Global| Feb 01 2007

Global| Feb 01 2007January ISM Manufacturing Survey Gives Back December Gains

Summary

The ISM Manufacturing Index fell back below 50 in January to 49.3, reversing December's gain and confounding forecasts of a further gain to over 51. Readings above 50 indicate that activity is expanding at half or more of the [...]

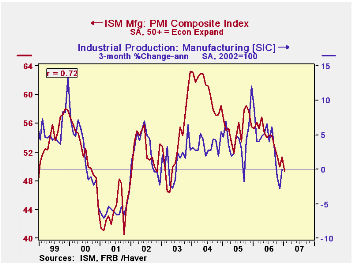

The ISM Manufacturing Index fell back below 50 in January to 49.3, reversing December's gain and confounding forecasts of a further gain to over 51. Readings above 50 indicate that activity is expanding at half or more of the responding companies, taken to mean that the manufacturing sector is generally growing. Thus, the January figure just below 50 describes a basically flat pattern for the month, taking account of seasonal adjustment.

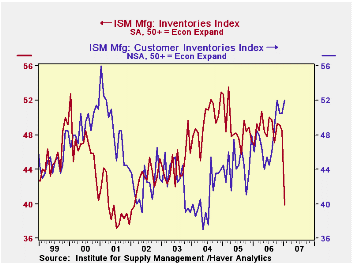

The change in the index was driven by inventories, which plunged from December's 48.5 to 39.9. This is the lowest reading since February 2002 and the sharpest month-on-month drop since July/August 1984. It indicates that manufacturers are reducing their holdings of materials and supplies. This item has only a 10% weight in the composite index, but the size of the decline means it reduced the index by 0.84 point.

Production was the next largest contributing factor, decreasing 2.8 points to 49.6. It has a 25% weight, so it took 0.7 point away from the total index.

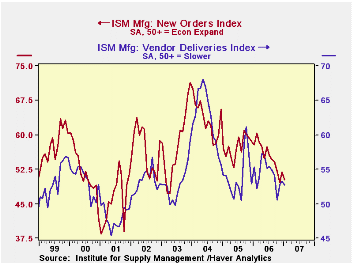

New orders were also weaker, but much more modestly, downshifting to 50.3 from 51.9 in December. This has the largest weight in the index calculation, 30%, and thus subtracted 0.48 from the total. Supplier deliveries are still positive, but less so, easing from 53.3 to 52.7 in January. This means that activity at vendors is moderating so fewer companies face protracted waiting times for deliveries of supplies.

Employment actually moved favorably, from 49.4 in December to 49.5 in January. The tiny improvement indicates that employment is falling at fewer companies, and indeed, with the reading so close to 50%, it is best described as "steady".

Prices paid by survey participants rebounded in January to 53.0 from 47.5 in December, largely recouping that month's decline. The press release from the Institute of Supply Management reports that aluminum, nickel and stainless steel went up in price, along with corn products. Copper, resins, natural gas and basic steel were all down. Note that the index is based on the number of companies reporting higher prices, not the number of commodities or materials with higher prices.

Finally among survey items of note this month, companies reported that their customers' inventories rose further to 52.6 from 50.5. This measure has been above 50 for four months, but before October, had been below 50 since the middle of 2001. This item is read negatively: more survey respondents in January judged that their customers stocks' are excessive, suggesting that those customers could cut back on future orders.

Taken together, this ISM report portrays a flat manufacturing sector, with little change in activity and sharp inventory reductions. A slowing in activity was indicated by industrial production data through December, and this ISM report implies that has carried forward into early 2007.

| ISM Manufacturing Survey | Jan 2007 | Dec 2006 | Nov 2006 | Jan 2006 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Composite Index | 49.3 | 51.4 | 49.9 | 55.3 | 53.9 | 55.5 | 60.5 |

| Prices Index (NSA) | 53.0 | 47.5 | 53.5 | 65.0 | 65.0 | 66.4 | 79.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates