Global| May 17 2007

Global| May 17 2007Japan's Growth a Bit Slower than Expected, but Encouraging Forces in Place

Summary

Japanese GDP grew at a 2.4% annual rate in Q1, less than Q4's 5.0% and less than market expectations of 2.7%. Q4 was also revised downward from 5.5% reported in mid-March. The slower growth was due to a contraction in investment, and [...]

Japanese GDP grew at a 2.4% annual rate in Q1, less than Q4's 5.0% and less than market expectations of 2.7%. Q4 was also revised downward from 5.5% reported in mid-March.

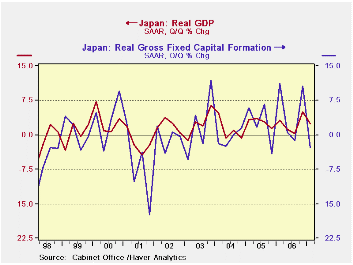

The slower growth was due to a contraction in investment, and Q4's investment amount was also reduced from prior reports. So total fixed capital formation fell at a 2.8% rate, following growth of 10.6% in Q4. Residential was off 1.3% in Q1 and nonresidential plant and equipment at a 3.7% rate. The revision to Q4 was small for residential but nonresidential was cut from 13.2% to 9.4% growth. Even so, plant & equipment expenditures for 2006 as a whole came in at 11.0%. Thus, the decrease in Q1 came on the heels of quite strong gains during last year. Further, new depreciation rules went into effect with the new fiscal year in April, and the accounting change would have discouraged major capital spending just before that.

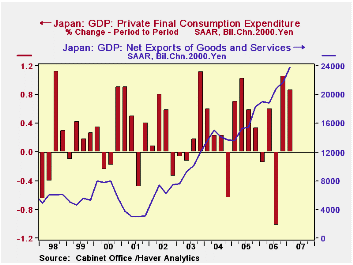

By contrast, consumption did well. In Q1, it grew at a 3.5% annual rate, following 4.3% in Q4. These two quarters are a considerable pick-up from last year's overall tepid performance. And Q4 was even revised a bit higher. Net exports also added to overall growth, as exports themselves grew 13.9%, annualized, in Q1 after 3.4% in Q4. This latter figure was also revised upward for Q4, which previously had shown 2.4% growth. Partially offsetting, imports switched from their declining pattern in Q3 (-1.5%) and Q4 2006 (-0.5%) to a moderate gain of 3.8% in Q1. The amount in Q4 was revised upward marginally.

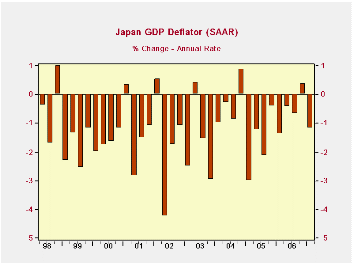

The transitory accounting-rule factors on capital spending can well mean that it will turn back up soon. And the nice back-to-back growth in consumer spending is encouraging. Prices do persist in their decline. We calculated a deflator from the seasonally adjusted GDP figures, and it fell 1.2% in Q1, although it had risen 0.4% in Q4. The "official" deflator based on not seasonally adjusted data was off just 0.2% year-on-year in Q1. Government officials assert that Japan is on the verge of breaking out of deflation, and these recent patterns suggest that is an apt description. In this space on Monday, Louise Curley noted the role of its vibrant Asian neighbors in boosting the Japanese economy. So there look to be a number of positive forces in the outlook.

| JAPAN (% Chg, SAAR*) | Q1 2007 | Q4 2006 | Q3 2006 | Year/ Year | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Real GDP | 2.4 | 5.0 | 0.3 | 2.0 | 2.4 | 2.8 | 1.1 |

| Private Consumption | 3.5 | 4.3 | -4.0 | 1.6 | 0.5 | 2.7 | 0.4 |

| Government Consumption | -0.3 | 0.3 | 2.5 | 1.2 | 1.3 | 0.8 | 1.3 |

| GFCF** | -2.8 | 10.6 | -1.2 | 1.7 | 5.3 | 2.5 | -0.7 |

| Private Residential | -1.3 | 8.9 | -1.0 | -0.2 | 1.0 | -0.5 | 2.6 |

| Plant & Equipment | -3.7 | 9.4 | 3.8 | 4.7 | 11.0 | 4.2 | 2.5 |

| Public Investment | -0.6 | 17.0 | -17.6 | -6.8 | -8.0 | 0.5 | -5.4 |

| Exports | 13.9 | 3.4 | 9.6 | 7.4 | 6.3 | 10.4 | 10.5 |

| Imports | 3.8 | -0.5 | -1.5 | 2.0 | 2.8 | 4.4 | 9.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.