Global| Feb 13 2008

Global| Feb 13 2008Japan's Consumer Confidence Very Weak

Summary

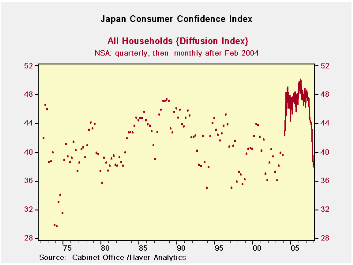

Japan’s consumer confidence survey did not used to be monthly. That is why the chart shows its past as a quarterly report represented by unconnected dots co-joined with its new form in which the dots are connected month-to-month. [...]

Japan’s consumer confidence survey did not used to be monthly.

That is why the chart shows its past as a quarterly report represented

by unconnected dots co-joined with its new form in which the dots are

connected month-to-month. Based on a full sample of observations back

to 1988 the current Consumer confidence readings are very weak. Based

on the data from 2004 onward when monthly reporting kicked in these are

the worst levels for all of the components that this report has seen.

But in its broader historic context, while overall livelihood is nearly

at an all-time low, employment is still above mid range in its 54th

percentile. Willingness to buy durable goods is weak in the bottom 25

percentile of its range. The same relative position is true of expected

income growth. People assess the value of their assets as in about the

bottom third of its historic range.

Clearly Japan is undergoing some difficulties. The consumer is

still very concerned about the future. While the OECD leading

indicators show Japan in an upswing of sorts, Japan’s own indicators

continue to show the economy bogged down with some conditions still

worsening.

| Japan Consumer Confidence | ||||||||

|---|---|---|---|---|---|---|---|---|

| Monthly | Change over | Percentile of range* | ||||||

| Dec-07 | Nov-07 | Oct-07 | 3-mos | 6-mos | 12-Mos | Since 2004 | Since 1988 | |

| Overall Livelihood | 34.9 | 37.0 | 41.0 | -7.3 | -7.5 | -8.6 | 0.0 | 0.0 |

| Income growth | 39.6 | 40.7 | 42.2 | -2.8 | -2.6 | -2.5 | 0.0 | 26.1 |

| Employment | 40.6 | 43.1 | 45.3 | -5.8 | -8.4 | -8.4 | 0.0 | 59.7 |

| Willing to buy Durable Goods | 37.0 | 38.4 | 42.8 | -8.5 | -9.4 | -11.9 | 0.0 | 27.3 |

| Value of Assets | 40.8 | 42.4 | 44.6 | -3.4 | -5.9 | -4.7 | 0.0 | 40.1 |

| For two-person households; * Percentiles since Mar 2004 when series became monthly or full period | ||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates