Global| Jul 29 2009

Global| Jul 29 2009Japan Retail Sales Remain Sour

Summary

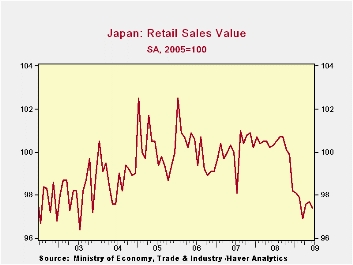

Japan retail sales fell in June but June caps a three-month period in which sales have expanded. Still, in the quarter-to-date Japan’s retail sales are falling but only slightly. Over 12-months retail sales are off by about 3%, led by [...]

Japan retail sales fell in June but June caps a three-month

period in which sales have expanded. Still, in the quarter-to-date

Japan’s retail sales are falling but only slightly.

Over 12-months retail sales are off by about 3%, led by

declines in fabric and apparel and the rest of retail which dropped by

4.2%. Auto sales are only off by 0.5% Yr/Yr. Food and beverage sales

are off by 1.2%. Sales at department stores and supermarkets slipped

6.7% on the year, and after those figures are adjusted for the number

of stores (same-store sales), sales posted their 15th straight monthly

decline, according to METI.

This is hardly a robust picture of activity yet today the MoF

upgraded its assessment of Japan’s economy for the first time in five

years. The Ministry of Economy, Trade and Industry said. The

government's massive stimulus measures, which include tax-cut programs

such as incentives to buy new cars, may help to boost retail sales in

the future. For now the consumer is in the doldrums and spending habits

remain subdued. Leading indicators for Japan have not turned the corner

to signal positive trends yet.

| Jun-09 | May-09 | Apr-09 | 3-mo | 6-mo | 12-mo | Yr-Ago | Q-to-Date | |

| Total SA | -0.3% | 0.1% | 0.7% | 2.1% | -1.6% | -2.9% | 1.2% | -0.3% |

| Not seasonally adjusted | ||||||||

| Total: Nominal | -0.5% | 0.5% | 0.3% | 1.1% | -0.8% | -3.0% | 0.7% | -0.7% |

| Motor Vehicles | -1.9% | -4.1% | 7.5% | 4.7% | -5.7% | -0.5% | -3.2% | 3.0% |

| Food& Beverage | -1.4% | 2.0% | -1.0% | -2.0% | -3.7% | -1.2% | 14.8% | -1.0% |

| Fabric apparel& access | -4.5% | 1.4% | 1.5% | -6.5% | -1.0% | -5.7% | -6.6% | 2.5% |

| Rest of Retail | 1.1% | 0.4% | -0.7% | 3.5% | 2.3% | -4.2% | -5.0% | -1.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates