Global| Apr 02 2012

Global| Apr 02 2012Japan: The Yen Since The Bank of Japan's Policy Change in Mid February

Summary

In mid February of this year, the Bank of Japan announced a price stability goal of 1.0% in place of its price expectation of 0.5% and raised its Asset Purchase Program by 10 trillion yen to 65 trillion yen in mid February. The policy [...]

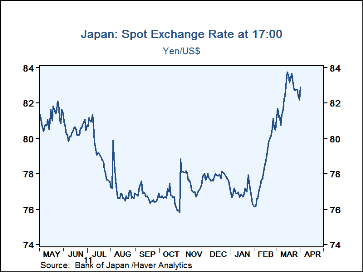

In mid February of this year, the Bank of Japan announced a price stability goal of 1.0% in place of its price expectation of 0.5% and raised its Asset Purchase Program by 10 trillion yen to 65 trillion yen in mid February. The policy change has resulted in a significant depreciation of the yen. It has depreciated from 76.13 to the dollar on February 2, 2012--its recent high point--to 83.66 on March 20, almost 10%, but it has since begun to appreciate and is up 0.1% today. The path of the yen/dollar rate can be seen in the first chart.

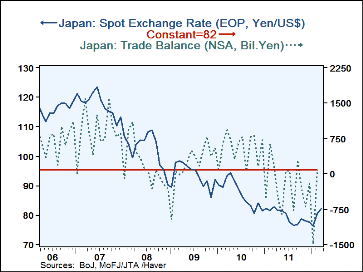

The second chart shows the relationship between the exchange rate and the trade balance. Obviously a rising exchange rate tends to discourage exports and encourage imports, reducing the balance of trade. Until this past year, Japan had been able to maintain a positive balance of trade in spite of a rising exchange rate as a result of continued improvements in productivity. Last year Japan experienced several months of negative balances of trade as a result of largely exogenous factors-- earthquake, tsunami, nuclear problems and floods in Thailand. As the effects of these disruptions begin to wear off. there may be some strengthening of the yen, but if the monetary authorities keep to the more relaxed policy, the pace of appreciation should be subdued. We have added a constant to the chart, 82 yen to the dollar, which represents the current estimate of the break even point--that exchange rate the would balance exports and imports.

| Yen/USD | Change | |

|---|---|---|

| February 2 | 76.13 | -- |

| March 15 | 83.74 | +9.9% |

| April 2 | 82.91 | -0.1% |