Global| Oct 11 2017

Global| Oct 11 2017Japan's Core Orders Surge As Sector Growth Plods Ahead

Summary

Japan's machinery and core order series both expanded sharply in August. Both series show gathering momentum as Japan continues to post better than expected growth metrics despite still lagging inflation performance. Total and core [...]

Japan's machinery and core order series both expanded sharply in August. Both series show gathering momentum as Japan continues to post better than expected growth metrics despite still lagging inflation performance.

Japan's machinery and core order series both expanded sharply in August. Both series show gathering momentum as Japan continues to post better than expected growth metrics despite still lagging inflation performance.

Total and core order trends

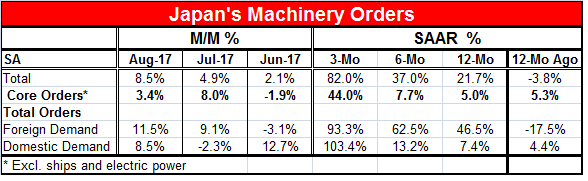

Total orders rose by 8.5% in August and core orders (that exclude large projects likely to be lumpy in nature) gained 3.4%. Both series grew strongly in July and their respective three-month growth rates are 82% for headline orders and 44% for core orders. Both are very hot readings! Both series show annualized growth rates from 12-month to six-month to three-month, expanding at an ever more rapid pace. This acceleration is an encouraging sign for growth. But now the short-term annualized growth rates are so high that there will be a following period when growth rates will slow from these super-heated and unsustainable levels.

Total foreign and domestic orders

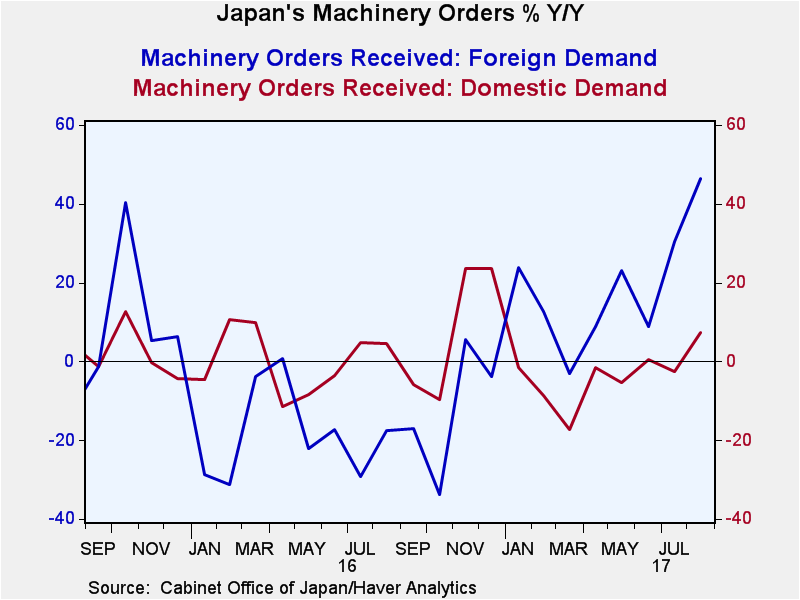

Total foreign and domestic orders both were strong in August with foreign demand rising by 11.5% and domestic orders rising by 8.5%. These two series, as well, show accelerating growth on shorter horizons. Domestic growth is up to a 103.4% annualized pace over three months while foreign order growth is up to a pace of 93.3%.

More perspective on orders

However, taking more perspective on the report, core orders, the more well-behaved series over time, shows a gain of just 5% over 12 months and that is slower than the 5.3% it had grown over 12 months one year ago. The foreign/domestic split breaks out to show that over 12 months foreign demand is up by 46.5% but domestic demand is up by just 7.4%. Obviously, this means that there are some large projects being done to satisfy foreign demand. Similarly, foreign demand has picked up over 12 months, compared to having declined over 12 months one year ago. Domestic demand in terms of total orders has picked up its pace from 4.4% one year ago to 7.4% over the last 12 months.

Japan's growth context

The context for growth in Japan is still difficult. Its population is shrinking; thus, making the drive to better growth an uphill struggle. It also has a huge mound of debt (yes, that it mostly owes to its own people) and that makes it hard to use anything but the most temporary fiscal aids to growth. In this month's round of PMI data, China turned up weaker numbers, an adverse development for Japan since China is its largest trade partner. Still, Taiwan was just reported a 28.1% export surge in one month, driving exports to a monthly new record. On a broader scope, the IMF has just lifted its global forecast, but the change was rather small. Still, it is a signal that globally economies are doing better than had been expected. The German government has hiked its own outlook, strongly raising its growth outlook for this year to 2% from 1.5% previously and lifting the 2018 outlook to 1.9% from 1.6%. These sorts of ratcheting up moves in the various outlooks are reassuring.

Risks remain

Still, when the IMF lifted its outlook, it also warned that the recovery was not fully balanced and could still be at risk. One question for recovery is, of course, what happens when central banks take away the extra stimulus they have provided for so long...and we are on the cusp of that occurring. In the U.S., the Fed is both raising rates and shrinking its balance sheet. The ECB seems ready to begin removing some of its special stimulus next year. The Bank of England is talking about the need to eventually run a less expansive policy. So far, the Bank of Japan is not party to those sorts of discussions. But if growth continues to firm up, what we have found is that with a background of better growth central bankers have been willing to hike rates even if they are not meeting their inflation objectives. Would Japan be prepared to do the same?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.