Global| Jan 13 2004

Global| Jan 13 2004Japan Current Account Surplus Sustained, as Financial Accounts Show Capital Outflow

Summary

Some months ago in this space, Louise Curley explained how the large Japanese current account was bringing Japan a strong influx of foreign exchange reserves. However, this situation shifted soon after that report appeared. The [...]

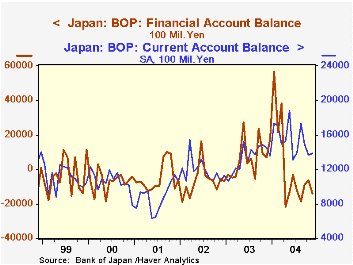

Some months ago in this space, Louise Curley explained how the large Japanese current account was bringing Japan a strong influx of foreign exchange reserves. However, this situation shifted soon after that report appeared. The current account surplus has tapered a bit in the most recent months, although it has still been large enough that the average for the 11 months of 2004 indicates a continuing uptrend over the last several years.

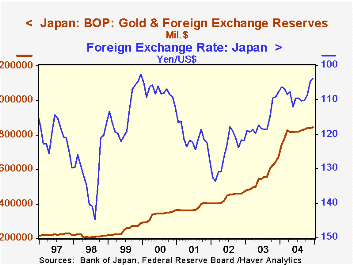

But the financial account has turned around. Net inflows of funds through the financial accounts averaged ¥683 billion in 2003, when the influx of FX reserves was largest. Now, the financial account is negative: Japanese assets abroad are increasing, sending capital out of the country. As seen in the accompanying graph, this has been going on persistently since April. As a result, the rise in FX reserves has slowed dramatically: the last three months have averaged just ¥173 billion, compared with ¥1.561 trillion for the year through November.

So far this change in financial flows has meant little to the value of the yen. It continues to rise against the dollar, which today is running about ¥102.50. The pace of increase has slowed very recently from the sharp move in November, which is evident from the table below. But it remains on an upward path, illustrating that sometimes, currency trends respond to factors other than trade flows and even other than capital flows. Political, cultural and even weather factors can impact traders' assessments of a nation's standard of value.

| Trillions of Yen | Nov 2004 | Oct 2004 | Sept 2004 | Nov 2003 | Monthly Average|||

|---|---|---|---|---|---|---|---|

| 2004* | 2003 | 2002 | |||||

| Current Account, SA | +1.386 | +1.362 | +1.495 | +1.453 | +1.546 | +1.330 | +1.184 |

| Financial Account, NSA | -1.389 | -0.632 | -0.864 | +0.706 | +0.173 | +0.683 | -0.671 |

| Change in Reserves, NSA | +0.298 | +0.109 | +0.112 | +1.752 | +1.561 | +1.794 | +0.483 |

| Exchange Rate: Yen/$ | 104.70 | 108.78 | 110.09 | 109.18 | 108.55 | 115.92 | 125.27 |

| Trillions of Yen | Nov 2004 | Oct 2004 | Sept 2004 | Nov 2003 | Monthly Average|||

|---|---|---|---|---|---|---|---|

| 2004* | 2003 | 2002 | |||||

| Current Account, SA | +1.386 | +1.362 | +1.495 | +1.453 | +1.546 | +1.330 | +1.184 |

| Financial Account, NSA | -1.389 | -0.632 | -0.864 | +0.706 | +0.173 | +0.683 | -0.671 |

| Change in Reserves, NSA | +0.298 | +0.109 | +0.112 | +1.752 | +1.561 | +1.794 | +0.483 |

| Exchange Rate: Yen/$ | 104.70 | 108.78 | 110.09 | 109.18 | 108.55 | 115.92 | 125.27 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.