Global| Jun 10 2005

Global| Jun 10 2005Japanese Investors Buy Sizable Amount of Foreign Debt; Foreign Investors Buy Sizable Amount of Japanese Debt

Summary

Japan's Ministry of Finance (MoF) has reorganized its data on the purchase and sales of foreign securities by Japanese investors and the similar data on foreign investment in Japanese securities. The new data began this past January [...]

Japan's Ministry of Finance (MoF) has reorganized its data on the purchase and sales of foreign securities by Japanese investors and the similar data on foreign investment in Japanese securities. The new data began this past January and are designed to mesh better with the balance of payments. They are contained in Haver's "JAPAN" database and summary statistics are available weekly in JAPANW.

In the table below, we show total purchases and sales of foreign securities by Japanese investors. In May, Japanese residents bought ¥14.4 trillion worth and sold ¥11.4 trillion, making net purchases of ¥3.0 trillion. This figure appears in the table with a minus (-) sign. This convention is in line with balance of payments practices that treat these transactions according to the direction of the flow of capital. With net purchases, then, there is a net outflow of money and the sign is minus (-). In February and March, sales exceeded purchases, so there was a net inflow of money into Japan and the sign of the net figure is plus (+).

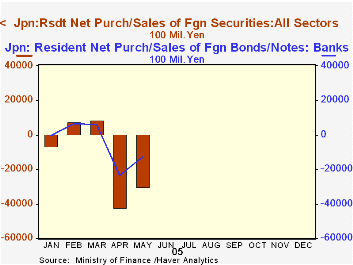

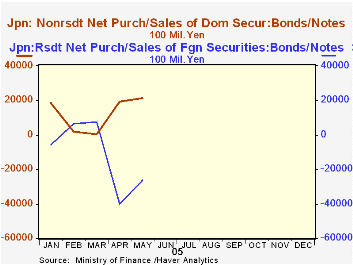

The bulk of the new securities investment abroad is in bonds and notes; this is typical, according to the old data, which was discontinued with the December 2004 figures. Further, as seen in the first graph, banks take a substantial share of this investment activity. With only five months of the new data, we can't judge trends yet, of course, but it does seem here than when the new Japanese fiscal year started in April, investment abroad picked up significantly. At the same time, foreign investors stepped up their net purchases of Japanese securities in April and May as well. Here, net purchases have the expected plus (+) sign, since they represent a net inflow of funds into Japan. Japanese investment abroad is larger, but a point we highlight here is that there are active flows of capital and financial assets in both directions, illustrating the diversity of interests in world capital markets.

| Japan (Trillion ¥) | May 2005 | Apr 2005 | Mar 2005 | Feb 2005 | Jan 2005 |

|---|---|---|---|---|---|

| Purchases | 14.372 | 14.915 | 10.348 | 10.631 | 10.728 |

| Sales | 11.351 | 10.681 | 11.171 | 11.410 | 10.064 |

| Net Purchases/ Sales | -3.017 | -4.234 | +0.824 | +0.779 | -0.664 |

| Bonds & Notes | -2.626 | -4.003 | +0.768 | +0.648 | -0.589 |

| Equities | -0.254 | -0.199 | -0.059 | +0.031 | -0.151 |

| Money Market Instruments | -0.138 | -0.032 | +0.114 | +0.010 | +0.075 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates