imports and balance.

Hong Kong traditionally runs a deficit on its trade in goods while Taiwan runs a surplus as can be seen in the first chart.

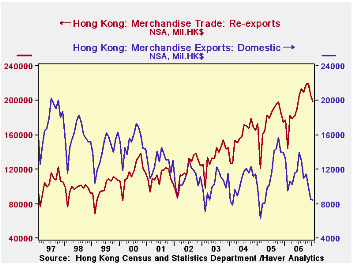

Although Hong Kong has a population that is less than one third of that of Taiwan' 23 million, its total exports in 2006 were $317 billion compared with $224 billion for Taiwan and its imports were $334 billion compared with $2020 billion for Taiwan. Hong Kong imports unfinished goods, finishes them and re-exports them. It this re-export trade that accounts for Hong Kong's greater trading activity relative to that of Taiwan. The second chart shows how Hong Kong's re-exports have grown over the past ten years while domestic export have fallen.

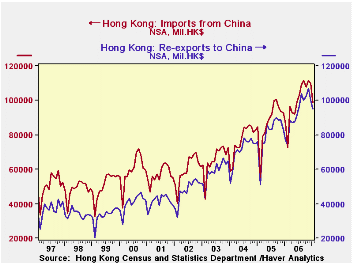

Most of Hong Kong's import and re-export trade is with China. The third chart shows Hong Kong's imports from China and Hong Kong's re-exports to China.

| TRADE IN GOODS TAIWAN & HONG KONG |

Q4 06 | 3Q 06 | 4Q 05 | Q/Q % | Y/Y % | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Taiwan (Bil. US$) | ||||||||

| Exports | 19.8 | 19.6 | 16.8 | 1.34 | 17.88 | 224.0 | 198.7 | 174.0# |

| Imports | 18.0 | 16.7 | 14.5 | 7.66 | 23.87 | 202.8 | 182.6 | 167.8# |

| Balance | 1.8 | 2.9 | 2.3 | -1.1* | -0.5* | 21.2 | 15.8 | 6.2 |

| Hong Kong (Bil. US$) | ||||||||

| Exports | 26.6 | 27.6 | 24.5 | -3.71 | 8.51 | 316.8 | 289.5 | 256.4 |

| Imports | 27.2 | 30.3 | 23.9 | -10.36 | 13.42 | 334.7 | 300.0 | 271.4 |

| Balance | -0.6 | -2.7 | 0.6 | 2.1* | -1.2* | -17.9 | -10.4 | -12.0 |

| HK Imports from China (Bil. HK$) | 98.5 | 109.9 | 86.9 | -10..38 | 13.36 | 1193.7 | 1050.4 | 919 |

| HK Re-exports to China | 64.7 | 100.1 | 77.1 | -5.32 | 22.89 | 1116.1 | 968.4 | 851.4 |

| HK Domestic Exports | 8.4 | 8.5 | 13.1 | -1.07 | -35.79 | 134.7 | 136.1 | 126.1 |

| HK Re-Exports | 199.0 | 206.2 | 176.9 | -3.48 | 12.49 | 2326.5 | 2115.1 | 1894.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates