Global| Mar 10 2004

Global| Mar 10 2004Japan Current Account at Record, Bolstered by Services & Income Flows

Summary

Japan's seasonally adjusted current account surplus widened to a record in January, according to the Bank of Japan/Ministry of Finance report on the nation's Balance of Payments issued today. The increase over December was ¥345 [...]

Japan's seasonally adjusted current account surplus widened to a record in January, according to the Bank of Japan/Ministry of Finance report on the nation's Balance of Payments issued today. The increase over December was ¥345 billion. Notably this was not due to a larger surplus in merchandise trade. That balance remained exactly the same as in December, ¥1185.8 billion, as exports and imports rose by equal amounts..

In the month, then, non-trade factors held sway: the deficit on services decreased markedly, and the surplus on income flows widened. It reached a record ¥849 billion, ¥154 billion more than the monthly average for all of last year. The January gain, ¥212 billion, was more than accounted for by a favorable swing in portfolio investment income of ¥336 billion. The service accounts saw a decrease in imports of "other business services", that is, excluding financial, communication and computer services.

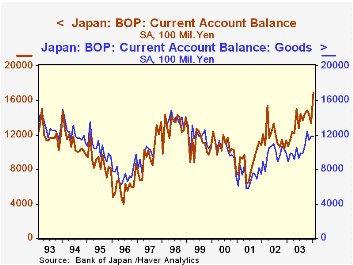

The picture from these data still shows Japanese merchandise trade with a sizable surplus due to strong exports. But imports have been growing since late 2001 as the Japanese economy works its way out of recession. And other forces tied to capital markets have been at work, so that, as can be seen in the accompanying chart, the current account in Japan no longer moves in lock step with the trade account.

| Billion Yen (Months seasonally adjusted) | Jan 2004 | Dec 2003 | 2003 Monthly Average | 2003 Total | 2002 Total | 2001 Total |

|---|---|---|---|---|---|---|

| Current Account | 1685.2 | 1339.9 | 1315.4 | 15785.2 | 14139.7 | 10652.4 |

| Trade Balance | 1185.8 | 1185.8 | 1021.3 | 12255.0 | 11733.2 | 8527.0 |

| Exports | 4626.8 | 4545.3 | 4327.2 | 51926.1 | 49479.7 | 46583.5 |

| Imports | 3441.0 | 3359.5 | 3305.9 | 39671.3 | 37746.4 | 38056.4 |

| Services | -318.7 | -394.7 | -321.4 | -3889.1 | -5264.3 | -5315.1 |

| Income | 848.8 | 637.3 | 690.5 | 8286.0 | 8266.6 | 8400.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.