Global| Jan 24 2005

Global| Jan 24 2005JOLTS: Job Openings Down But Hires Up in the US

by:Tom Moeller

|in:Economy in Brief

Summary

The Job Openings & Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics indicated that the job openings rate fell back in November to 2.4%, the average for 3Q. The job openings rate is the number of job openings on the [...]

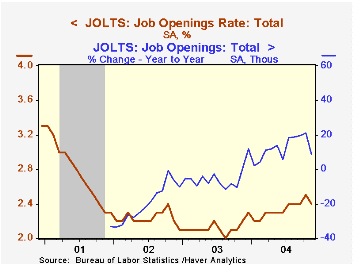

The Job Openings & Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics indicated that the job openings rate fell back in November to 2.4%, the average for 3Q. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings.

The total number of job openings in November fell a sharp 6.3% m/m (+8.5% y/y) and reversed about all of the gains during the prior two months.

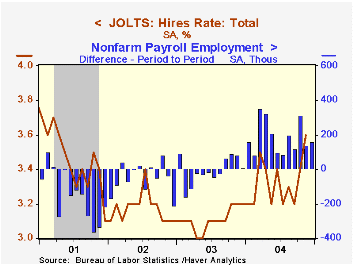

The latest hires rate rose sharply to 3.6%, the highest level since early 2001. The hires rate is the number of hires during the month divided by employment.

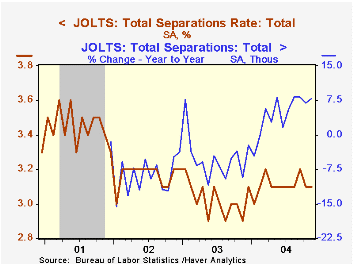

Job separations rose a hefty 7.9% versus last year but fell slightly m/m to 4.098 million. The separation rate was unchanged at 3.2%. Total separations include quits, layoffs, discharges, and other separations including retirements. The total separations, or turnover, rate is the total number of separations during the month divided by employment.

The survey dates only to December 2000 but has since followed the movement in nonfarm payrolls.

From the U.S. Department of Labor, a description of the Jolts survey and the latest release is available here.

| JOLTS (Job Openings & Labor Turnover Survey) | Nov | Oct | Nov '03 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|

| Job Openings Rate: Total | 2.4% | 2.5% | 2.2% | 2.1% | 2.2% | 2.8% |

| Hires Rate: Total | 3.6% | 3.4% | 3.2% | 3.1% | 3.2% | 3.5% |

by Tom Moeller January 24, 2005

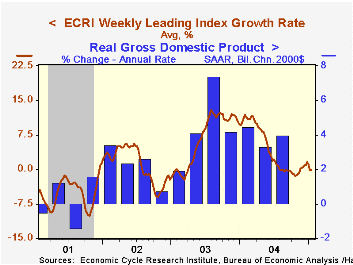

The Weekly Leading Index of the US economy published by the Economic Cycle Research Institute (ECRI) rose sharply in the latest week due to lower initial jobless claims and rising mortgage applications. Six month growth in the index held at -0.1% versus lows of -1.5% this past Fall.

Past recessions in the US economy were signaled by negative growth in the ECRI Leading Index in the -5 to -10% range. During the last ten years there has been a 69% correlation between the six-month growth in the ECRI leading index of the US economy and two quarter growth in real GDP.

The components of the ECRI weekly leading index are money supply plus stock & bond mutual funds, the JOC-ECRI industrial materials price index, mortgage applications, bond quality spreads, stock prices, bond yields, and initial jobless insurance claims.

The ECRI Leading Index's recent pattern generally mirrors the Conference Board's Index of Leading Economic Indicators, with a slight lead. Construction of the ECRI Leading Index differs from the Conference Board Index but there has been a 70% correlation between the y/y percent change in the two series over the last 10 years.

The median lead of the ECRI index at business cycle peaks has been 10.5 months and at cycle troughs 3.0 months.

The latest from ECRI is available here.

"Slower Growth" by John H. Makin is an Economic Outlook publication from the American Enterprise Institute and can be found here.

| ECRI Leading Index | 01/14/05 | 01/07/05 | Growth Rate | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Weekly | 133.3 | 132.2 | -0.1% | 6.2% | 4.1% | 1.0% |

| Dec | Nov | |||||

| Monthly | 133.2 | 132.5 | 1.0% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates