Global| Jan 11 2008

Global| Jan 11 2008Japan’s Economy Watcher Index Measures Sink Sharply

Summary

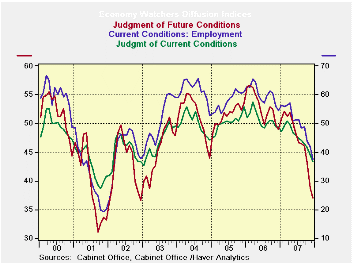

The Economy watcher indices and the Teikoku indices are all at relative low points in their respective ranges. The headline economy watchers index is in the bottom 5% of its five year range. Still Japanese authorities say that the [...]

The Economy watcher indices and the Teikoku indices are all at

relative low points in their respective ranges. The headline economy

watchers index is in the bottom 5% of its five year range. Still

Japanese authorities say that the virtuous circle is intact (some

circle). The Economy Watchers’ employment index is at a five year low.

The future index from the Economy Watchers complex is in the bottom 1.5

percentile of its five year range. Surely this can’t be good.

We can add to this the finding in the November US trade report

that real non petroleum US exports growth has turned negative over

three months. Surely the rest of the world economy is slowing down and

slumping US exports – despite their competitiveness- is one sign. These

results from Japan are just another piece of the puzzle that helps to

explain US export weakness despite a huge decline in the dollar

exchange rate (although it’s not so weak vs the yen).

The Teikoku sector indices echo the Economy-Watcher findings.

The manufacturing, retail and wholesale sector indices are on five year

lows. Construction is in the bottom 16% of its range. Services are

‘relatively strong’ holding to the bottom 20% of their range…

Japan is still slowing and expectations of the Economy

Watchers do NOT see a turning here soon. Results still seem to be worse

than what the government wants to admit.

| Key Japanese surveys | |||||||

|---|---|---|---|---|---|---|---|

| Raw readings of each survey | Percent of 5Yr range* | ||||||

| Dec-07 | Nov-07 | Oct-07 | Sep-07 | Dec-07 | Nov-07 | Oct-07 | |

| Diffusion | |||||||

| Economy Watchers | 36.6 | 38.8 | 41.5 | 42.9 | 5.0% | 15.1% | 27.5% |

| Employment | 37.5 | 41.9 | 43.8 | 48.8 | 0.0% | 14.7% | 21.5% |

| Future | 37.0 | 38.8 | 43.1 | 46.0 | 1.5% | 10.6% | 32.2% |

| NTC Manufacturing | 52.3 | 50.8 | 49.5 | 49.8 | 47.3% | 30.2% | 15.5% |

| Econ Trends (Teikoku'/50 neutral/weighted diffusion) | |||||||

| Manufacturing | 40.8 | 41.7 | 42.4 | 43.8 | 0.0% | 9.7% | 18.9% |

| Retail | 34.2 | 34.4 | 37.2 | 37.7 | 0.0% | 0.0% | 17.1% |

| Wholesale | 37.0 | 38.3 | 39.1 | 40.2 | 0.0% | 0.0% | 6.3% |

| Services | 43.5 | 45.0 | 45.6 | 46.6 | 20.1% | 36.4% | 42.7% |

| Construction | 32.0 | 32.6 | 34.7 | 36.8 | 16.4% | 22.8% | 43.8% |

| 100 is high; Zero is low | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.