Global| Aug 22 2007

Global| Aug 22 2007Japanese Trade Picture Murky: Rising World Commodity Prices Push Imports Higher

Summary

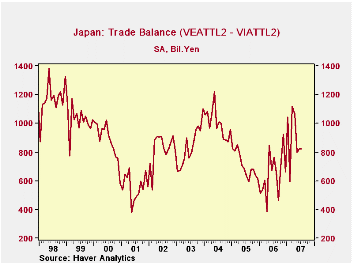

Japan's trade surplus either widened a bit in July or narrowed noticeably, depending on how you look at it. The reported balance from the raw data diminished to ¥671 million from ¥851 million in July 2006. However, the seasonally [...]

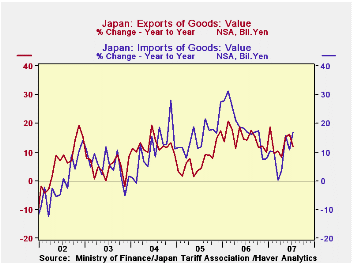

Japan's trade surplus either widened a bit in July or narrowed noticeably, depending on how you look at it. The reported balance from the raw data diminished to ¥671 million from ¥851 million in July 2006. However, the seasonally adjusted balance inched outward to ¥823 million from ¥822 million. This compares with a seasonally adjusted balance of ¥766 million a year ago. Both exports and imports rose 0.5% in July from June. Exports were up 11.7% from the year-ago amount and imports, a substantial 16.9%.

Some observers highlighted the deterioration, noting that it was more than forecasters expected and might foretell more slowing of the Japanese economy. There was already some surprise in Q2 GDP, which saw quarter-to-quarter growth decrease to just a 0.5% annual rate from 3.2% in Q1. However, from this perspective of the ongoing trend in seasonally adjusted data, the recent string of trade figures looks fairly favorable (see first graph).

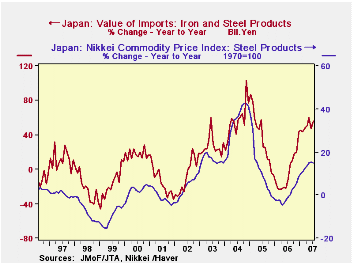

The feature of this report that caught our attention came when we started to look at petroleum imports. With prices up so sharply, these imports were up 14% from a year ago. But wait! total imports were up 16.9%. Other things must have increased considerably more than oil. Indeed. Iron ore 35%; iron and steel products, 55.7%; nonferrous ore, 59.6%; nonferrous alloys, 27.8%, chemicals, 23.8%; electrical machinery, 17.1%. Commodity prices have struck here, apparently, sticking resource-starved Japan with accelerating import costs; in some cases, such as copper, world markets have already eased, but Japan is still paying higher more, possibly for materials that were ordered some time ago. We show here another example, imports of iron and steel products with the Nikkei domestic commodity price index for steel products.

Will these facts help the Bank of Japan in its rate setting decision, due overnight tonight? They would present a two-handed argument for a rate change: high-cost imports weighing on the economy, but the accompanying prospect of a more notable resumption of inflation. We'd guess -- without any credential as a forecaster of Japanese monetary policy -- that developments in world markets, more than these dual pressures within the Japanese economy itself, would stop the BoJ from raising a rate this week.

| JAPAN, Bil.¥ | July 2007* | June 2007* | May 2007* | Year Ago* | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Trade Balance | 823 | 822 | 796 | 766 | 658 | 726 | 996 |

| Not Seas Adj | 671 | 1223 | 383 | 851 | -- | -- | -- |

| Exports | 7086 | 7053 | 6973 | 6333 | 6271 | 5471 | 5097 |

| % Change | 0.5 | 1.1 | 2.9 | 11.7 | 14.6 | 7.3 | 12.1 |

| Imports | 6264 | 6231 | 6177 | 5567 | 5612 | 4746 | 4101 |

| % Change | 0.5 | 0.9 | 8.2 | 16.9 | 18.3 | 15.7 | 10.9 |

by Robert Brusca August 22, 2007

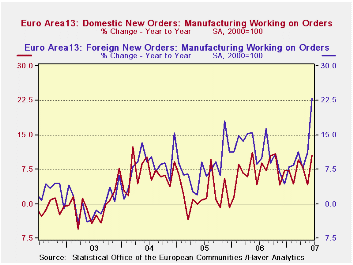

Euro area domestic orders are fine but are slower than export orders - both are accelerating over 3 months.

The UK alone (not a Euro area member) shows orders weakening but the CBI survey shows gains in August. We are left with a bit of uncertainty about Europe. But nothing has truly been weak apart from the episodic experience of things like UK orders weakening then rebounding. There are more substantial hints of slowing, but none of weakness. And during the liquidity squeeze the Euro has lost some ground, a factor that is good for Euro area growth prospects.

While there is some irregularity in the Euro area, Italy and France have showed the most consistent signs of weakness among large economies, although French industrial orders have emerged again as strong after some weakness. The ECB is under pressure to not hike rates and today the French finance minister proves there is at least a side and one-half to every argument, by making a case for a rate cut from the ECB. Yes I said (he said) ‘cut’.

Within the Euro area there is this odd result that domestic orders are softer while export orders are strong and accelerating strongly. Exports still undertake a national definition in these data. So export orders from Germany to a French firm would be export orders to France but would still reflect internal EMU orders. This sort of thing makes it a bit hard to sort out what is in train here. For now domestic orders are a bit weaker but are not suspect since they are accelerating, too. Europe’s slowdown may be in progress but it does not seem to be anything more serious than that.

| Saar except m/m | % m/m | Jun-07 | Jun-07 | Jun-07 | Jun-06 | Jun-05 | ||

| Euro area Detail | Jun-07 | May-07 | Apr-07 | 3-Mo | 6-mo | 12-mo | 12-mo | 12-mo |

| MFG Orders | 4.4% | 1.5% | -0.3% | 24.5% | 17.5% | 15.5% | 6.3% | 5.4% |

| MFG Sales | 0.9% | 0.7% | 0.3% | 8.2% | 7.2% | 7.1% | 7.7% | 3.1% |

| Consumer | 0.5% | 0.4% | 0.3% | 4.9% | 4.1% | 4.8% | 7.7% | 3.1% |

| Capital | 0.5% | 0.4% | 0.5% | 5.7% | 7.3% | 8.2% | 4.0% | 1.8% |

| Intermediate | 0.9% | 0.7% | 0.2% | 10.7% | 4.0% | 10.6% | 6.9% | 2.7% |

| MFG Orders | ||||||||

| Total Orders | 4.4% | 1.5% | -0.3% | 24.5% | 17.5% | 15.5% | 6.3% | 5.4% |

| E-13 Domestic MFG orders | 1.8% | 0.5% | 0.2% | 10.7% | 4.0% | 10.6% | 4.2% | 0.9% |

| E-13 Foreign MFG orders | 8.7% | 3.7% | -2.0% | 48.4% | 30.7% | 23.1% | 8.5% | 9.1% |

| Countries: | Jun-07 | May-07 | Apr-07 | 3-Mo | 6-mo | 12-mo | 12-mo | 12-mo |

| Germany: | 4.7% | 3.2% | -1.5% | 28.3% | 27.2% | 17.9% | 9.7% | 7.1% |

| France: | 5.1% | 2.6% | 0.6% | 38.6% | 26.6% | 8.4% | -0.6% | 9.6% |

| Italy: | #N/A | 2.5% | -0.8% | #N/A | #N/A | #N/A | 10.1% | 4.9% |

| UK: | -1.7% | -2.4% | -6.7% | -35.9% | 12.2% | -7.2% | 10.2% | -2.3% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.