Global| Oct 03 2005

Global| Oct 03 2005Japan's Tankan Survey Moderately Disappointing

Summary

Preliminary results of .the Bank of Japan's Tankan Survey were moderately disappointing, falling short of consensus expectations. The percent balance between optimists and pessimists evaluating the current conditions in the third [...]

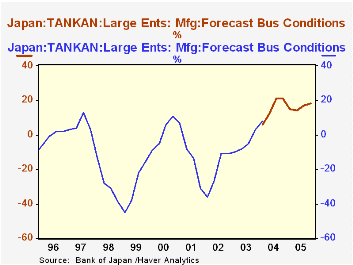

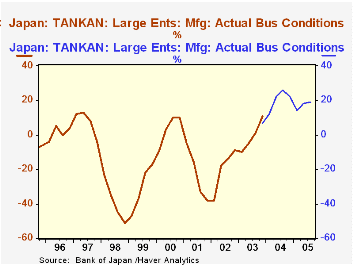

Preliminary results of .the Bank of Japan's Tankan Survey were moderately disappointing, falling short of consensus expectations. The percent balance between optimists and pessimists evaluating the current conditions in the third quarter was 19%, compared with 18% for the second quarter. The consensus was 20-21%. The forecast for the fourth quarter is for an excess of 18% for optimists over pessimists. Although the results have fallen short of expectation, they continue to show a healthy increase of optimists over pessimists, compared to the past, as can be seen in the two attached charts, which show the appraisals of current conditions and forecasts for the following quarter. To show some perspective we have added the DISCONTINUED series to the current data that are available only from early 2004.

The major differences between the current and the discontinued series are (1) a revised industrial classification, (2) changed sampling measures to conform with the 2001 census and (3) a change in the definition of size from one based on the number of employees to one based on capitalization.

Several commentators have suggested that the high price of oil has played a significant role in dampening business confidence. In an interview with the Financial Times, Kazuo Momma, head of economic assessment and projection at the bank of Japan, while granting the serious direct effects of the high price of oil on Japanese business confidence, also stressed his longer term concerns. "We are more worried about the indirect, second wave effects coming from the slowdown of the world economy, particularly the US and China."

| Tankan Survey | Q4 05 | Q3 05 | Q2 04 | Q1 05 | Q4 04 | Q3 04 | Q2 04 | Q1 04 |

|---|---|---|---|---|---|---|---|---|

| Large Manufacturing Enterprises | ||||||||

| Current Conditions | 19 | 18 | 14 | 22 | 26 | 22 | 12 | |

| Forecast | 18 | 17 | 14 | 15 | 21 | 21 | 12 | 6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates