Global| Sep 16 2008

Global| Sep 16 2008Japanese Consumers More Pessimistic and German Investors Less Pessimistic before the Lehman Bankruptcy

Summary

Japanese consumers couldn't be much more pessimistic than they were in August, before the failure of Lehman Brothers. In the latest survey of consumer confidence, the diffusion index fell to 30.1 in August from 31.4 in July. This [...]

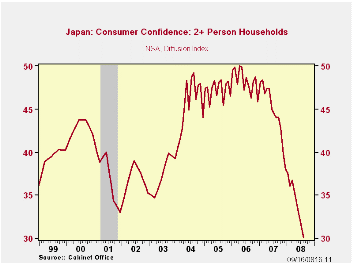

Japanese consumers couldn't be much more pessimistic than they

were in August, before the failure of Lehman Brothers. In the latest

survey of consumer confidence, the diffusion index fell to 30.1 in

August from 31.4 in July. This value compares with 33.0 in the

2000-2003 recession as shown in the first chart. (Prior to April 2004,

the Consumer Confidence indicator was recorded quarterly.) Of the

components of the index, the overall livelihood, willingness to buy

durable goods and income

growth, all are below their recession lows.

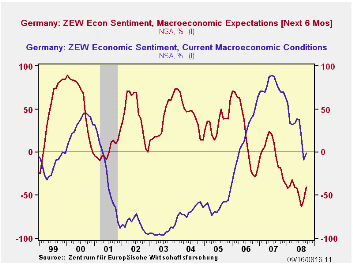

German investors and analysts, on the contrary, were slightly less pessimistic in the ZEW September survey as shown in the second chart. However, pessimists still out weighed optimists on their appraisal of both current conditions and expectations. There were 1% more pessimists than optimists appraising the current situation, compared with an excess of 9.2% in August, and the excess of pessimists over optimists appraising the outlook six months ahead was still 41.1%, down from 55.5% in August.

Some 31 out of 315 replies to the ZEW September survey were

received after the bankruptcy of Lehman Brothers. According to their

press release, ZEW reported that a separate analysis of these replies

"shows that the economic expectations for Germany have not deteriorated

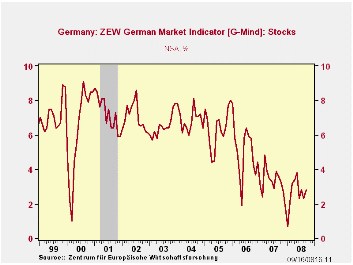

in the course of the incident.

Stock market expectations, however, were corrected downwards significantly." The German market indicator, G-Mind Stocks, has been trending downward over the past three years as can be seen in the third chart. The indicator did, however, manage a slight rise in September in spite of the pessimistic views of the 31 respondents posting replies after the collapse of Lehman Brothers.

| JAPAN | Aug 08 | Jul 08 | Previous Low | M/M Dif | Chg from Low | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|

| Consumer Confidence (Diffusion Index) | 30.1 | 31.4 | 33.0 | -1.3 | -2.9 | 44.7 | 48.3 | 47.3 |

| Overall Livelihood | 28.5 | 29.3 | 36.6 | -0.8 | -8.1 | 42.2 | 45.6 | 45.8 |

| Willingness to Buy Durable Goods | 28.3 | 29.2 | 40.9 | -0.9 | -12.6 | 45.7 | 50.0 | 49.5 |

| Income Growth | 35.0 | 36.3 | 35.3 | -1.3 | -0.3 | 42.6 | 44.7 | 44.8 |

| GERMANY | Sep 08 | Aug 08 | Sep 07 | M/M Dif | Y/Y Dif | 2007 | 2006 | 2005 |

| ZEW Indicators (% balance) | ||||||||

| Current Conditions | -1.0 | -9.2 | 74.4 | 8.2 | 75.4 | 75.9 | 18.3 | -61.8 |

| Expectations 6 mo Ahead | -41.4 | -55.8 | -18.1 | 14.4 | -23.0 | -3.0 | 22.3 | 34.8 |

| G-Mind Stocks | 2.8 | 2.3 | 3.6 | 0.5 | -0.8 | 3.3 | 5.0 | 6.4 |